In recent years we have seen a dramatic transformation in the way in which people in this country use money. The textbooks tell us that money is ‘anything that is generally acceptable as a means of exchange’. For hundreds of years people thought of money as coins, and then notes and coins with the development of bank notes. During the twentieth century cheques became widely used as a means of payment and later plastic money in the form of credit and debit cards.

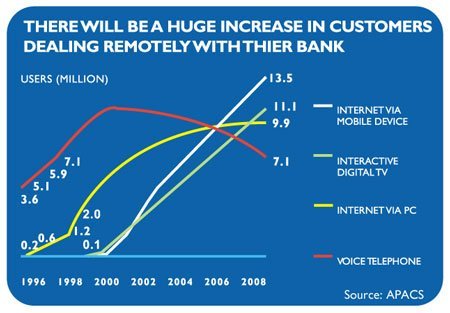

In the late twentieth century we saw another revolution in the way in which people made transactions. This change was the result of the Information and Communications Technology (ICT) revolution enabling electronic transactions to take place. A major impact of the ICT revolution has been that, increasingly, payments are made without the use of cash. Currently, over 75% of all cash in circulation is withdrawn from Automated Teller Machines (ATMs). 86% of adults in the UK hold one or more plastic cards. Debit cards are now the most heavily used non-cash payment method by individuals. Debit card payments are forecast to double over the next ten years. Increasingly people are making non-cash payments by using credit cards, via the Internet, through Interactive Digital TV and through other modern methods. For example, the chart below indicates the huge increase in customers not dealing directly with their bank.

Despite these dramatic changes, cash continues to be the most important form of money in the UK. It will be around for many years to come. The development of cash machines, or ATMs, has been a key element in transforming the way people access their money.

Today cash machines, or ATMs, are the most popular method of withdrawing cash for most personal customers. In two billion transactions during 1999, ATMs in the UK dispensed £108 billion. Three out of every five adults use ATMs regularly, making on average 67 withdrawals during the course of the year.

Creating an ATM system in the UK

Today the UK’s ATMs are linked together through the LINK network. LINK is a system joining together 40 of the UK’s major financial institutions (banks, building societies and independent ATM operators). In the modern world in which customers dominate the way in which services are provided, it is essential that account holders in any bank or building society are able to access their money at the most convenient location. The creation of LINK means that a Halifax account holder, for example, is able to withdraw cash from an ATM belonging to any one of the other members of LINK.

Although the concept of a shared cash machine network is simple, the technology behind LINK is amongst the most sophisticated in the world. LINK has two computer systems – a central computer system and a back-up or disaster recovery site. Both systems are so powerful that each is capable of processing 10,000 transactions every minute.

When a LINK cardholder requests money from a LINK machine, a message is sent via LINK to their bank to make sure that their Personal Identity Number (or PIN) has been entered correctly and that the cardholder has sufficient money in the account to cover the withdrawal. These messages are transmitted in ‘real time’ to ensure the tightest security. Speed is of the essence and LINK is able to verify within seven tenths of a second that a Bank A customer seeking to withdraw cash from a Bank B ATM has input correct details and that they have the funds in their account. LINK also calculates the settlement amount to be credited or debited from each member bank or building society to cover the value of cash machine withdrawals during the previous day. Because it is a closed network, the overall settlement has to come to zero every day.

Stakeholders

LINK is a company limited by shares. The 40 financial institutions which use its services are the key stakeholders, although only 22 of them own the company. LINK has two Boards: The Company Board (owners) controls the overall direction and running of the company. The Network Board consists of representatives from each financial institution and meets bi-monthly to establish the ground rules for shared transactions and the arrangements for LINK membership. It is important to remember that only about 40% of ATM transactions involve LINK because the remaining 60% involve customers of a particular bank using the ATM facility of their own bank. LINK only handles the shared transactions but there are about 86 million of these each month and the numbers are steadily rising.

