Digital currencies have now become a real trend among the traders of traditional assets and have attracted a new audience of tech savvies. One of the features that characterize digital currencies is volatility. However, the cryptocurrency space now has a solution in the form of coins, which have a safer value and are quite stable compared to traditional cryptocurrencies such as bitcoin: stablecoins. What are stablecoins and how to buy cryptocurrencies, we would like to explain to you in more detail below. We’ll go into more detail about the functionality, benefits, and types of different stablecoins.

What is stablecoin

Stablecoin is a cryptocurrency whose value is tethered to the price of another commodity or asset, like dollars or euros. Therefore, unlike unstable cryptocurrencies such as bitcoin or Ethereum, they are well suited for value-preserving traditional investments because they are less vulnerable to price fluctuations. They can also be tied to assets such as precious metals, gold, or oil. The general idea of stablecoins is to maintain a stable value over time.

How Stablecoins work

The technology behind Bitcoin and Ethereum is groundbreaking and has opened up many potential applications. However, these cryptocurrencies have specific characteristics that make them somewhat unsuitable for everyday use as a substitute for fiat currencies (currencies that are not tied to the price of a commodity, such as gold or silver). This is primarily due to their substantial volatility. This trait is positive for a trader, as it can increase profits.

These are cryptocurrencies that are less susceptible to price fluctuations. Stablecoin allows you to quickly use crypto exchanges (cryptocurrencies like bitcoin) for a traditional asset (such as the U.S. dollar or gold) without having to leave the corresponding platform (cryptocurrency exchange).

The three most important characteristics of a stablecoin:

- unit of account:

- medium of exchange;

- medium of exchange.

In cryptocurrencies, it is customary to limit the number of coins. An asset has value only when there is a finite quantity. In addition, the limitation protects against inflation. Such scarcity is achieved, for example, by pegging the value to gold.

Types of Stablecoins

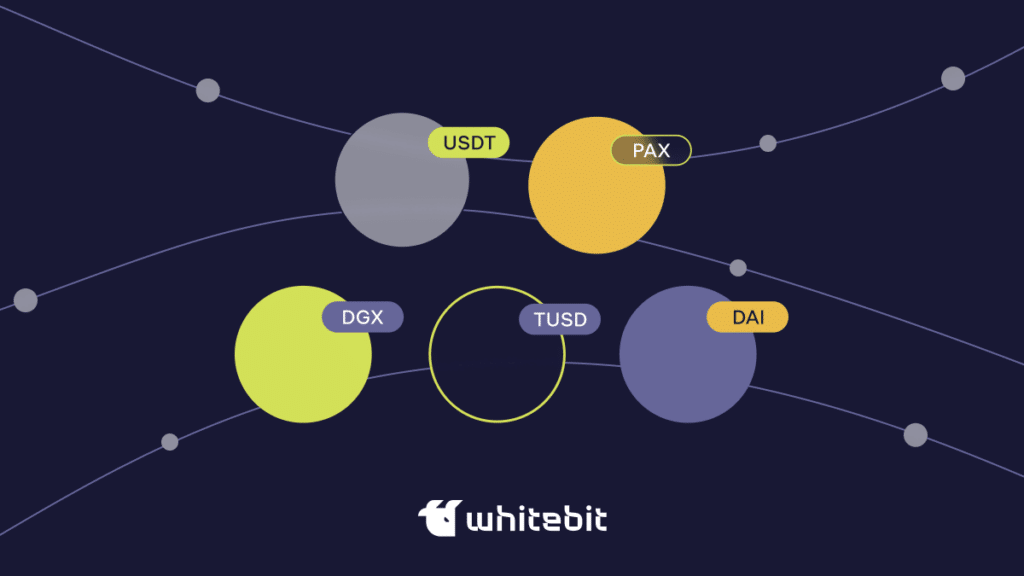

There are the following types of stablecoins:

- Tether (USDT). With a current daily trading volume of over $25 billion, Coin Tether (USDT) is the best-known stablecoin among cryptocurrencies with a stable value. USDT is not 100 percent backed by physically deposited U.S. dollars, but more or less liquid assets back it. Nonetheless, USDT trades reliably at its target level of $1.

- Paxos Standard (PAX). Since its launch in October 2018, the PAX coin has traded at a similar accuracy with a target value of one U.S. dollar. It runs on the Ethereum blockchain. With stackablecoins like PAX, the company behind the protocol (Paxos Trust Company) is responsible for building reserves that fully support each token. Paxos Trust Company claims to have resources that fully support each PAX.

- Digix Gold (DGX). As the name suggests, the DGX is based on the value of gold. According to the website, one Digix Gold unit is equal to one gram of gold. Digix wants to create a global marketplace for digital gold, where users can buy gold quickly and efficiently. The gold values corresponding to the tokens are stored in safe houses and inspected quarterly by an independent auditor, Bureau Veritas.

- TrueUSD (TUSD). This Stablecoin is also based on the U.S. dollar. Dollars must back the cryptocurrency. It has a 1:1 ratio. It is also the first crypto-asset based on the TrustToken platform.

- Dai (DAI).DAI, on the other hand, is a decentralized stablecoin that runs on Ethereum and tries to maintain a value of one U.S. dollar. Unlike centralized Stablecoins, DAI is not backed by U.S. dollars in a bank account but by a pledge on the Maker platform. It is important to note that if the Dai credit system is updated or closed, Dai holders may need to convert their Dai to Ethereum through the Maker platform. In this way, the stored crypto-assets serve as mortgage bonds.

The advantages are obvious: your equity stays in the crypto universe and can be immediately reinvested or used for payments in the real world with cryptocurrencies if needed. Banks as intermediaries, including waiting times and sometimes high transaction fees, are eliminated. Unlike other crypto projects, tying the price to a currency such as a dollar or a euro means you are immune to value fluctuations.