The first decade of the 21st century has been a rollercoaster ride for economic activity. Business confidence was high at the start of the millennium. This was particularly fuelled by the growth of the Internet as a means of buying and selling. A lot of companies have developed websites and there has been a rapid increase in online purchasing.

At the same time, a number of countries opened up their markets to international trade. For example, Poland and the Baltic States of Estonia, Latvia and Lithuania joined the European Union. China and India have also grown to become world economic forces.

However, during 2008/9 the rapid growth of world markets came to a halt. Many of the problems stemmed from banks lending money to risky borrowers. When some of these failed to pay back this led to a rapid loss of confidence in the banking system. Banks became reluctant to lend – for example, for mortgages or business loans. This led to a sudden dip in people’s spending which reduced demand for products and services. The effect was catastrophic for many businesses. Many famous companies closed down. Perhaps the best-known high street business to suffer was Woolworths which closed its doors in March 2009.

The Davis Service Group provides textile maintenance services in the UK and Europe. This includes linen hire, work-wear rental, dust control mat, laundry and washroom services. The Group consists of two main operating companies each with its own directors and executive team.

These two operating companies delegate responsibility and authority to profit centres throughout the Group. Providing essential services enables the company to grow when economic activity is expanding in its various markets. For example, it has recently been growing quickly in Poland. At the same time because the services it provides are so essential to other businesses, it manages to maintain sales in times of falling demand.

This case study examines how Davis Service Group, one of Britain’s key service companies, has managed the recent change in the business cycle.

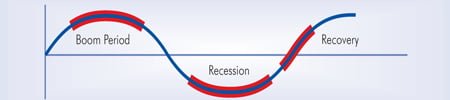

The business cycle

The national economy experiences periods of ‘boom’ and sometimes periods of ‘bust’. In periods of boom, most people tend to be better off. Businesses have full order books for their products so that sales and profits are high. At the same time, there are high levels of employment. School leavers and graduates find it easy to get work with good prospects.

However, history shows that the good times do not last forever. This is when recession sets in a period of weakening demand for most goods and services. This can then turn into a slump when there is rapidly growing unemployment and sales and profits fall substantially.

The period of time a recession may last is variable. Forecasters look for signs of ‘green shoots’. These are signs that a recovery is taking place. The ‘green shoots’ include new companies setting up, development of new products and firms starting to take on more employees.

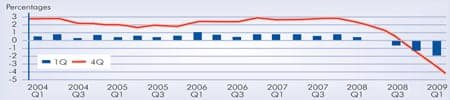

A recession occurs when for two quarters (a quarter is three months) in a row the value of all the goods sold in an economy falls. This occurred in the UK and other parts of Europe in the second half of 2008.

Economic activity is measured by Gross Domestic Product (GDP). GDP is a measure of all of the goods and services sold in an economy in a particular period, for example, a quarter.

The line graph most visually shows the impact of the recession at the end of 2008:

- quarter by quarter changes shown in blocks

- four quarters (1 year) changes shown in the line graph.

How does recession affect a company like the Davis Service Group?

- Some of the Group’s activities are in sectors that are not affected significantly by the recession, for example, healthcare. Governments retain this type of activity as a high priority for the population, even in times of recession. About 30% of the Davis business is in this service sector.

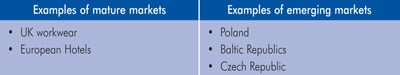

- Some of the Group’s activities are in mature markets. It is inevitable that there will be some decline in demand in these markets because in a recession demand falls and customers of Davis reduce their requirements and spending levels.

However, at the same time, Davis Service Group has been growing rapidly in new markets such as Poland, the Baltics, and the Czech Republic. These economies are emerging markets at different stages of the business cycle. This means that because their economies are still developing and textile rental is a new service, the impact of the recession is smaller. As Davis is developing a new market, it therefore sees its sales continuing to increase.

Recession

The way to survive and prosper in a recession is to reduce costs, such as cutting out any waste activity and outperforming competitors. In a recession:

- demand for company products and services falls

- jobs are lost in the economy

- many businesses cut down on their investment in new plant and equipment

- businesses close down.

In Davis’ mature markets, there has been some decline in demand. The Group has responded by cutting back on products and services that are not performing so well. One of Davis’ services is to supply and clean workers’ overalls for industrial companies. As jobs are lost in the wider economy during a recession, manufacturing companies require fewer work clothes. Davis therefore has to discuss with customers where layoffs will occur and how this will impact on its sales. For example, it will seek alternative wearers such as canteen workers. However, the recession may also encourage some companies, who at present manage their textile needs within the business, to consider outsourcing their requirements. This will generate additional custom for Davis. At the same time, Davis can look to make cost savings. The Group currently sources some of its textile products from the Far East and China. As demand falls, the Group could increase the proportions of goods supplied from such cheaper sources.

