Successful organisations are able to compete in tough environments.

To do this, they need:

- capable managers who are willing to face facts and make hard decisions

- excellent resources, including flexible and enterprising employees

- financial resources to support initiatives for change, growth and improvement.

This case study examines how in 1999 MFI, the leading furniture retailer in the UK, recognised the need to make key changes in order to develop a successful competitive strategy. In particular, it focuses on how the organisation has managed its finances more effectively.

MFI is looking to move on from being ‘a company that sells furniture’ to ‘a company that delights customers’. In the past, MFI’s success was based around high quality products at affordable prices, with a reasonable level of service. However, in today’s market place that is not enough: it does not differentiate MFI sufficiently from its competitors.

MFI sees its transformation as a journey with several milestones along the way. The first milestone was to establish a firm financial foundation on which to build a competitive strategy. The next was to create a fully integrated company that is focused on providing unparalleled customer service.

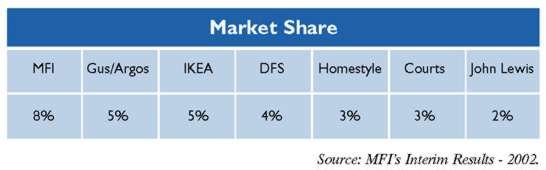

MFI specialises in furniture and fittings for kitchens, bedrooms, home offices, bathrooms and living/dining rooms. It is the market leader in the UK furniture market, which is worth £10bn a year.

MFI has worked with a range of top designers to create the furniture designs required to:

- build competitive advantage

- create a range of exciting customer focused designs

- establish a totally new look for MFI’s furniture stores to make them more attractive and appealing to the customer.

MFI’s major brands includes:

- Hygena – the UK’s Number 1 kitchen brand

- Schreiber – a premium furniture brand associated with leading craftsmanship.

MFI holds 30of the new kitchens market and 24of the bedrooms market.

As well as being the market leader in the UK, MFI also has a strong presence in France with its leading brand Hygena Cuisines. Howden Joinery is another important part of MFI. It supplies kitchens to the building trade and is the first choice for small builders and contractors. Howden Joinery has recognised that its customer (the local builder) has different requirements to a member of the public buying through its retail store network i.e. the stock needs to be there to take away from Howden Joinery depots ‘vs’ delivery to customers’ homes.

Recently MFI has introduced Howden Joinery in the USA on a pilot basis operating in the same way as the UK i.e. stock to take away.

In 1999 MFI had completed the refurbishment of most of its stores into the Homeworks format. The purpose behind this investment was to generate high levels of sales growth. However, the refurbished stores were not delivering the increased sales growth that was expected. As a result, in the period prior to 1999 MFI experienced a considerable net outflow of cash, and this had to be financed by borrowing.

In business, ‘gearing’ refers to the proportion of finance that a business has raised from borrowing from external sources compared with that raised internally from operations or shareholders. Highly geared companies are companies with a high proportion of external borrowing. It makes sense to borrow, but not too much. MFI’s increased borrowing led to it becoming highly geared. A highly geared company has to pay large sums to its lenders in the form of interest (see below). This holds back the growth of a business because profits are reduced.

Sale and leaseback is an important potential source of finance from land, buildings and other valuable assets that a company owns. A business sells its freehold property to an investment company, and then leases it back for an agreed number of years. The main advantage is that the business taking out the lease no longer ties up its money capital in fixed assets, and can ensure that the funds that are released work more productively in generating ongoing wealth. At the time, sale and leaseback was the most suitable source of funds for MFI, because further bank loans or other interest bearing loans would have aggravated the gearing position further.

customers. Growing the business involves generating profits through the turnover (value of sales) being substantially greater than the cost of sales (costs that go into achieving business turnover).

Provided that products are sensibly priced, the profit margin a business achieves will be high when customers’ needs are well met (resulting in a high turnover) and costs are well managed. Of course, the profit then needs to be channelled into growing the business and paying a dividend to shareholders rather than into paying heavy interest charges. Interest is the payment that a borrower has to make to a lender. Interest payments have to be made regularly over the loan period. At the end of the agreed loan period the borrower will have paid back the principal (i.e. the original sum borrowed) and interest.

