What is insurance?

Life is full of risks. Insurance can provide security against some of these risks. For example, motor insurance provides cover for certain costs resulting from a road accident or the theft of a car.

A contract of insurance involves the insured making a payment, (a premium) to an insurer. In return for the premium the insurer agrees to provide the insured with cover for certain types of losses arising from specified events. For example, a policy of household insurance might provide cover for damage to a house in the event of a fire.

Insurance and the UK economy

All businesses are exposed to risks in their day to day operations. Without insurance cover to provide protection against some of these risks, businesses would find it difficult to operate efficiently and profitably. Therefore, insurance is a vital part of most developed economies. Insurance and pension funds account for 1.4%* of the UK’s total Gross Domestic Product (GDP). Insurance also accounts for £3.8 billion* of export sales.

Businesses sometimes insure tangible assets like fleets of cars, machines and buildings, in the same way as homeowners insure their houses and contents such as televisions, videos, etc. Businesses can also insure against losses arising from certain events. For example:

- Commercial Combined Insurance – This covers physical damage to premises and to equipment, stock etc. as well as goods in transit, business interruption, employers’ liability and public/product liability.

- Professional Indemnity Insurance – This covers professionals such as accountants and solicitors, for liabilities that might arise from the advice they give or the recommendations they make in their professional capacity.

- Employers’ Liability Insurance – Employers’ liability insurance is a legal requirement for employers in the UK. The insurance is designed to meet claims by employees for bodily injury, illness or disease suffered while carrying out their duties of employment.

*International Finance Services London – International Financial Markets in the UK (page 10), May 2003

Lloyd´s of London

Lloyd’s of London is the world’s oldest and best known insurance market. In the 17th Century, London’s growing importance as a trade centre led to an increasing demand for ship and cargo insurance.

Business in those days was conducted very informally. A merchant with a ship to insure would ask a ‘broker’ to take the risk from one wealthy merchant to another seeking insurance cover. Each merchant would take a portion of the risk and the broker would visit several merchants until the risk was completely covered. The broker’s skill lay chiefly in ensuring that policies were underwritten only by people who could meet their share of a claim, if need be, to the full extent of their personal fortunes. This process came to be known as underwriting.

Lloyd’s first existed as a coffee house owned by a man called Edward Lloyd who encouraged ships’ captains, merchants, ship owners and others with an interest in overseas trade to visit his establishment. So, at a time when communications were unreliable, Lloyd’s gained an enviable reputation for trustworthy shipping news. This was crucial to successful underwriting and ensured that Lloyd’s became recognised as the place for obtaining both information and marine insurance.

In 1769, a number of Lloyd’s customers broke away and set up a rival establishment. However, the ‘New Lloyd’s Coffee House’ eventually proved too small. A committee was elected and 79 merchants, underwriters and brokers each paid £100 into the Bank of England for new premises. In 1774 rooms were leased in the Royal Exchange. No longer a coffee house, the modern Lloyd’s had been born.

Over the next century the society of underwriters at Lloyd’s gradually evolved. Membership was regulated and the elected Committee was given increased authority. This period culminated in 1871 with the incorporation of Lloyd’s by Act of Parliament. The Lloyd’s Act 1871 gave Lloyd’s a formal legal basis allowing it to acquire property and make by-laws backed with the full authority of Parliament. This established Lloyd’s as a business institution that can still be seen working successfully today.

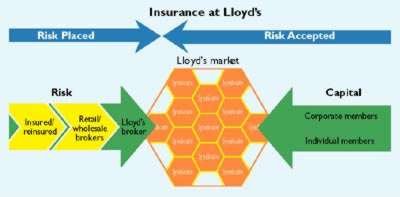

Lloyd’s is very different today, but operates using the same principles of broking and underwriting, providing a market made up of:

- Brokers, acting on behalf of their clients, who bring risks to the market; and

- Underwriters, accepting risks from the brokers on behalf of syndicates, who provide insurance cover.

Lloyd´s: a market, not a company

A market place is a physical or virtual place that enables those with goods or services to sell, to make contact with those who want to buy. Many UK towns have local market places where traders sell their products from stalls to consumers. There are larger markets where bulk trade in meat, fish, flowers and other commodities takes place for resale by local businesses nationwide. New Covent Garden Market in London is one such market, selling fruit and vegetables. Other examples include Smithfield Market (wholesale meat) and Billingsgate Market (fish). National markets such as these developed as the UK economy moved from an agricultural to an industrialised focus.

Lloyd’s is an insurance market where businesses from all over the world can find insurance for risks in exchange for payment of a premium. The premium is based on the sum insured and the nature of the risk. As the UK economy has developed from a national economy to part of the global economy, Lloyd’s has also developed into a global insurance market. The Lloyd’s market brings in business from over 180 countries and has its own offices and staff in over 25 different countries.

Lloyd’s uses a range of IT systems to process the millions of risks dealt with every year. Its website www.lloyds.com provides information on the types of insurance available in the market. Lloyd’s syndicates underwrite a huge range of businesses and projects including oilrigs, banks, satellites and airlines. The global business environment is constantly evolving.

Lloyd’s underwriters are famous for recognising new insurance opportunities and requirements, and for meeting them. For example, the Lloyd’s market provides cover for offshore wind farms, an area of the energy industry that the UK government is planning to expand.

