Starting your own business is a really exciting time for any individual. And choosing the right van for your needs is also really important. For many self-employed people, their van will be their lifeline for their business. And when it’s time to buy one, it can be hard to know which to choose. This guide looks at a few factors you should consider on how to choose your van. And also expert tips on how to fund your next van purchase.

Set a budget and stick to it.

The first thing you should consider when buying a van is how much you can afford to pay for one. You can either pay in one lump sum with cash or savings or use a finance or lease deal to spread the cost. Your budget should be affordable and realistic but also be able to get you a van that is fit for purpose. If you’re buying with cash, you may know a ballpark figure to save up for in order to get a van. Another way is you may need to set a monthly budget for financing. Whichever you choose, you should always set a budget that is achievable.

Consider your van requirements.

The size and load space of your van can determine which cars are in your budget. Depending on the type of business you have, your van requirements can vary. When shopping around for vans, the payload of a van is really important as it’s the maximum weight the vehicle is allowed to carry at one time. An overloaded van can not only affect the performance of the vehicle. But it can also land you a fine from the police too!

Shop new vs used vans.

Depending on how you want to pay for your van and what your budget is, you could consider both new and used van finance deals to see which is the most cost-effective. If you’re buying with cash, you may be limited to a used van as buying from new can be costly. If your budget is limited, it may mean you have to opt for an older van, which is more likely to cause problems along the way. Additionally, if your budget can stretch to it, you should try to get the newest van possible to help avoid any additional repair work. For flexible leasing options, consider exploring Pink Car Leasing.

Financing a van.

Van finance is a great way to get a newer and better van than you would when paying with cash alone and pay for it over a term that suits you. You will need to meet the lender’s criteria before you can get approved for van finance. The rate you are offered depends on your personal circumstances. Once approved though, you can get a van within your monthly budget and pay for it over a number of years! Applicants may find it harder to get a van when they’re self-employed as their income can vary but there are now many lenders and brokers who can help offer you finance. However, it can be a good idea to deposit all of your earnings into a UK bank account. This is in order to be able to prove your income and affordability to potential lenders. Depending on which form of finance you choose, you can take ownership of the van ponce all payments have been made and the agreement has come to an end.

Leasing a van.

Leasing a van is different from finance and you won’t ever own the van when you lease it. A lease is a long-term rental and means you can use a van over a number of years. Make an initial payment followed by monthly payments that fit your budget till the end of the term. You don’t have to pay company van tax if you’re a sole trader either. You can claim VAT back if you’re VAT registered, and you only use the van for business purposes too!

Developing responsiveness through organisational structure (MP3)

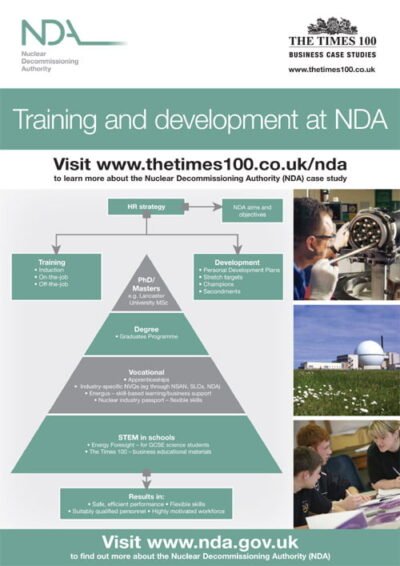

Developing responsiveness through organisational structure (MP3)  NDA A3 ePoster Edition 15 "Training and development at NDA"

NDA A3 ePoster Edition 15 "Training and development at NDA"  Enterprise Rent-A-Car A3 ePoster Edition 13 "Using a range of management styles to lead a business"

Enterprise Rent-A-Car A3 ePoster Edition 13 "Using a range of management styles to lead a business"