Commercial real estate analytics has emerged as a pivotal component in the decision-making processes of investors, developers, and property managers. This field encompasses the systematic analysis of data related to commercial properties, including office buildings, retail spaces, industrial facilities, and multifamily housing. The rise of big data and advanced analytical tools has transformed how stakeholders assess market conditions, evaluate property performance, and forecast future trends.

By leveraging sophisticated algorithms and data visualisation techniques, professionals in the commercial real estate sector can derive actionable insights that drive strategic planning and investment decisions. The evolution of technology has played a significant role in shaping commercial real estate analytics. With the advent of cloud computing, machine learning, and artificial intelligence, the ability to process vast amounts of data has become more accessible than ever.

This technological advancement allows for real-time analysis and predictive modelling, enabling stakeholders to respond swiftly to market fluctuations. As the landscape of commercial real estate continues to evolve, the integration of analytics into everyday operations is no longer a luxury but a necessity for those seeking to maintain a competitive edge.

Summary

- Commercial real estate analytics involves the use of data and technology to analyse and understand the commercial property market.

- It is important for investors, developers, and property managers to use analytics to make informed decisions and mitigate risks in the commercial real estate industry.

- Types of commercial real estate analytics include market analysis, financial analysis, and risk analysis, among others.

- Key metrics and data sources in commercial real estate analytics include property valuation, rental rates, occupancy rates, and economic indicators.

- Commercial real estate analytics is used in decision making to identify investment opportunities, assess property performance, and optimize portfolio management.

The Importance of Commercial Real Estate Analytics

The significance of commercial real estate analytics cannot be overstated, as it provides a framework for informed decision-making. Investors rely on analytics to identify lucrative opportunities and mitigate risks associated with property investments. By analysing historical data and current market trends, stakeholders can make predictions about future performance, which is crucial for long-term planning.

For instance, understanding rental trends in a specific area can help investors determine the optimal time to buy or sell a property, ultimately influencing their return on investment. Moreover, commercial real estate analytics enhances operational efficiency. Property managers utilise data analytics to optimise building performance, reduce costs, and improve tenant satisfaction.

By monitoring key performance indicators (KPIs) such as occupancy rates, maintenance costs, and tenant turnover, managers can implement strategies that enhance the overall value of their assets. This data-driven approach not only streamlines operations but also fosters a proactive management style that anticipates issues before they escalate.

Types of Commercial Real Estate Analytics

Commercial real estate analytics can be broadly categorised into several types, each serving distinct purposes within the industry. Descriptive analytics focuses on historical data to provide insights into past performance. This type of analysis often involves examining trends in rental rates, occupancy levels, and property values over time.

For example, a property manager might analyse occupancy rates over the past five years to identify seasonal patterns that could inform future leasing strategies. Predictive analytics takes this a step further by using statistical models and machine learning techniques to forecast future outcomes based on historical data. This type of analysis is particularly valuable for investors looking to assess the potential appreciation of a property or predict market shifts.

For instance, predictive models can analyse demographic trends and economic indicators to forecast demand for office space in a particular region. Prescriptive analytics offers recommendations based on the insights gained from descriptive and predictive analyses. This type of analytics helps stakeholders make informed decisions by suggesting optimal courses of action.

For example, if an analysis reveals that a particular retail location is underperforming due to high competition, prescriptive analytics might recommend strategies such as targeted marketing campaigns or adjustments in pricing to enhance competitiveness.

Key Metrics and Data Sources in Commercial Real Estate Analytics

To effectively utilise commercial real estate analytics, stakeholders must be familiar with key metrics that provide insights into property performance and market conditions. Some of the most critical metrics include net operating income (NOI), cap rate (capitalisation rate), internal rate of return (IRR), and cash-on-cash return. NOI is a measure of a property’s profitability, calculated by subtracting operating expenses from gross rental income.

Cap rate provides insight into the expected return on an investment by comparing NOI to the property’s purchase price. Data sources play an equally vital role in commercial real estate analytics. Publicly available datasets from government agencies, such as census data and economic reports, provide valuable context for market analysis.

