Not so long ago, many organisations were quite prepared to take production decisions without any proper analysis of their market. Sometimes decision-makers hit on good ideas or acted on a hunch that was fundamentally sound. The chances of success, however, were always likely to be reduced simply because they were making decisions without having first gathered, collated and analysed appropriate information.

Proper marketing is the route to satisfying customers. Research shows that organisations which constantly satisfy customers are more likely to be successful i.e. more profitable than organisations that don’t: hardly surprising. If organisations discover the needs and interests of their consumers, there are benefits both for the consumers and the organisation.

Few industries have changed as much in recent years as sports and leisure. Today’s consumers have many choices regarding the sports and leisure activities they watch or in which they actively participate. They can look for sports and leisure pursuits at home, in leisure centres of various kinds, at sports clubs or at sporting events. This choice has made it increasingly necessary for sports organisations to make decisions that are better related to the changing lifestyle and shifting interests of modern consumers (i.e. consumer focused).

Cricket is one of the UK’s traditional sports, embedded in our sporting heritage. Today, however, cricket has to compete for more than ever before with other exciting, entertaining sports activities. Although these activities enrich people’s lifestyles, they also represent a threat to traditional, long-standing sports. For example, in other cricket-playing parts of the world such as the West Indies, the broader diet of sport, coming mainly from the USA, has diluted popular interest in playing and watching cricket.

This case study looks at how the England and Wales Cricket Board (ECB) recently undertook a substantial piece of market research. The ECB’s aim was to research how to:

- increase audiences at cricket matches

- stimulate interest in cricket in general

- encourage more people to play the game.

The England & Wales Cricket Board

Since its formation in 1998, the England and Wales Cricket Board has looked to create a framework in which cricket can succeed at all levels. This has involved establishing a clear vision of the direction in which the game should move. All levels of cricket were considered, from the grassroots in playgrounds and parks to the international Test arena. The ECB’s vision for cricket is:

“to ensure that England becomes and remains the most successful and respected cricket nation in the world and to encourage the widest possible participation and interest in the game throughout England and Wales.”

To have any hope of success, a vision must be supported by:

- tangible business objectives

- an Action Plan designed to achieve these objectives.

The ECB initially published Raising the Standard before launching the National Strategy for Cricket called A Cricketing Future for All in 2001, which provides a comprehensive framework for taking the game forward.

Market research

The ECB wanted to use market research to develop precise strategies that would help the future of cricket and make it more consumer focused. This research would enable the ECB to plan ahead with some certainty rather than rely on unsubstantiated guesswork and hunches.

According to the American Marketing Association:

“Market research is the systematic gathering, recording and analysing of data about problems relating to the marketing of goods and services.”

The keywords are:

- systematic – using a clear, organised method or system

- gathering – knowing what data you are seeking, and collecting it

- recording – keeping clear, organised records of what you discover

- analysing – collating and interpreting data in order to draw out relevant trends and conclusions that can be used as a basis for a strategy

- problems relating to marketing – obstacles that are preventing the growth of the business.

The ECB’s research covered three phases:

- Analysing the existing environment: collecting and considering relevant facts and figures about cricket spectators, TV audiences, radio listeners, newspaper readers, and participants in cricket and other sports.

- Developing a consumer focus: interviewing different groups of existing and potential spectators to find out their views, preferences and expectations.

- Generating ideas for new products: identifying and testing audience reaction to a different type of cricket proposed in the light of consumer focused research.

Market research methods

The starting point for the market research involved developing appropriate market research methods. The first step was to gather secondary information. Secondary information is often called ‘desk research’ and is frequently the starting point for any research. This has already been collected by someone else, often for another purpose. It often represents, therefore, one of the cheapest and easiest sources of information.

If you want to find secondary data on the web, type in the area you are researching into a search engine together with words like market research or report.

Secondary data will probably not meet all of an organisation’s needs but is a very good starting point for research. The data gathered in this way often helps to define and clarify problems within the context of the research objectives. Following that, an organisation can look to generate the more closely focused primary data it requires.

For the ECB, secondary data helped to identify who the existing and potential consumers of cricket are. In addition to existing consumers, other groups of potential cricket consumers included:

- children

- women

- young men

- ethnic minorities

- inner city communities.

At the same time, the secondary data identified some vital details about the changing marketplace for cricket. For example, cricket has done rather well in the face of both direct competition and indirect competition, with attendance at international matches rising substantially in recent years and record numbers of people playing different types of cricket.

