In apparel retail, collection cycles are notoriously short. This pushes retailers to liquidate surplus inventory by all means to make room for the upcoming collection. The pressure is so high that very often businesses are willing to sacrifice their profit in order to speed up and increase sales.

Why is it happening? As they lack time, retail teams usually apply the same, or standard, markdown prices to every discounted item. In many cases, these prices are too low or too high as they do not fit every single product as they cannot be universal. In other words, such prices are not optimal.

In order to craft optimal markdown offers, retailers need to take into account the elasticity of price of every product. This would help to define if this particular product should be priced higher or lower, or have the same price in order to boost sales and simultaneously revenue of the whole product portfolio.

However, factoring in price elasticity along with hundreds of other necessary parameters is impossible in manual pricing. Therefore, advanced businesses are actively investing in modern pricing software to get additional profit brought by markdown optimization and remain relevant in the highly competitive market.

Intertop, a brick-and-mortar apparel retailer, partnered with Competera to test the effectiveness of a pricing tool based on machine learning algorithms. The companies launched a six-week market test, which involved two groups of products of four footwear brands: Clarks, Tommy Hilfiger, Geox and Timberland.

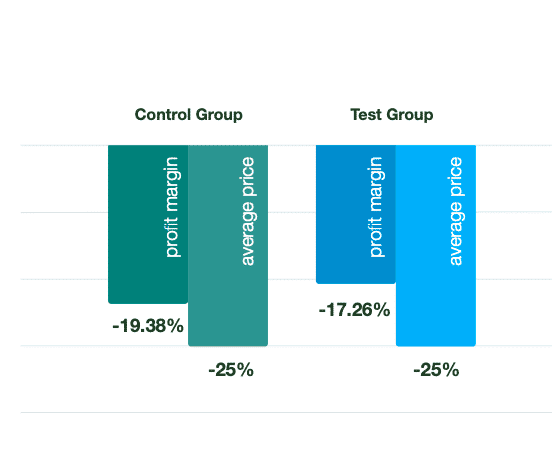

In the test group, Intertop’s pricing managers applied Competera’s elasticity-based markdown price suggestions. In the control group, managers kept true to more traditional pricing. After six weeks, the retailer sold all the selected products by the set deadline, while also enjoying the following results.

- Profit margin saving hit 200 basis points.

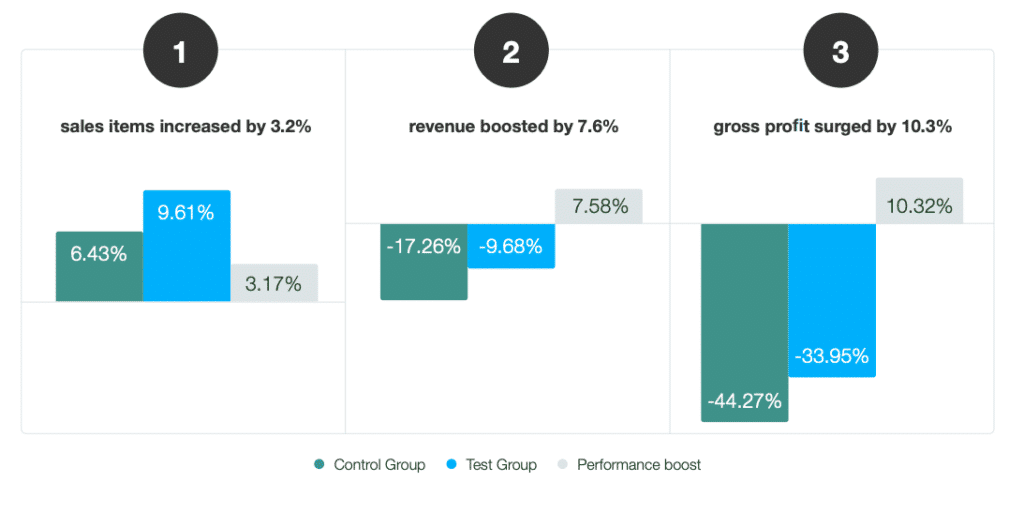

- For Clarks, the test group performed better than the control group by three parameters.

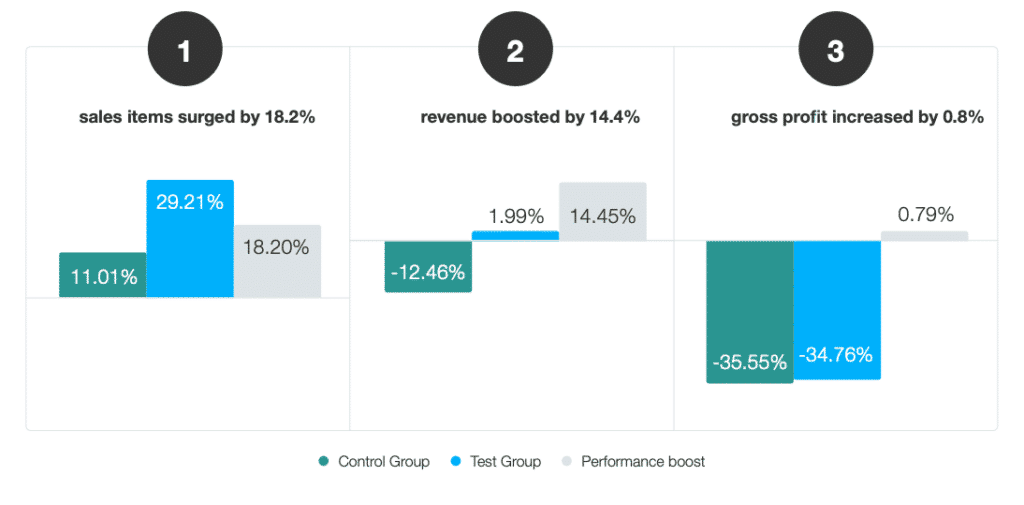

- For Tommy Hilfiger, also, the test group outperformed the control group by three parameters.

The retailer has also managed to speed up repricing significantly. Today it takes 15 minutes on average, which means 4 hours saved per pricing manager per repricing cycle. Quicker repricing translates into more opportunities for retail teams to upgrade their skills and focus on strategic tasks.

Ilona Baskova, brand manager responsible for pricing at Intertop, comments on the new potential of the pricing manager: “As technology takes up routine tasks, pricing managers need to boost their analytical skills and business thinking. We have to learn to see the big picture and make not tactical, but strategic decisions.”

She adds: “When using machine learning algorithms in repricing, we set business goals and constraints, while letting machines do the rest of the job. In other words, we do not do repricing per se, but we set the rules of the game and control the results.”

Intertop is ready to apply Competera’s solution to optimize pricing for its upcoming collection.