Bibby Line Group started out as a family-run shipping business. It was founded in 1807 and since that time the company has grown to become a global business. It has also diversified into new business areas, such as financial services and asset management services, as well as logistics.

Today, Bibby Line Group employs over 5,000 people in 21 countries. It has a turnover in excess of £1 billion. Despite its size, the Group is not a public company. It remains in private ownership. The business is almost wholly-owned by the immediate Bibby family and its family trust. In 2011 Bibby Line Group received the UK Private Business of the Year accolade at the National Business Awards.

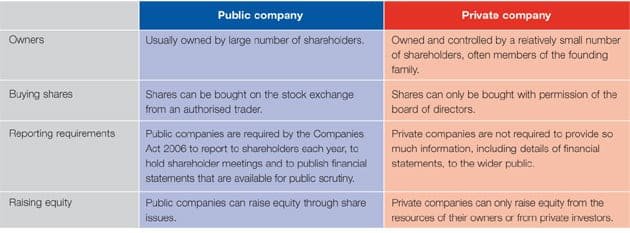

By retaining a private company structure, successive generations of the family have maintained control of the ownership of the business. Shares in a public company can be freely traded (bought and sold) on the stock exchange. However, shares in a private company can only be bought and sold with the permission of the board of directors.

A private company structure also allows the owners to maintain firm control over the culture and values of the business. The culture of an organisation is described as ‘the way we do things around here’. An important feature of Bibby Line Group’s culture is inclusiveness. It is recognised that everyone who works for the organisation has an important contribution to make. This emphasis on building a family-based business is reflected in the company’s main aim:

‘The fundamental aim of the business is to invest in and develop a diverse portfolio of companies – the diversity is there to manage risk and create growth opportunities – which will be handed onto the next generation, and we’re currently with the family’s sixth generation.’

Every business should be based on a set of core values. These drive everything a business does. Bibby Line Group has defined six values which it ensures are adopted throughout the organisation:

- Positively challenging which is seeing how things it already does can be done better

- Restless momentum which is focused on innovating, using the people and equity available to develop new products, markets and services

- Making sure that all employees act with real integrity

- Nurturing lifetime relationships with customers, suppliers and employees by developing activities to ensure that they meet each of the parties’ objectives

- If the organisation can live the first four values then it will be powered by people and be focused on customers.

This case study looks at the strategies used by Bibby Line Group to grow the business, whilst retaining its strong family ethos.

Growth as a business strategy

Choosing the right business strategy can give a company a competitive advantage over its rivals. A strategy is a plan to meet business objectives. These might be to increase profits, to grow the business or even just to survive through a difficult economic period.

A strategy needs to set the scope and direction of a company. The scope relates to what products and services the company produces and what markets it operates in. In recent years Bibby Line Group has extended its scope to branch out into new products and markets. The direction the company has taken has been one of growth. This has been achieved through both organic and inorganic growth. Organic growth comes from growing the existing business by winning new customers and increasing sales.

Inorganic growth involves acquiring or merging with other companies to increase the portfolio.

There are several business benefits associated with a growth strategy:

- Efficiencies from economies of scale. As businesses grow larger, they may be able to reduce their unit costs. For example, the same information technology system can be used to serve several businesses in the Group rather than just one. Larger companies can buy supplies and materials in bulk and so benefit from discounts for large orders.

- Control through large market share. Companies with a large share of a particular market can, to some extent, exert influence over the market and their competitors. They can be leaders rather than followers in terms of pricing and other aspects. Smaller rivals will not have the same influence.

- Security from spreading financial risk. Having a portfolio of businesses enables a company to spread risks. If some subsidiaries have poor results, they can be supported by those areas of the company that are doing better. All businesses in the portfolio help the Group’s results by making a contribution to overheads.

A focus on innovation

Bibby Line Group has achieved outstanding performance by continually seeking ways to grow and diversify. One of the Group’s values is ‘restless momentum’. This means continually innovating.

Innovation involves the development of new ideas, both for improved goods and services and for new and better ways of working.

This focus on innovation is central to all businesses within Bibby Line Group. Each subsidiary operates independently but all are encouraged to innovate. Each management team is responsible for the achievements of its part of the Group’s business. The subsidiaries are also expected to grow and, like the overall Group, this can be achieved both organically and inorganically.

Organic growth

Organic growth is achieved from within a business. It can be from winning new customers, by increasing sales of existing products and services and by introducing new product lines. It can also be achieved by moving into new geographic markets, perhaps by selling more in export markets. Organic growth is often safer than inorganic growth. Once a business has acquired a specialism, such as transporting cargoes by sea, it can be relatively easy to expand, for example, by sailing on new routes. It can be more difficult to buy and integrate another existing business into the existing company.

The early history of Bibby Line Group is characterised by organic growth. Starting with seven ships at the beginning of the nineteenth century, the company expanded over the next 20 years to acquire another 18 vessels. Initially it focused on routes to Mediterranean ports, before expanding to support trade with India, China and, later still, South America. Its ships carried many different cargoes, including cotton, sugar, animal hides and many other commodities.

