In the early 1930s, Jefferson Smurfit Snr saw the untapped potential of a small Dublin box factory, and with the purchase of that firm, the story of the Jefferson Smurfit Group began.

Over the succeeding decades, the Smurfit Group grew rapidly, obtaining a listing on the Dublin Stock Exchange in 1964, the London Exchange in 1970 and the American Stock Exchange in 1983. Dr. Michael Smurfit, son of Jefferson Smurfit, Snr and Chairman and Chief Executive since 1977, has led the Group through a period of successful global expansion.

Today, the Jefferson Smurfit Group, together with its associates, is the largest paper-based packaging organisation in the world. With more than 200 companies operating over 400 facilities around the globe, the Group’s integrated operations in Europe, the United States, Latin America and Asia employ more than 45,000 people in 25 countries.

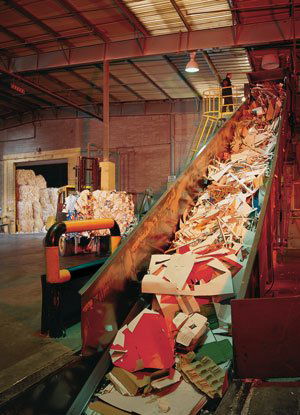

The Group is the world’s second largest producer of paper and board, and is the world’s largest producer of containerboard and corrugated containers. More than 60 reclamation plants around the world, processing more than 5 million tonnes of waste paper, make the Group the world’s largest paper recycler and give the Jefferson Smurfit Group the highest degree of control over this most significant raw material.

With the Group’s research and development centres, the Group continues to develop the products and techniques which will ensure its industry leadership into the future.

This case study examines the three central strategies of the Smurfit story – focused growth, global scope, and integrated development. It is by these strategies that the Jefferson Smurfit Group has evolved and continues to grow and add value to its business in today’s global marketplace.

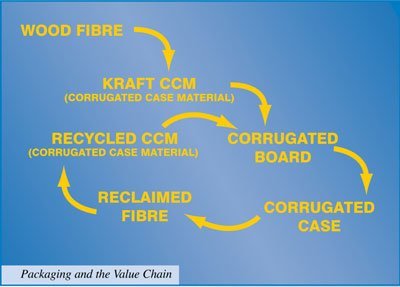

Packaging and the value chain

Packaging, in whatever form it takes, provides three basic benefits: containment, protection and display.

- Containment – Facilitating the transport and storage of goods from source to end user.

- Protection – Ensuring the safety and integrity of goods through shipping and storage.

- Display – Providing marketing and consumer-orientated information to the end user.

Packaging adds value to the goods it contains. One of the most important terms in business is ‘added value’. All businesses prosper in direct proportion to their ability to add value to their ‘input’ materials. The more value they add, especially in comparison to their competitors, the more competitive their products become.

Throughout the history of modern packaging, these benefits have remained fundamentally unchanged. The market-place in which they are offered, however, has undergone enormous changes. The Jefferson Smurfit Group, as well as the packaging industry as a whole, has had to evolve and adapt to changing requirements. By doing so, the Smurfit Group also adds value to its business, while better serving its customers.

The Smurfit Group strategy has been to add this value in three specific ways:

- by focusing on its core business

- by offering a global, geographically balanced presence in the market-place

- by integrating its elements – both vertically and horizontally – to achieve the maximum in economy, efficiency and profitability.

We will now look at specific examples of how this is achieved.

Focusing on the core business

Companies may add value to their business in any number of different ways. A conglomerate, for example, may acquire other businesses that are not connected with any of its other activities, providing a widely diversified range of operations. An example of this might be a company like the Virgin Group, which operates an airline, a railway, a radio station, a chain of cinemas, a retail chain, and even a soft drinks division.

Alternatively, a business may pursue a strategy of concentration on its core activities. This is the approach favoured by the Smurfit Group. The core competence of the Jefferson Smurfit Group is paper-based packaging. This represents 89% of the Group’s production capacity, and the Group is committed to maintaining and sharpening that focus.