Roles in the Lloyd’s market

The Corporation of Lloyd’s

The Corporation of Lloyd’s is the administrative body of the Lloyd’s market. The Corporation itself does not provide insurance. The role of the Corporation is to provide the infrastructure for underwriters and brokers to do business. The Corporation acts in a supervisory capacity to ensure that the market operates efficiently and effectively and that those involved meet certain standards.

Underwriters/Syndicates

The Lloyd’s market is made up of a collection of syndicates. Underwriters work for these syndicates, assessing risks on the basis of specialist knowledge and accepting or declining a risk on behalf of the syndicate. The underwriter works with the broker and calculates a premium based on the probability of the risk occurring and the value insured. The underwriter may accept the whole of the risk or only part, in which case the broker will need to visit a number of syndicates in order to cover the risk. This means that one risk may be covered by more than one syndicate in the market, with each syndicate taking a percentage of the risk.

The structure of the Lloyd’s market encourages flexibility and an entrepreneurial approach to underwriting. The risks insured in the Lloyd’s market are divided into the following main classes:

- Property and Casualty

- Aviation

- Marine

- Energy

- Motor

- Re-insurance.

Lloyd’s underwriters create innovative policies tailored to meet customers’ needs. Examples of innovation in the Lloyd’s market include specialist policies for:

- satellites

- niche UK motoring activities e.g. coach companies, taxi fleets

- protection against hostile takeoverbids

- large international, national and local sporting events.

Brokers

There are over 160 firms of Lloyd’s brokers operating in the Lloyd’s market. The brokers act on behalf of clients who are seeking to cover their risks by arranging insurance with underwriters. The brokers have a thorough understanding of the Lloyd’s market and many specialise in finding insurance for particular risks.

Brokers use their specialist knowledge of the insurance available in the market to choose the best syndicate and negotiate competitive prices for their clients. Brokers add value to the underwriting process for their clients by:

- representing their interests

- achieving the best value for money

- ensuring the quality of the cover offered meets the client’s needs

- finding the most competitive price.

Corporate and private members of Lloyd’s

All insurers require capital to provide security for their underwriting. After all, policyholders need to know that an insurer will have the funds to pay in the event of a claim. The capital that finances the activities of the syndicates in the Lloyd’s market is provided by what are known as members.

There are two types of member:

- Corporate members – insurance businesses such as Munich Re, Berkshire Hathaway, Ace and XL

- Individual members – the individual capital providers in Lloyd’s known as ‘Names’. Until 1994 Names were the sole capital providers for the market.

Members provide capital to syndicates operating in the market, who use this capital to underwrite risks. In 2003, 87%* of the capital backing the Lloyd’s market was provided by corporate members.

* Lloyd’s Members’ Services Unit, February 2003

Types of market

There are a number of different types of markets in which businesses operate:

- Commodity markets include those for raw materials such as cocoa used in the production of chocolate. A shipment of cocoa from Africa may be split between two buyers – the product is the same for both buyers. Insurance bought at Lloyd’s is often bespoke – the product or policy is created specifically for the client, so the product might not be the same for each client.

- Consumer markets involve producing goods and services for the private individuals who consume them. Large companies that supply consumer markets, such as manufacturers and banks, insure at Lloyd’s.

- Capital goods markets involve trade in valuable equipment that a manufacturer will use to produce end products for consumer or industrial markets. This equipment will have a long life span and will be listed as an asset of the company and because of its worth, such equipment will be insured so it can be replaced if stolen or repaired if damaged.

Services can be provided to consumers or businesses in the same way products are sold to consumers.

The Lloyd’s syndicates operate primarily in the market for specialist insurance, providing insurance services to their clients.

Other specialist markets within commercial services include capital markets such as the Stock Exchange, where companies sell shares in their businesses. The Stock Exchange provides a structure and market place for the trade in shares and is similar to Lloyd’s in that it facilitates buying and selling between others, but does not buy or sell itself.

Transactions

To understand the difference between transactions in a consumer market such as private car insurance and in a business market such as marine insurance, it is necessary to identify the organisations involved in the chain.

Very often a consumer will purchase motor or household insurance directly from an insurer. Therefore, a typical consumer private motor policy transaction might be represented as shown in the diagram.

However, when seeking cover for more complex commercial risks businesses usually employ the services of a broker. The placement of a commercial risk in the Lloyd’s market might be represented as shown here.

Brokers use their knowledge of the market and close relationships with underwriters to spread large, unusual or difficult risks between syndicates. Underwriters on the syndicates take on risks brought to them by the brokers, and using their knowledge and experience provide tailored insurance at competitive prices.

Both the broking firms and syndicates have competitors in the Lloyd’s market and this competition within the market assists in trying to provide the best cover at the best price for the client.

Conclusion

All business involves risk, and so business owners need to protect themselves through insurance which will pay out if the events covered by the policy occur. This helps the business to continue to trade.

Lloyd’s allows businesses to buy cover against risks in a way that suits their needs. Lloyd’s underwriters specialise and compete against other underwriters so the client’s needs are best met. The market place at Lloyd’s facilitates trade between buyers and sellers of insurance.