No business could survive on its own without friends and allies. To be successful, businesses need to develop relationships with other organisations and to draw on the support and services they provide. The successful business will develop healthy relationships with suppliers, partners and providers of finance.

In this case study, we look at a very important relationship for an increasing number of small and medium sized businesses in this country – the one that they build up with investors. In particular, we focus on the role of 3i Group, the leading specialist investor in unquoted companies in the UK.

The role of investors is of crucial importance to the UK economy. In the past, countries like Japan and the United States led the field in providing support for the growth and development of the small and medium sized business sector. Today, the UK is rapidly catching up in this sphere. By the end of the 1980s, for example, there were over 100 member companies making up the British Venture Capital Association.

Recognising the needs of small and medium sized companies

Today it is widely recognised that small and medium sized companies play a vital role in the well-being of a modern economy. They create many of the new ideas that provide the driving force for prosperity and growth. Some will one day become the major blue chip companies at the centre of the economy. They are increasingly important employers, as larger organisations downsize in modern markets, where the emphasis is on flexibility. They also provide us with many of the goods and services which make it possible for us to enjoy a more comfortable lifestyle.

Types of finance

Venture capital is finance, in the form of shares or loans, which is provided by an investment institution to back a business venture which is expected to grow in value. Organisations like 3i are prepared to provide finance for growing small and medium sized companies in exchange for part of the ownership of the business. It often goes well beyond simply providing finance for growing organisations – involving taking an active interest in the fortunes of that organisation.

What does 3i do?

3i is a company whose business is investment. 3i was founded in 1945 by the Bank of England and the major UK banks to invest in small and medium sized enterprises. Since then, 3i has gone on to play a key role and provides increasing sums of capital for business growth. 3i floated on the London Stock Exchange in 1994 and is now one of the top 100 UK companies, with a current market capitalisation of around £3 billion. 3i is able to provide a highly personal service by working through a network of offices across the country. This enables 3i to keep close to the companies which it backs in the independent business sector. In most cases, the decision to invest will be made by the local 3i office in Aberdeen, Manchester, Southampton or wherever.

3i is a risk taking organisation that shares the entrepreneurial attitudes of the companies it backs. Investment decisions are based on judgements of management quality and the potential of a business, not just its track record. The decision to become involved draws upon not only the skills of individuals, but also on 3i’s collective experience built up over more than 50 years.

Investment

In essence, 3i helps the small and medium sized business sector to play a more dynamic role in the economy by providing the finance that this sector needs to grow more smoothly. Individuals and organisations are able to obtain the finance to become more entrepreneurial, to take appropriate risks and to do the sorts of things they should be able to do in a dynamic economy. Most of the investments 3i makes are between £100,000 and £30 million. In 1996, 3i invested around £3 million every working day. In early 1997, 3i had investments in approximately 3,200 businesses in the UK and continental Europe. Before making investments, 3i examines each business individually and in depth. The ability and integrity of the management and the growth potential of the business are the key factors 3i considers when deciding whether or not to invest.

For most businesses, growth is an essential part of their development. There are two main types of growth:

- Organic growth. This involves growing a business from within. Most businesses grow by ‘ploughing back’ or re-investing, their profits, taking on more staff, opening new outlets, buying more equipment etc. However, sometimes they need a more substantial injection of funds than they are able to generate in the short term. 3i enables organisations to grow organically at a faster rate than would otherwise be the case. For example, an organisation may recognise that by investing in new technology they will be able to leapfrog the competition and achieve higher than average profits. However, it may not be able to fund this technology solely from retained profits and this is where 3i comes in.

- Growth by acquisition. The alternative way of growing is to join together with other companies by means of a take-over, or merging two or more businesses. To acquire other businesses it is usually necessary to have access to additional finance. This is another situation where 3i can be of assistance.

There are a number of categories of investment in which 3i is involved:

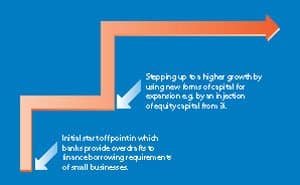

- Growth capital. This is a very important type of finance or ‘capital’ as it is often called. When businesses want to finance a new area of growth they may need additional longer term finance. Prior to this, a business may have been growing successfully with the support of a bank. However, the business is aware that an overdraft is a short-term facility, which can make it vulnerable. The alternative that will enable businesses to climb up a step involves raising capital on a long-term basis.

- Emerging businesses. These are typically businesses of less than three years old, which are developing a potentially valuable product or service. These companies often require funding to meet research and development costs and to launch the product on the market.

- Management Buy-Outs (MBOs). An MBO occurs when the management team of a business, usually with the backing of institutional investors, takes over ownership of the business where they are employed. MBOs emerged during the ‘enterprise’ years of the 1980s as a major factor in restructuring British industry. Often, these involve a large company disposing of one of its subsidiaries by selling it to its management team. An MBO can also occur in family businesses when the owners retire. MBOs can be relatively small, where the managers may own the majority of the shares, or large, where 3i and other investors are, together, likely to own the majority of the shares. Having played a significant role in the restructuring of British industry, MBOs are now starting to do the same in continental Europe.