The benefits of this strategy for the Smurfit Group have been obvious. By concentrating on its core competency, the Smurfit Group has been able to add value to its acquisitions of other companies by employing its unique industry experience to improve the utilisation and profitability of these assets. In many cases, the Smurfit Group has acquired paper industry assets from diversified conglomerates who have been unable to realise the full potential of these assets because of their lack of experience in the paper and packaging industry.

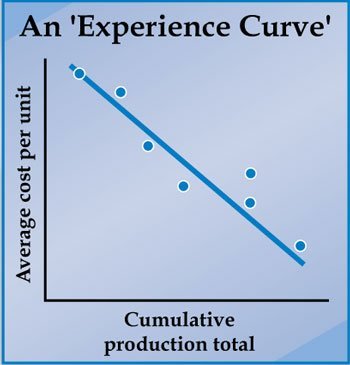

The Boston Consultancy Group developed the experience curve. It shows that the unit costs of adding value fall as cumulative production increases. According to the experience curve, the unit cost of adding value falls by as much as 20-30% with each doubling of experience. This is because greater experience leads to:

- economies of scale

- elimination of inefficiencies in production

- increased productivity

- improvements in product design.

Experience, therefore, is a key asset and concentration on core business is a key strategy for the Smurfit Group.

Innovation

Experience, of course, is not enough. New ideas are also needed. New and more efficient ways of manufacturing paper, corrugated packaging and cartons are constantly being sought – to serve the customer and the consumer better, as well as to add value to Smurfit products. For this purpose, the Jefferson Smurfit Group operates two dedicated research and development centres in Talence, France and Carol Stream in Chicago. These centres are responsible for continual improvements in the processes used and products produced by Smurfit companies around the world.

Another centre, at Epernay, France, is responsible for performance testing of all Smurfit packaging products, subjecting them to simulated conditions of stress and environment which they will encounter when in use, and sharing the lessons learned with all the Smurfit companies around the world.

Globalisation

The packaging industry, like many others, has been experiencing a period of fundamental change over the last 30 years. National or regional markets are merging into a single, global marketplace, facilitated by dramatic developments in communications and transportation. At the same time, international trade barriers have been falling away, allowing for the free movement of goods and services. The world market itself has also been expanding, with the emergence of new players from the former communist bloc in Eastern Europe and Asia, as well as the development of large transnational markets like the European Union, the North American Free Trade Association, and the Association of South East Asian Nations.

To meet these challenges and to avail of the new opportunities which they represent, the Jefferson Smurfit Group has pursued a course of geographically balanced growth. Strategic decisions led to expansion into the United Kingdom when significant further growth in Ireland was unlikely. Similarly, expansion into the United States and Latin America began when European prospects appeared unattractive.

Expansion in Europe was later facilitated by the emergence of the Single Market and the growing need for pan-European packaging suppliers. Today, the Group has taken its first steps toward expansion into the Far East, where new markets and new opportunities beckon. At the same time, however, it has been the policy of the Smurfit Group to invest power at the local level. Group headquarters concerns itself with overall performance and cash management, while operational matters like customer relations, performance efficiencies and pricing are left to local management who are familiar with local trading conditions. This means that the Smurfit Group can offer the range and scope of a global company, while at the same time providing customer service which is locally tailored.

The Genesis Project

A global company with many individual, locally managed facilities must have a communications infrastructure which allows for the free and instant sharing of information throughout the organisation. Ideas and innovations need to be freely shared among the various companies, while local trading information, management reporting and corporate policy need to be effectively communicated between the individual companies and the global headquarters. For this reason, the Genesis Project was born.

Phase 1 of the Genesis Project includes the creation of a company-wide Intranet for intra-company knowledge sharing, the enhancement of reporting systems throughout the Group, and the integration of accounting, purchasing, inventory and maintenance systems into a Group-wide implementation. Subsequent phases will take this initiative into other areas of Group operations, to include estimation, order processing, planning and transportation functions.