Careful growth

Intelligent companies grow carefully. This means they are sometimes prepared to sell loss-making or poorly performing businesses, or realise profits when the value of an asset has reached its peak. The returns from selling businesses or assets can then be reinvested in new ventures. Knowing when to sell is an important business skill. Bibby Line Group sold its fleet of ships in 2005-07 when the global economy was at its peak. This provided the company with cash:

- to reduce debts in some of its businesses

- to reinvest in businesses that were less likely to be hit hard in a global recession.

This meant that when the global recession occurred in 2008 and 2009, Bibby Line Group was in a healthy position. It was debt-free and had money available to invest in growth opportunities. Taking advantage of lower prices of vessels during the recession and cheaper loans, Bibby Line Group purchased six new ships in 2010-11 as well as diving support vessels. Using its maritime expertise, the company has been able to develop new businesses in more specialist sectors of the industry:

- Bibby Maritime specialises in providing and operating shallow water floating accommodation vessels. For example, the company is providing a vessel that is supporting the exploitation of natural gas reserves found off the coast of Australia by housing workers at the onshore terminal.

- Bibby Offshore provides dive support vessels for the offshore gas and oil exploration and production industry. These are used by divers who are installing, repairing and maintaining sub-sea oil and gas platforms and pipelines.

These businesses are examples of how the Group has been able to maintain organic growth in its maritime businesses during a difficult economic period.

Inorganic growth

Inorganic growth occurs when a company grows by merging with or acquiring other businesses. Mergers and acquisitions are a much faster way of growing a company than organic growth.

The company immediately gains the customers and sales of the acquired businesses, as well as its assets and market position. However, inorganic growth is a more risky strategy than organic growth because it involves taking over a new business, which may have a different culture and way of doing things. It can also be expensive – profitable businesses cannot be acquired cheaply.

The acquisition strategy of Bibby Line Group has enabled the business to diversify into new product and service areas. As an example, the Group’s distribution business recently expanded its product and service range by taking over two companies – one in the returnable packaging market and the other providing logistics to the food manufacturing industry. Logistics involves all the processes required to move goods from a point of origin to an end point, such as from a factory to a retailer.

New markets

Another example of inorganic growth was Bibby Line Group’s acquisition of Garic Ltd in 2008. Garic is a plant and equipment hiring company to the construction industry. This is a relatively young and dynamic company with lots of growth potential.

In 2007, Bibby Line Group entered the convenience retail industry when it acquired a 51% stake in Costcutter. It later took full control of the convenience store retailer in 2011. Bibby Line Group views the convenience retail sector as an excellent long-term prospect. It plans to support the Costcutter management team in continuing to put retailers at the heart of the business.

The strategy of diversification has enabled Bibby Line Group to move into industries with strong growth prospects. For example, in 1982 the company moved into the rapidly growing financial services market. There were real opportunities in this market. Today, Bibby Financial Services is the UK’s largest independent (i.e. non-bank) debt factorer. This business provides finance to companies to help with cash flow. It offers a service to companies that conduct a substantial number of transactions on a credit basis. Bibby Financial Services provides finance to these companies against unpaid sales invoices. The company can use this finance to buy in more products to sell. Bibby Financial Services now factors over £6 billion of debt in 14 countries. Since the business was set up by the Group it has grown organically, expanding into Hong Kong, Sweden and New Zealand in 2011, and inorganically by acquiring businesses in the UK and Europe. More recently it has created new financial products in Australia and Poland.

Measuring growth

There are many measures that a company can use to measure growth. For example, it can measure it by increased market share, greater volume of sales or larger profit. Bibby Line Group uses several ways of measuring the company’s growth. Each of the businesses within Bibby Line Group measures growth in a way that is relevant to the type of business. For example:

- Bibby Financial Services measures debts factored (up 24% in 2010) and growth in sales (up 25% in 2010)

- Bibby Distribution measures profit (increased by 21% in 2010) and turnover (increased by 25% in 2010)

- Garic measures turnover (increased by 36%).

At a Group level, the growth is measured in terms of its shareholder funds. The shareholder funds of any business are simply the value of what a business owns (its assets) minus what it owes (its liabilities) at any one time.

As a business grows, so too do its shareholder funds. Shareholder funds at the Bibby Line Group have been increasing for over 10 years and most recently have been growing by 15% annually (over the most recent three years).

Conclusion

Growing a business is about taking opportunities when they arise. Historically, Bibby Line Group grew through its expertise in shipping and carrying out international operations. Over time, this business expertise was applied in new contexts and the Group diversified into new products and markets.

As a family company, Bibby Line Group has very strong traditions and values. At the heart of these values lies a belief in trusting employees and enabling them to make decisions. This company culture has enabled it to be creative in looking for new opportunities. The company focus is on being close to customers. Armed with this understanding of customers and their requirements, Bibby Line Group has been able to grow organically – building on core expertise. Just as importantly it has been able to engage in inorganic growth – moving into new and exciting lines of business at opportune times.