The new management team was able to use the cash from the sale and lease back programme to rehabilitate the business. In particular, MFI was able to invest in New Product Introduction (NPI) to replace tired and non-modern styles of furniture. This involved working with the best designers in the field and carrying out extensive market research with customers to find out what ‘delighted’ them.

MFI piloted new concepts, ideas and products in its stores, tested them to find out customer reaction and then invested in the most profitable lines. MFI has changed the shape of its stores to emphasise that it provides furniture for ‘every room in the house’. Each ‘room’ in an MFI store gives design-conscious customers a picture of how they can make their own homes attractive and design-focused.

To change the shape and feel of its stores, MFI worked with a design partner (Conran Design Group) that had the closest understanding of MFI customers. Conran Design Group proposed an environment in which customers would take pleasure and pride in their homes. This was achieved by looking at the store as a home – as a series of rooms in which customers can be inspired, seek advice, create their own room styles and be well served with a value-driven offer.

Another success has been the growth of Howden Joinery, which provides a personal service to small builders and contractors involved in fitting kitchens.

MFI and Howden Joinery are therefore part of an integrated business designed to meet the needs of retail and trade customers and their different requirements.

Based on the dynamic success of the UK business in recent times, the company is

seeking to become truly international through piloting, testing and then investing overseas as well as forming partnerships with leading overseas companies to sell their products in the UK.

For example, in August 2001, MFI created a joint venture to open several MFI stores in Taiwan with a local company. In October 2001 MFI signed a joint venture agreement with Ethan Allen, the largest furniture retailer in the USA, to open several Ethan Allen stores in the UK.

Any business that wants to grow must secure the necessary funding. There are several

sources of cash funding for a public limited company (plc). It can:

- sell further shares to existing shareholders at an attractive, discounted price

- raise funds from loans (where the borrower pays interest and eventually the principal) or from short-term borrowing in the form of a bank overdraft. This results in a heavy burden of interest

- generate and plough back profits. This is a really attractive option. Profit is internally generated cash that is the reward for making the assets of the company work more efficiently.

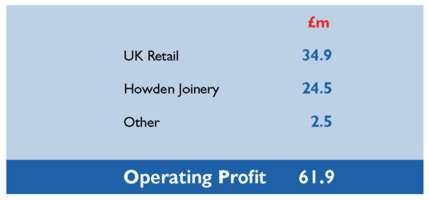

In 2001 MFI’s profit and loss account showed the following details:

With such profit figures, MFI is able to grow through internally generated funds. In addition, the company has focused on making all its assets work profitably. Idle assets do not generate cash, so MFI seeks to maximise the profit potential of all assets. For example, it has embraced website technology. Customers can now order online 7 days a week, 24 hours a day. This represents highly efficient use of key MFI fixed assets – its computer network system and distribution system.

Stock is another important business asset. Idle stock becomes obsolete, can get damaged and ties up capital that could be used more effectively elsewhere in the business. MFI is seeking to optimise the stock carried across its business.

For example, it has increased the number of stock turns through developing an integrated supply chain, so that stock can be delivered quickly to where and when it is needed, rather than holding unnecessary stock. By providing the customer with ‘products that delight’. MFI ensures that stock is sold quickly and turned into cash, which can then be used to generate further profits.

MFI has also worked hard at reducing debtors by offering competitive rates of trade credit to its trade customers i.e. builders.

In addition, the company works closely with its suppliers to negotiate better buying terms.

The story of how MFI now manages its finances helps it grow. The best way of growing a business is through profits generated through successful trading. Delighting customers provides high levels of turnover. At the same time, generating finance internally removes the cost of borrowing money – interest payments. Other forms of financial efficiency e.g. making your fixed assets work harder, reducing stock, reducing debtors and negotiating better supply terms – all help to deliver growth for a company. It is having the cash to work your business that drives the success story: cash is king.