Integrated development

The closer integration of the elements of a company offers many opportunities for achieving economies and efficiencies. Two types of integration are vertical and horizontal.

- Vertical Integration is a combination of businesses that operate at different stages of manufacture of the same product.

- Horizontal Integration is a combination of businesses that operate at the same stage of manufacture of the same product.

The Jefferson Smurfit Group is committed to the concept of vertical integration. For this reason, the Group is deeply involved in the entire range of activities which this entails, from owning and/or managing forests, to the reclamation and recycling of waste paper, to the manufacture of paper, right through to the manufacture of containerboard, boxboard, paper sacks and corrugated cases. Most significant, perhaps, is the Group’s recycling activities – as previously mentioned, the Jefferson Smurfit Group is the world’s largest recycler of waste paper.

Waste paper is a vital source for the fibre used in making containerboard and boxboard. This reclaimed fibre is known as secondary fibre, to distinguish it from the primary fibre which is provided by wood. Both types of fibre are needed, but on average, 70-80% of the fibre used in the production of paper packaging is this secondary, recycled fibre.

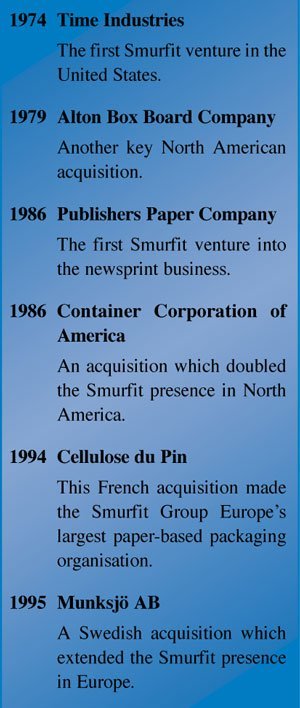

Horizontal integration has also been a feature of the Smurfit strategy for growth, where the Smurfit Group has acquired firms which operate in its own area of competence, and which offer opportunities for market expansion. This is a feature of the Smurfit Group’s strategy of acquisition-led growth.

Acquisition-led growth

From its very beginning, the Jefferson Smurfit Group has grown primarily through the acquisition of other companies. The theory behind this strategy can be simply expressed – building value, not machines. The paper and packaging industry is cyclical in nature. This is because the demand for packaging is directly related to how the rest of the economy is doing.

Economies do not experience a steady rise in growth. The reality is that economic growth experiences a series of fits and starts, leading to a trade-off between pleasure and pain. When demand for goods is high, the demand for packaging is high also. When the demand for goods falls, the demand for packaging falls as well. Historically, during periods of high demand, the paper and packaging industry has tended to over-invest in plant and production capacity, with the result that, today, growth in production capacity has exceeded growth in demand.

Some of the Smurfit Group’s more significant acquisitions are shown in the table.

By prudently acquiring additional production capacity in times when demand is down, the Jefferson Smurfit Group has been able to add value to its business without building new plants and machinery which are likely to lose value later in a subsequent downturn of the economy as a whole.

The Smurfit acquisition strategy has always been focused on adding value to the Group and this has been achieved by adherence to the following principles:

- Identification of undervalued assets – Acquiring well-invested, quality assets at attractive prices, often from groups for whom paper and packaging is not a core business.

- Critical timing Acquiring production capacity at times when industry cycles offer advantageous circumstances.

- Rationalisation for maximum performance – Realising the full value of new acquisitions by using industry expertise to extract maximum performance.

- Strategic minority stakes – Taking minority stakes where full ownership would mean unacceptable risk or over-exposure of the balance sheet.

Conclusion

This case study has examined the three concepts of focused growth, globalisation, and integrated development and how, together, they are the cornerstone of the Jefferson Smurfit Group management philosophy.

It has also looked at how a policy of acquisition-led growth has been applied by the Smurfit Group to the unique circumstances of the paper and packaging industry. Together, these strategies have enabled the Jefferson Smurfit Group to grow from a single, small factory to an international group with over £7 billion in annual sales.