On Wednesday, July 12, 1989, Abbey National Building Society converted to become Abbey National plc. This case study tells the story of how that conversion came about and shows how to thrive in today’s competitive financial sector, organisations must have the size and flexibility to operate in a range of related markets.

What is a Company?

A company is set up to run a business. It has to be registered before it can start to operate, but once all the paperwork is completed and approved, the company becomes registered as a legal body.

The owners of a public company are its shareholders. However, customers and other businesses do not deal with the shareholders on a day to day basis – they deal with ‘the Company’.

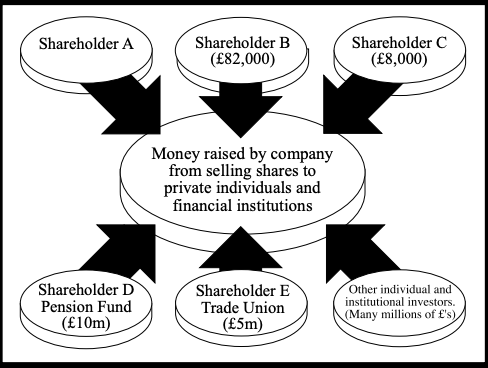

Shareholders put funds into the company by buying shares. New shares are often sold at a ‘face value’ (that is, a nominal price) of £1 per share, but this is not always the case. Some shareholders will only have a few hundred pounds worth of shares, while others may have thousands of pounds worth.

Public Companies

The shares of a listed public company are bought and sold on the London Stock Exchange. The main advantage of this is that large amounts of capital can be raised very quickly. There is the risk, however, that the original shareholders can lose control of their business if large quantities of shares are purchased as part of a ‘takeover bid’.

To create a listed public company the directors must apply to the London Stock Exchange Council, which will carefully check the company’s accounts. A business which wants to ‘go public’ will then arrange for a merchant bank to handle the paperwork.

Trading in shares has certain risks. The London Stock Exchange has good days when a lot of people want to buy shares (this is called a ‘bull market’) and bad days, when a lot of people want to sell (this is called a ‘bear market’). If a company issues new shares in a bear market it can find itself in difficulties – for example, if it hopes to raise £1 million, it might want to sell a million shares at £1 each; but on a bad day it might only be able to sell half of its shares at this price.

Abbey National

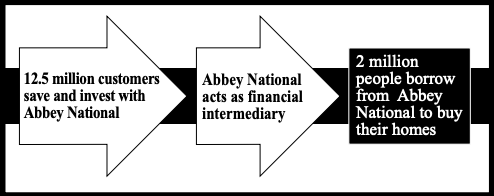

Abbey National is the UK’s second largest mortgage lender, helping over 2 million people to buy their homes. This lending is funded through the savings and investment accounts of some 12.5 million customers and through money raised in the wholesale funding markets.

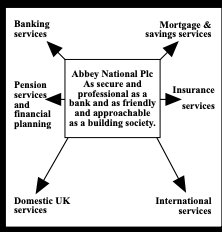

As well as its mortgage and savings operations, Abbey National offers a range of personal financial services including pensions and insurance.

Early Abbey National

Abbey National’s origins go back to the building society movement of the 19th Century when a group of people would club together and pool their funds in order to buy every member of the group home. The early societies were known as ‘terminating societies’ and would break up when every member had a house.

The next step was the development of ‘permanent societies’, where there were two groups of people – savers and borrowers. Savers put their money into the society and earned interest on the savings. Borrowers took out loans to buy houses (mortgages) and repaid them, with interest added on, over periods of 20 or 25 years.

As a building society, Abbey National can trace its roots as far back as 1849.

Two of the permanent societies were the:

- National Building Society; and the

- Abbey Road Society.

The two societies joined together to form the Abbey National Building Society in 1944. The Society’s head office was (and still is today) 221 Baker Street, also known as the home of Sherlock Holmes, the hero of Arthur Conan Doyle’s famous detective stories.

Background to plc

The changing Scene

The 1980s and 1990s have been a period of profound change in the financial services market. To understand Abbey National’s decision to convert to a plc it is important to understand the major forces for change. These were:

- The deregulation of financial markets. Before the 1980s it would have been unthinkable for Abbey National to straddle as many key areas of the financial services market as it does today. Until then, different financial activities such as banking, mortgage lending, savings and insurance were performed by distinctly different kinds of organisations – banks, building societies and insurance companies. That changed in the 1980s, as regulations that limited competition were abolished in a process known as deregulation. Building societies were still confined by law to a narrow range of businesses which involved lending mortgages to home buyers and growing depositors’ savings. The 1986 Building Societies Act changed this by allowing building societies – whose activities were very limited – to convert to PLC status so that they could take advantage of the industry’s deregulation.