Falling investment by companies in a recession has a limited impact on Davis Service Group’s sales. The company typically supplies on three-year contracts.

Textiles such as bed linen (for a hotel or hospital) are bought for customers continuously throughout the year. The customer uses as many of these textiles as it needs to run its operations during the contract period. The textiles are used for up to three years before the products complete their useful lives. This sequence needs precise timing. For example, it is important that the purchase of linens for hotels is completed before the run-up to the peak summer season.

The recession has forced some companies to close down certain operations altogether. However, this is not the approach Davis has taken. It continually re-allocates production between its plants to make the best use of resources. It also puts aside or ‘moth-balls’ other plants or production lines when demand is less. In this way, the company is best placed to increase supply when recovery occurs.

Managing a business through a recession requires careful planning. One key advantage for Davis is that it empowers managers in local operations to make decisions for themselves. Local managers are best placed to understand local market conditions and can decide on staffing levels, textile purchases, distribution requirements and important ongoing contact with the customer.

At a central level financial experts at the company consider how best to deal with changes in interest rates and exchange rates. The exchange rate is the rate at which one country’s currency can be exchanged for other currencies. For example, Davis operates both in the UK where the currency is the pound sterling, as well as in other parts of the European Union where the Euro is used. In 2008 and 2009 the value of the pound fell against the Euro. As a consequence, Davis’s business on the Continent became more valuable to it.

Another important factor for Davis Service Group during the recession has been to maintain a strong financial position. This includes borrowing money from banks to finance some of its activities. Davis has maintained good relations with its bankers over many years and as a result, the banks have been willing to commit to Davis by continuing to lend money to the company.

Davis also needs to keep its shareholders happy. It pays out a dividend of around half of its earnings each year, giving the shareholders a secure income – very important in difficult economic times.

Recovery

A recovery takes place after a recession when for two successive quarters demand starts to pick up again. Recovery means that there is more money in the economy. Companies and people have more disposable income, so they can buy more. This generates additional demand for goods and services. This growth in sales means more income for investment in the business and more prospects of employment.

Market confidence in business is also very important in encouraging recovery. People have to believe that things are getting better to start investing again. Some businesses may be reluctant to take on new staff and take risks during this time, but those that do may be better placed to take advantage of rising demand as recovery continues. A strong business like Davis can take advantage of the recession. It may even consider taking over other businesses or competitors who may not be performing as strongly to enhance its product portfolio and competitive position.

The only certainty about the recession in 2008/2009 is that eventually, it will come to an end. To be able to be ready for recovery Davis is taking steps to ensure that its business will be in good shape. These steps include investing in equipment, implementing more efficient processes and reducing costs.

Boom

Sometimes a period of boom follows on from recovery. During this period people become very confident. If businesses provide the right goods to the market these goods will sell. Businesses can be confident that they will be more able to borrow money to invest and develop.

Of course, there are different challenges which can arise in a period of boom. For example:

- firms might find it more difficult to recruit and retain skilled labour. They might therefore be forced to raise wages to attract employees which puts up their costs

- in the economy as a whole, there may be a general rise in prices. This general increase in prices is termed inflation.

Davis, like all companies, will grow if boom conditions return. However, the Group is well structured to manage its way through both periods of recession and boom. This is partly due to the important nature of the services that it provides. For example, providing bed linen to the UK’s National Health Service and other hospitals is essential at all times.

Davis is focused on a range of services that are particularly valued by its customers. Most companies want to concentrate on doing what they do best.

For example, a hospital seeks to cater for the healthcare needs of patients. A restaurant wants to focus on giving customers high quality food and service. A car factory focuses on manufacturing cars and other vehicles efficiently. They do not necessarily have the people or equipment to provide non-core activities such as providing and frequently cleaning work-wear, table cloths and towels. This is where Davis Service Group’s services provide value.

Conclusion

The end of the first decade of the 21st century will be remembered as a period of rapid recession. During this time, many people have lost their jobs and famous banks and retail outlets have gone out of business.

Businesses need to respond to the challenges of a recession. The key to riding out a recession is to provide high quality services that customers want and need.

Davis provides a good example of a company producing a portfolio of services to customers in well-chosen markets. By cutting costs and focusing on investing in growth opportunities, the Group can grow in periods of recovery as well as recession.

Managing firms throughout the business cycle (MP3)

Managing firms throughout the business cycle (MP3)