Why Life Insurance Won’t Pay

When it comes to life insurance, it is crucial to be aware of the potential reasons for denied claims. Discovering that a life insurance claim has been rejected can be distressing and financially burdensome for policyholders and their beneficiaries. In this blog, we will explore the specific scenario of a life insurance payout being denied due to an alcohol-related death and shed light on the key factors contributing to the reasons life insurance won’t pay out.

Denied Life Insurance Claim:

One significant reason for a life insurance claim denial is when the insured’s death is directly linked to alcohol consumption. Life insurance policies often include provisions that exclude coverage for deaths resulting from excessive alcohol consumption or alcohol-related incidents. These exclusions are put in place to manage the risks associated with alcohol abuse and its impact on mortality.

Alcohol-Related Death and Policy Terms:

It is vital for policyholders to carefully review their life insurance policy terms to understand how alcohol-related deaths are addressed. If the insured’s death is determined to be alcohol-related, such as due to chronic alcoholism or drunk driving accidents, the insurance company may have grounds to deny the claim. Policyholders should take note of any specific exclusions or limitations regarding alcohol-related deaths within their policy documents.

Importance of Full Disclosure:

To ensure a smooth claims process, it is imperative to provide accurate and complete information during the application stage. Failing to disclose relevant details, such as a history of alcohol abuse or excessive drinking, can lead to claim denials. Insurance companies rely on accurate information to assess risk and set appropriate premium rates. Any misrepresentation or omission regarding alcohol-related habits could be deemed as a violation of the duty of utmost good faith.

Seeking Professional Assistance:

If your life insurance claim has been denied due to an alcohol-related death, it is advisable to seek professional assistance to explore your options. Reputable claims management companies, like Resolute Claims, specialize in helping policyholders appeal denied claims. They have the expertise and experience to navigate the appeals process effectively, gathering necessary evidence and presenting a compelling case on your behalf.

Conclusion:

Understanding the potential reasons for denied life insurance claims is essential. In the case of an alcohol-related death, where the insured’s demise is directly linked to excessive alcohol consumption, it is not uncommon for claims to be denied. To avoid claim denials, it is crucial to disclose all relevant information during the application process. Carefully review policy terms. In the event of a denied claim, seeking professional assistance from a trusted claims management company can greatly increase your chances of a successful appeal.

At Resolute Claims, we specialize in assisting individuals in appealing denied life insurance claims. Our dedicated team is here to guide you through the process, provide expert advice, and maximize your chances of obtaining the payout. Contact us today to learn more about our services and how we can support you in your claims journey.

Syngenta A3 ePoster Edition 16 "Investment appraisal in action"

Syngenta A3 ePoster Edition 16 "Investment appraisal in action"  Promoting social inclusion through access to legal services (PDF)

Promoting social inclusion through access to legal services (PDF)  Adding value through health and safety (MP3)

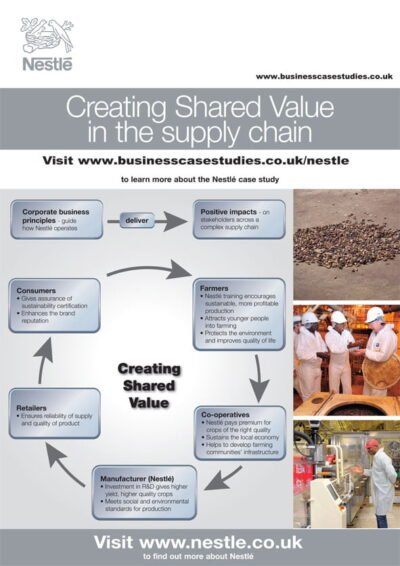

Adding value through health and safety (MP3)  Nestlé A3 ePoster Edition 17 "Creating shared value in the supply chain"

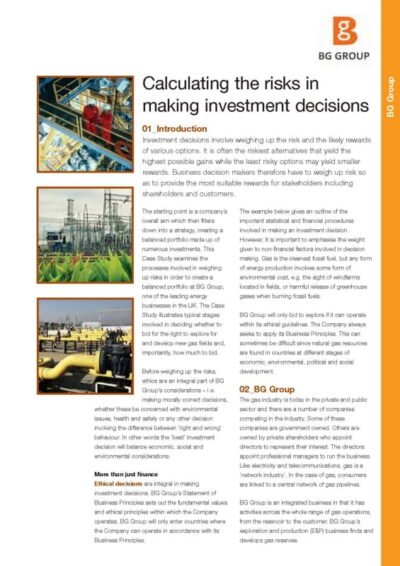

Nestlé A3 ePoster Edition 17 "Creating shared value in the supply chain"  Calculating the risks in making investment decisions (PDF)

Calculating the risks in making investment decisions (PDF)  UNISON A3 ePoster Edition 16 "Using promotion to campaign for public services"

UNISON A3 ePoster Edition 16 "Using promotion to campaign for public services"  The Environment Collection Business Case Studies eBook

The Environment Collection Business Case Studies eBook  A vision for a smarter world (PDF)

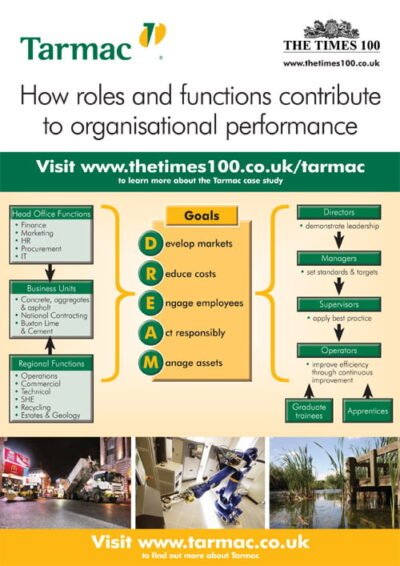

A vision for a smarter world (PDF)  Tarmac A3 ePoster Edition 14 "How roles and functions contribute to organisational performance"

Tarmac A3 ePoster Edition 14 "How roles and functions contribute to organisational performance"  OPITO A3 ePoster Edition 15 "Sectors of industry"

OPITO A3 ePoster Edition 15 "Sectors of industry"  Respecting stakeholder values (PDF)

Respecting stakeholder values (PDF)  Balancing stakeholder needs (PDF)

Balancing stakeholder needs (PDF)  Using customer service to position a business (PDF)

Using customer service to position a business (PDF)  Interpreting and understanding accounts (PDF)

Interpreting and understanding accounts (PDF)  The Editions Collection Business Case Studies eBook

The Editions Collection Business Case Studies eBook  The value of generating change (PDF)

The value of generating change (PDF)  Wilkinson A3 ePoster Edition 13 "Marketing strategy for growth"

Wilkinson A3 ePoster Edition 13 "Marketing strategy for growth"  Developing and implementing a strategic approach to ethics (PDF)

Developing and implementing a strategic approach to ethics (PDF)