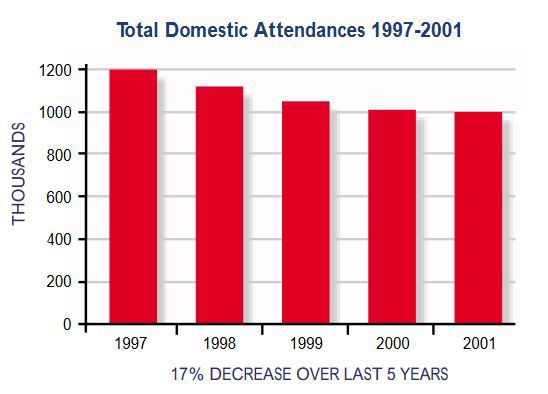

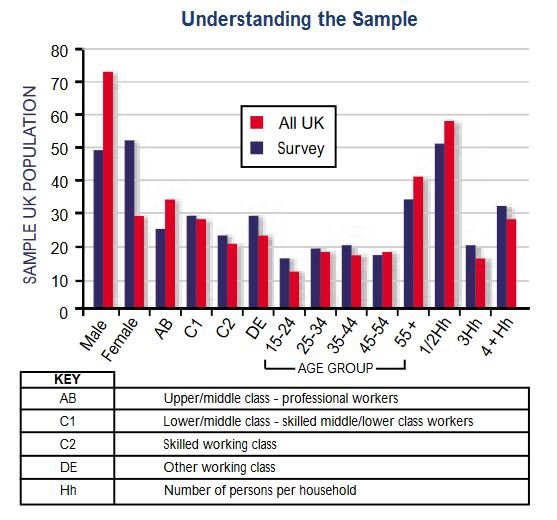

However, this achievement has to be viewed against a background in which individual members of county cricket clubs (formerly the backbone of England’s domestic professional cricket) have been falling. The numbers attending domestic competitions have also fallen, and there has been a 17 decrease in attendance at county matches over the past 5 years. The research also confirmed that the majority of current county cricket spectators tend to be males who are middle-aged or older and from a middle class background.

Having gathered the secondary data, the rest of the research involved collecting primary information. Primary research is research undertaken to meet the specific requirements of the organisation and can be expensive. The data collected is first-hand knowledge, ‘straight from the horse’s mouth’. The primary research collected for the ECB was both quantitative and qualitative.

The quantitative research involved at-home interviews with a nationally representative random sample of 4,104 adults. Likert scales (i.e. a way of rating a series of questions from 1 – 5: very serious = 5 to not at all serious = 1.) were then used to discover the interests of different groups of consumers. For example:

Q1 Which of the following currently describes you best?

- I love cricket

- I really like cricket

- I don’t mind cricket

- I don’t like cricket much

- I don’t like cricket at all

- I hate cricket

- Don’t know

Q2 On a scale of 1 to 5, how much would you say you know about the game of cricket?

- 1 = nothing at all

- 2 = not a lot

- 3 = a bit

- 4 = a fair amount

- 5 = a lot

Qualitative research was conducted by a researcher, talking face-to-face with groups of people with similar characteristics e.g. women, young men, and ethnic groups. This research revealed, among other things, that some groups of consumers felt that there was a lack of buzz and excitement associated with cricket compared to other sports, particularly with the county game. Younger and potentially new cricket audiences made clear that they wanted forms of entertainment with enough excitement to justify the leisure time and money they would invest in by purchasing a match ticket.

For cricket to appeal to these new and different groups of consumers, the game would have to be offered in a new, different, more exciting format. The research also showed that many customers who had a positive first experience of cricket would come back for more.

Meeting consumer needs

Findings from both the quantitative and qualitative research clearly highlighted some of the major barriers that discouraged people from attending cricket matches. For example, many people:

- didn’t know about events and were unsure how to find it

- were concerned about the value of entertainment in relation to other activities

- wondered about how inviting the cricket grounds were.

The research showed that there was significant interest in cricket on the part of a range of different groups of consumers who wanted:

- easy access to information telling them when and where matches were taking place

- virtually guaranteed entertainment, so there would be an enjoyable return on time and money invested

- a socially inviting environment where they would feel welcome, irrespective of their class, gender, age or race.

Any new cricket product needed to be targeted at specific market segments which could be identified, isolated and ‘worked on’ e.g. with mail shots. At the same time the research suggested that although any new product had to be seen as new and different from existing forms of cricket, the ECB would not have to reinvent the game. Many of the potential consumers who did not attend cricket matches liked cricket but felt that cricket matches needed to be more exciting and less time-consuming.

The 20-over game

The final phase of the research showed that a cricket match that lasted around 3 hours rather than all day would appeal to new audiences such as females between 15 and 44, as well as families. This suggested that a cricket match restricted to 40 overs (240 balls bowled), the equivalent of 3 hours of play, would help the game to become more consumer focused.

For the ECB, this idea represented a radical step, but one clearly designed to increase consumer focus. So the ECB decided to ‘go for it’. The game called the Twenty20 Cup, will be an evening competition between county sides with 20 overs per side. To assist the entertainment values further, the Twenty20 Cup will incorporate music into all matches as boundaries are scored or batsmen are dismissed. There will even be a live pop concert at the opening match and on the final’s day. The first competition will be played during a 2-week period in June 2003 and the final is scheduled to be under floodlights in July 2003.

The ECB realised that some traditionalists might not support this popularised version of the game, but the market showed that, if appropriately targeted, it will attract a high level of interest amongst new consumer groups such as young people, women and families.

Conclusion

The programme of market research has proved to be an invaluable tool in helping to develop a more consumer focused approach to cricket. The year 2003 marks an important step forward for the professional game. The ECB anticipates that this venture will yield long-term benefits that will help the game within England and Wales to become stronger at all levels, both professional and amateur.