Additionally, proprietary databases maintained by real estate firms offer detailed information on property transactions, rental rates, and tenant demographics. Platforms like CoStar and REIS are widely used in the industry for their comprehensive databases that facilitate in-depth market research. Furthermore, technology has enabled the integration of alternative data sources into commercial real estate analytics.

Social media sentiment analysis, foot traffic data from mobile devices, and satellite imagery can provide unique insights into consumer behaviour and market dynamics. By incorporating these diverse data sources, analysts can develop a more nuanced understanding of market trends and tenant preferences.

How Commercial Real Estate Analytics is Used in Decision Making

The application of commercial real estate analytics in decision-making processes is multifaceted and extends across various stages of property investment and management. For investors, analytics serves as a critical tool for evaluating potential acquisitions. By conducting thorough market analyses that incorporate historical performance data and predictive modelling, investors can identify properties that align with their investment criteria.

For instance, an investor may use analytics to assess the growth potential of a neighbourhood by examining demographic shifts and economic indicators. In addition to acquisition strategies, commercial real estate analytics informs asset management decisions. Property managers leverage data analytics to optimise operational efficiency and enhance tenant experiences.

By analysing tenant feedback and occupancy patterns, managers can implement targeted improvements that increase tenant retention rates. For example, if data reveals that tenants are dissatisfied with maintenance response times, property managers can adjust their processes to address these concerns proactively. Moreover, analytics plays a crucial role in lease negotiations and renewals.

By analysing market rental rates and occupancy trends in comparable properties, landlords can make informed decisions about pricing strategies that maximise revenue while remaining competitive. This data-driven approach not only strengthens negotiation positions but also fosters transparency between landlords and tenants.

Advantages and Limitations of Commercial Real Estate Analytics

The advantages of commercial real estate analytics are numerous and impactful. One significant benefit is the ability to make data-driven decisions that reduce uncertainty in an inherently volatile market. By relying on empirical evidence rather than intuition or anecdotal information, stakeholders can minimise risks associated with property investments.

Additionally, the use of advanced analytical tools allows for more precise forecasting and trend analysis, enabling investors to stay ahead of market shifts. Another advantage lies in the enhanced operational efficiency that analytics provides. Property managers can streamline processes by identifying inefficiencies through data analysis.

For instance, if energy consumption data indicates excessive usage during certain hours, managers can implement energy-saving measures that reduce costs while promoting sustainability. However, there are limitations to consider when utilising commercial real estate analytics. One notable challenge is the quality and accuracy of data sources.

Inaccurate or outdated information can lead to misguided conclusions and poor decision-making. Furthermore, reliance on quantitative data may overlook qualitative factors that influence property performance, such as community sentiment or local economic conditions. Another limitation is the potential for over-reliance on predictive models without considering external variables that could impact outcomes.

While predictive analytics can provide valuable insights, unforeseen events such as economic downturns or changes in government policy can disrupt established trends. Therefore, it is essential for stakeholders to balance analytical insights with qualitative assessments and market intuition.

Trends and Innovations in Commercial Real Estate Analytics

The landscape of commercial real estate analytics is continually evolving as new technologies emerge and industry practices adapt to changing market conditions. One prominent trend is the increasing use of artificial intelligence (AI) and machine learning algorithms to enhance predictive capabilities. These technologies enable analysts to process vast datasets more efficiently and uncover patterns that may not be immediately apparent through traditional analytical methods.

Another significant trend is the growing emphasis on sustainability within commercial real estate analytics. As environmental concerns become more pressing, stakeholders are increasingly incorporating sustainability metrics into their analyses. This includes evaluating energy efficiency ratings, carbon footprints, and compliance with green building standards when assessing property value and performance.

Moreover, the integration of geographic information systems (GIS) into commercial real estate analytics has revolutionised spatial analysis capabilities. GIS technology allows analysts to visualise data geographically, providing insights into location-based factors that influence property performance. For instance, GIS can help identify areas with high foot traffic or proximity to public transport links—critical considerations for retail properties.

The Future of Commercial Real Estate Analytics

Looking ahead, the future of commercial real estate analytics appears promising as technological advancements continue to reshape the industry landscape. The integration of blockchain technology holds potential for enhancing transparency in property transactions by providing immutable records of ownership and transaction history. This could streamline due diligence processes and reduce fraud risks associated with property investments.