- Management Buy-Ins (MBIs). Since the late 1980s, MBIs have developed as another means of changing the ownership of a business. In this case, an incoming management team acquires the business with backing from institutional investors (as opposed to incumbent managers, who acquire it in the case of an MBO).

- Share purchases. This is where a proportion of the shares in a private company are bought by 3i, when someone wishes to sell all or part of his or her shareholding. In other words, 3i purchases shares directly from an individual shareholder. This is sometimes an alternative to selling a company or floating it on the stock market.

Long-term approach to investment

What makes 3i different is its approach to business. 3i has a long-term approach to investment and offers a distinctive blend of financial and industrial skills. 3i works with the management teams of companies to develop imaginative responses to business opportunities and to share the risks and rewards in achieving them. Investment executives are assisted by a team of specialist industrial advisers. 3i has 18 offices in the UK and eight offices in continental Europe.

Buy-out

3i’s approach can be illustrated by looking at two case studies. The first of these is the management buy-out (MBO) of Denby Pottery. Wedgwood, Royal Doulton and Denby are internationally famous for traditional English china and pottery. All three were established around two centuries ago, yet all have seen dramatic changes of ownership in the 1980s and 1990s.

At Denby, the change process began in 1987 when the company was taken over by Coloroll plc. This fast growing, ambitious company allowed local Denby management to continue to run the business and was keen to provide capital for investment. However, the onset of recession in 1989 dragged Coloroll down, leaving Denby’s fate in the hands of the receiver. A receiver is usually an accountant, appointed by a bank, whose task is to raise the maximum amount from the sale of assets, in order to repay creditors. The directors therefore knew that their business would soon be sold off. For those involved with the well being of Denby, including its suppliers, customers, employees, directors and managers, this was a very worrying period.

The directors and other managers of the company had a clear understanding of the strengths of their business. They were determined to make a go of it and therefore created clear and well thought out plans for a management buy-out. At the time there were several other organisations who were keen to take over Denby, so the competition was intense. The management team recognised that they could not go it alone – they needed help from people with the right sort of financial backing and an astute understanding of business. The weeks following the collapse of Coloroll were considerably anxious. The directors had to work around the clock to put together a convincing offer and business plan to present to the receiver.

The Denby MBO team turned to 3i for help. 3i was able to assist with the buyout process, provide suitable financial backing and was enthusiastic about the new enterprise. The buy-out process involved a considerable amount of hard work; from communicating with employees and customers, to establishing separate accounting systems, creating a new corporate identity and capitalising upon any available media interest. Fortunately, on 24th July 1990, the MBO team’s bid of £5.3 million won the receiver’s approval. 3i’s Nottingham office, working with the managers, provided the finance necessary to purchase the company. In reaching their decision, the local office was assisted by the knowledge of 3i’s team of industrial advisers, who were able to give detailed information on Denby’s market and potential. Crucially, 3i was impressed by Denby’s management, both as individuals and as a team which understood its market and had a successful track record of product development.

Increased sales

Since the buy-out, the introduction of new designs has accelerated and the company has increased its sales in the USA and France to complement its strength in the UK. As well as 3i’s initial £6.7 million investment, a number of additional loans have been made to finance new equipment, helping growth in profits and sales. In June 1994, Denby Pottery floated on The London Stock Exchange with a market capitalisation of £40 million.

This case provides an excellent example of what 3i can do. In effect, 3i served as both a lifeline and a bridge to Denby. At the time of the receivership, 3i served as a lifeline providing the means whereby an excellent management team were able to save their organisation and preserve its independence against outside bidders. The finance and expertise given by 3i then provided a bridging period in which Denby could restructure and build on its strengths, before moving onto a position where it could gain new sources of funds through a listing on the Stock Exchange.

Conclusion

Surrey Envelopes provides us with a good case example of the way in which 3i enables entrepreneurs with good ideas to secure the necessary backing to get started. Surrey Envelopes, based in Wimbledon, supply a range of envelopes that are printed with the clients’ designs – from simple black and white, to full colour. The company began trading in 1991. Today it has a very broad customer base and its work is mainly used in the direct marketing industry, for over 200 customers such as Orange, BT and Royal Sun Alliance. The company was founded by David Barnes and Jeff Greenleaf who had previously been directors of a major direct mail production group.

Surrey Envelopes was a ‘start-up’ company in 1991, with backing from the London office of 3i who provided equity and loan funding of £160,000 to finance the purchase of plant and machinery, the fitting out of the factory and working capital. In August 1992, 3i provided a further £93,000 to assist the company in buying a new four-colour printing press for printing envelopes with colour pictures. Surrey Envelopes has had a remarkable few years. From a standing start in March 1991 when it had no customers, it managed to achieve profitability in its first year of trading and has continued to grow with turnover now in excess of £4 million. In 1995 Surrey Envelopes won the British Venture Capital Association Award in the Start-Up category. At the award ceremony Helen Sinclair of 3i stated: We are keen to back young companies which, like Surrey Envelopes, have the potential to be the major companies of tomorrow.