Cash machine technology has improved over the years and many of today’s machines are now available 24 hours a day, 365 days a year. 94% of machines in the UK are now full function, with only 6% being simple cash dispensers. This means that almost all cash machines offer cash withdrawals, balance enquiries and will produce a receipt either on demand or automatically. Other services include the ability to order a chequebook, PIN change and account to account transfer, although these services are typically only available on a customer’s own bank machine. Colour screens are increasingly regarded as a standard requirement as is full graphic capability. Chip card readers are now being incorporated into both new and existing machines to enable the reloading of electronic purses and new initiatives in the future. Looking even further to the future, biometric (iris or fingerprint recognition) testing has been underway for several years to improve security.

Developing a strategy for the future

LINK is now at a crossroads in terms of its ongoing development. In recent times the organisation has developed to such a point that it now provides the UK network of ATMs. As a result it is in the enviable position of having a core product which serves as a cash cow enabling a consistent return to be made. However, it is looking to the long term. An organisation that stands still will frequently be overtaken. LINK is, therefore, building a strategy to secure its future. This is where strategic thinking is necessary. Building a strategy involves creating a long term plan designed to secure the future of the whole organisation.

Building an effective business strategy involves the following key steps:

- know where you are starting from

- know your destination

- look at alternative routes

- decide on the big steps that need to be taken

- get everyone in the organisation on board

- make it happen

- keep track of progress

- adjust your tactics as you move forward.

From the outset LINK had a clear idea of where it was coming from i.e. it provided the national network of ATMs.

SWOT analysis

In creating strategies in any organisation, it is important to carry out a SWOT analysis – i.e. a detailed study of the internal strengths and weaknesses of an organisation, and the external opportunities and threats facing the organisation. LINK’s SWOT analysis revealed that key strengths included the facts that:

- LINK is a low cost/high quality processor

- it is a stable company – its key business activity serving as a cash cow

- it has a strong market position

- it has a high quality team of people working for it

- the owners are the customers

- LINK has the ability to switch high volumes.

Examples of internal weaknesses include the narrowness of the market in which it operates and a need to establish a new vision for the future. Threats facing the organisation included:

- the development of substitutes for cash

- the trend towards globalisation of markets

- the possible growth of competitors in the payment systems market.

At the same time a number of key opportunities were identified including:

- deeper growth; enabling additional ATM functions e.g. distributing tickets for concerts or theatre

- broader growth; using existing LINK skills to expand into other communication platforms e.g. mobile phones

- the rapid growth of e-commerce

- the growth of new types of payment

- the rapid development of electronic switching as a means of making payments

- geographic expansion into Europe and perhaps beyond.

A vision for the future

Having carefully reviewed the environment in which it operates, LINK has built a vision of where it wants to be in the future. This vision (as for any organisation) needs to be inspirational yet achievable. The LINK vision is focused on leveraging its platform and core competencies to develop a backbone infrastructure for payment systems; the company is therefore setting out to be at the forefront of the development of such payment systems.

The Growth Strategy

A strategy is a plan of action as to how an organisation will achieve its goals and objectives. Given LINK’s existing position as a financially and strategically sound organisation with resources that can be ploughed into future developments, the new strategy now involves the following elements. Firstly, it is seeking to build in measured stages from its existing foundations, leveraging the existing network of connections to all the main banks and building societies in the UK. LINK is therefore reviewing the development of a range of new payment transactions which take into account all the new ways in which people can make payments.

This covers digital and other modern technologies, including the Internet, e-commerce, mobile technology and interactive digital TV. The company is also considering the possibility of expansion through the creation of joint ventures and partnership arrangements with appropriately qualified and established companies.

Conclusion

LINK, like most other companies, has a choice. Companies can either reinvent themselves or rest on their laurels. However, to do the latter could mean signing their own death warrant. In the world of rapidly advancing technology there is always a competitor out there with the capability to develop more advanced technologies which will capture tomorrow’s marketplace. LINK therefore has created its own future oriented vision and strategy to ensure that it will be tomorrow’s provider of the processes that manage the payment

systems of the future!