In the 21st century, consumers really do matter and businesses that wish to prosper must address their needs. This case study illustrates the high level of modern forms of customer service by showing how the Yorkshire Building Society has reshaped its retail activities around customer requirements. The study focuses on the development of a retail strategy based on identifying different customer needs and on devising ways of meeting these different needs.

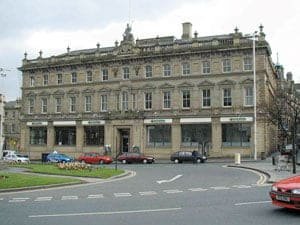

Prior to this initiative, all branches of the Yorkshire Building Society had been more or less identical in appearance, style and way of operating, whatever their location. Now, Yorkshire Building Society is looking to match the appearance, amenities and functions of individual branches more closely to the needs of their own local customers.

This new way of thinking includes providing the right sort of retail environment immediately a customer enters a branch. Until recently, the emphasis in the Yorkshire Building Society has not only been on providing a pleasant customer reception area, but also providing “office space” for staff to carry out administrative tasks. This often led to what looked like an office environment in which building society employees appeared to be office workers, rather than approachable customer service staff.

The vital task of profiling customers was carried out through demographic profiling. To create the demographic profile, Yorkshire Building Society used a classifying system that is widely used by providers of financial services for purposes of market research, known as Financial Acorn. Acorn breaks down populations into clearly defined segments. Financial Acorn divides customers into twelve segments.

Financial Acorn was used to profile each branch in terms of existing and potential opportunities. Yorkshire Building Society was not surprised to find that branches varied considerably. For example, some branches had a high percentage of “comfortable investors”, while others had a comparatively high percentage of “younger spenders”. The profile found that there was a mix of all of the different customer classifications in each branch and that all branches contained each classification, to a greater or lesser extent.

This type of classification is very helpful in giving a view of the financial requirements of customers in different building society branches, in different parts of the country. For example, in some areas there are a larger number of people who have a greater potential to save and invest because they have surplus cash. In contrast, some areas have larger numbers of young, affluent, single people who borrow money to invest in property or lifestyle.

The next step in the research exercise was to examine the market share held by individual branches. In particular, this involved identifying whether a branch had a greater or smaller share of the market than would be expected, given its customer profile. Some branches had a higher share of the market than would have been expected, which indicated their strength. Others, however, had a lesser share of the market than would be expected, and so provided an opportunity for improvement.

The exercise identified three main categories of branches, according to their particular characteristics. Not all branches fitted a category perfectly, of course, some were ‘a little bit of this, and rather more of that’. Some branches were found to have many existing customers, giving a higher market share than would be expected. Customers in these branches typically buy a wide range of products. These branches operate in markets in the Society’s heartland where it is very well known.

Other branches were found to have significant opportunities for growth, largely because the Society currently has a low market share and the brand is less well known. In the final category Yorkshire Building Society was found to have a relatively high market share but customers might typically buy only one or two products from the Yorkshire Building Society (eg a mortgage and house insurance). This under-buying opens up significant opportunities to engage in additional cross-selling of new products (saving schemes, holiday insurance, etc).

Having identified different categories of branches, it was easier to identify strategies that best suited the types of customers using these branches.

For example:

The main focus for branches with significant growth potential will be to attract new members through the entire product range.

The main focus for branches with a high market share, but a high percentage of sales in particular product areas will be to:

- generate cross-selling opportunities for the existing loyal customer base

- attract new customers through local marketing and mailing programmes

- develop customer relationships.

To meet its customers’ needs in a more sophisticated fashion, Yorkshire Building Society has compiled a Financial Acorn profile based on the catchment area of each of its branches.

To make sure the strategy works, it is first being piloted in selected branches across the UK. The selected branches are representative of the main categories of branch, and are located in the North-East, London and on the South Coast.

The pilot tests have involved:

- changing the branch layout

- adjusting the roles of branch personnel away from administration

- testing new sales approaches and using promotional materials.

All of the Yorkshire Building Society branch layouts have been redesigned to be more customer friendly, not just through their products, but also in design and facilities. Creating a retail environment within a building society is not just about selling more products. Branches in the pilot programme have adopted approaches to branch design and layout, which maximise their ability to meet customer needs. Zones have been created within the branches which are dedicated to browsing, information, fast cash and customer contact. The emphasis placed on these zones has been in response to the needs of that particular branch. For example, in an area where fast cash is more heavily used, more space has been dedicated to fast cash. Sofas for browsing and personnel as “meeters and greeters” have all played a part in creating a customer focused retail environment.

In order to achieve a more customer-focused approach, staff have been trained in new operational methods. This has largely been achieved through staff development programmes and management training. Empowering individual branch managers to make decisions concerning their clients has given employees ownership of the change programme and therefore, has contributed to its success.

In addition, the effectiveness of various types of local media in attracting sales into the branches is being evaluated. It is important to pilot different media in this way because a national advertising campaign is very expensive and can run into millions of pounds. This will also help Yorkshire Building Society maximise the effectiveness of its expenditure on advertising and marketing in the future.

There are also a variety of marketing methods being trialled. In areas with an emphasis on mortgages, for example, the marketing tools being used include local advertising using billboards and posters, as well as the local press, radio and the sides of buses and taxis. The principal message conveyed in these adverts focuses on the brand and on mortgages.

In contrast, in areas where the emphasis is on savings, direct mailing is the main marketing tool and the message focuses on the brand and on savings. The mailings have been categorised into two groups:

- mailing existing customers, focusing on key products from the Yorkshire Building Society savings range

- potential new customers are targeted based on a profile of existing customers who have already taken up the Yorkshire Building Society savings accounts.

The advertising and marketing strategies have been carefully designed to reach particular audiences in particular areas. For example, in areas where there are high percentages of “better off borrowers” the rears of buses have been used to advertise, as most of the target population will be car drivers.

Yorkshire Building Society recognises the importance of targeting its resources at better serving the needs of individual customers by creating more differentiation between branches, and by providing a more welcoming retail environment in which customers feel valued. This case study provides an interesting example of sophisticated marketing techniques that help an organisation to find out far more about its target market in order to provide a better, more focused service.

Building a local retail strategy (PDF)

Building a local retail strategy (PDF)