- The need for wider access to funding. If Abbey National was going to expand and develop for the future, it needed wider access to funding. Most of the mortgage lending that building societies do is financed by the money deposited by savers. Another useful source of funding is the wholesale money markets, which can sometimes lend money at a lower rate of interest than banks and building societies charge their borrowers. However, the amount of money building societies can raise on the wholesale markets is restricted – going public would give Abbey National wider access to these funds. In addition, the conversion would raise valuable share capital from the sale of Abbey National shares, which could be used to finance investment in the business.

Making the decisions

Abbey National realised that if it was going to thrive in the 21st Century it would need the freedom of action to diversify and make more use of wholesale funding. Building societies might be left behind if they remained essentially ‘one product’ home loan businesses when banks were moving into their market. Abbey National wanted the freedom to compete with the big banks on a level playing field – which it could not do as a building society.

Historically Abbey National had been ready to break new ground and find new ways of doing things – it was one of the first institutions to pay interest on current accounts, for example and the first to set its mortgage rate independently of other societies. So it was natural for Abbey National to lead the way by converting to a plc – seven years later it is still the only society to have done so, although Halifax (now merged with the Leeds) intends to follow suit, and other building societies also plan to convert.

Going public would mean that people could own a stake in Abbey National simply by buying shares. It would give the company access to more capital to support the new activities it intended to branch into, such as life assurance, financial planning services and overseas expansion. In addition, PLC status would enable Abbey National’s Treasury operation to raise more funding at cheaper rates on the wholesale money markets.

After numerous boardroom discussions the directors at Abbey National agreed that, while the company would still concentrate on providing financial services for people in the UK, it should become a public limited company and move into other financial markets.

Going Public

A number of important hurdles had to be passed before Abbey National became a public company.

- The members of the society – that is, customers who had mortgages or certain savings accounts which meant they owned the building society – had to support the change. At that time over five million people were eligible to vote.

- The society also needed to gain the Bank of England’s authority to become a bank.

- The Building Societies Commission, which regulates building societies, had to approve the conversion.

Abbey National put on a series of roadshows and produced extensive literature to put the argument for conversion to its members. A sophisticated voting system enabled members to vote by post if they could not attend the Special General Meeting where the ballot would be held. Of the four million votes which were received, only 300,000 people opposed conversion – it was a massive vote of confidence in Abbey National’s decision.

The regulators – the Bank of England and the Building Societies Commission – also approved the move to conversion, after carefully considering all the relevant points.

Share distribution

Each qualifying member of the society received 100 shares in the new company in recognition of their ownership. It was decided that giving an equal amount to each member was consistent with Abbey National’s history of mutuality and fairness. In addition, each current and retired member of staff received 100 shares.

The first owners of Abbey National plc were therefore its customers and its staff. At five million, it was the largest shareholder register in the world. Even today, the company has 2.4 million shareholders, one of the largest shareholder registers in Europe.

On conversion, Abbey National also offered its members the right to buy extra shares, issuing 750 million shares. This increased its capital so that it had a secure base for its expansion and development.

Continued Growth

It is now clear that Abbey National made the right decision in 1989. The company’s pre-tax profit in 1995 was £1.026 billion – more than double 1989’s figure of £501 million. On 30th June 1995, Abbey National is the fifth largest bank in the UK, with assets of over £100 billion.

Abbey National invested in a huge branch modernisation programme after conversion. Its 12.5 million customers now do business through a network of 867 bright and spacious branches, with offices where they can discuss their affairs in complete privacy with specialist financial advisers. They can also make transactions through over 1500 Abbeylink cash point machines, or through the company’s telephone banking service. Abbey National has also invested in the latest technology, which makes processing transactions faster and more accurate than ever before.

Abbey National staff can call up information about customers’ accounts and produce details of a range of financial products in an instant. The company uses technology to speed up processing work, leaving staff free to concentrate on customer service rather than administration. In 1992 Abbey National acquired Scottish Mutual Assurance plc, which sells life assurance and pension products through independent financial advisers, and used its expertise to launch Abbey National Life in 1993. Abbey National Life products are now sold through all Abbey National branches and by Abbey National Direct, the company’s telephone sales operation.

Abbey National’s Treasury & Offshore operations continue to provide wholesale funding for its products and to manage the Group’s liquidity. In 1994 Abbey National plc was registered with the Securities and Exchange Commission in the United States. This gives Treasury wider access to the US capital markets at a lower cost.

On 10 July 1995 Abbey National and the National & Provincial Building Society reached an agreement on the terms of a merger which was unanimously recommended by the board of N&P to its members. N&P’s members approved the merger at a Special General Meeting in April 1996 and in June the merger was confirmed by the Building Societies Commission (BSC). With the satisfaction of a number of other conditions, the merger took place on 5th August 1996.

Abbey National is continuing to expand, ensuring that it offers its customers tailor-made services to meet all of their personal financial needs. The company has a ‘mission statement’ which sums up its aims and values. This says that Abbey National’s ‘vision’ for the future is:

‘To be the outstanding financial services company in the UK’

The company is working hard to achieve this vision – converting to a PLC in 1989 was an important step along the way.