Furthermore, as the demand for remote work increases post-pandemic, there will be a shift in how commercial spaces are utilised. Analytics will play a crucial role in understanding changing tenant needs and preferences as businesses adapt their office layouts and space requirements. Stakeholders will need to leverage data-driven insights to navigate this evolving landscape effectively.

Finally, the ongoing development of advanced analytical tools will likely democratise access to commercial real estate analytics across various sectors within the industry. As user-friendly platforms emerge that cater to smaller investors and property managers, a broader range of stakeholders will be able to harness the power of data analytics to inform their decision-making processes. In conclusion, commercial real estate analytics stands at the forefront of transforming how stakeholders approach property investment and management.

As technology continues to advance and new methodologies emerge, those who embrace these changes will be well-positioned to thrive in an increasingly competitive market environment.

Commercial real estate analytics is a crucial tool for businesses looking to make informed decisions about their property investments. By utilising data and technology, companies can gain valuable insights into market trends, property performance, and investment opportunities. A related article on Business Case Studies discusses the importance of local intent in Google searches for small businesses. This article highlights how nearly half of all Google searches have local intent, emphasising the need for businesses to leverage this trend to attract customers and drive growth. By understanding and utilising local search trends, businesses can enhance their online presence and reach a wider audience. Read more here.

FAQs

What is commercial real estate analytics?

Commercial real estate analytics refers to the process of using data and statistical analysis to gain insights into the commercial property market. This can include evaluating property performance, market trends, investment opportunities, and risk assessment.

Why is commercial real estate analytics important?

Commercial real estate analytics is important as it provides valuable information for investors, developers, and property managers to make informed decisions. It helps in understanding market trends, assessing property performance, and identifying potential investment opportunities.

What are the key components of commercial real estate analytics?

The key components of commercial real estate analytics include property valuation, market analysis, financial modelling, risk assessment, and performance benchmarking. These components help in evaluating the potential of a commercial property and making informed investment decisions.

How is data used in commercial real estate analytics?

Data is used in commercial real estate analytics to analyse property performance, market trends, and investment opportunities. This can include data on property sales, rental rates, occupancy rates, demographic trends, and economic indicators. Advanced analytics techniques are used to derive insights from this data.

What are the benefits of using commercial real estate analytics?

The benefits of using commercial real estate analytics include improved decision-making, better risk management, identifying investment opportunities, understanding market trends, and optimizing property performance. It helps in maximising returns and minimising risks in commercial real estate investments.

Syngenta A3 ePoster Edition 13 "Feeding and fuelling the world through technology"

Syngenta A3 ePoster Edition 13 "Feeding and fuelling the world through technology"  Syngenta A3 ePoster Edition 14 "Developing an effective organisational structure"

Syngenta A3 ePoster Edition 14 "Developing an effective organisational structure"  A customer-centred approach to providing insurance (MP3)

A customer-centred approach to providing insurance (MP3)  Foreign Commonwealth Office A3 ePoster Edition 14 "Delivering the mission statement"

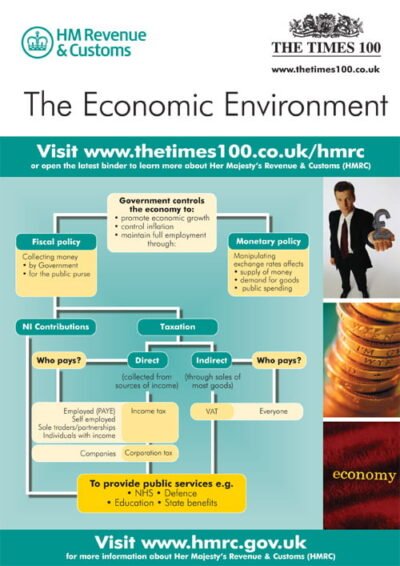

Foreign Commonwealth Office A3 ePoster Edition 14 "Delivering the mission statement"  HM Revenue & Customs A3 ePoster Edition 12 "The economic environment"

HM Revenue & Customs A3 ePoster Edition 12 "The economic environment"