The owners of a company are called shareholders because they each own parts – or shares – of an organisation, which provide them with a right to a portion of the profits. Shareholders are both private individuals and institutional investors who may buy shares through the stock market, as well as people who have a direct connection with the company such as employees and founding members.

In large companies, most shareholders are removed from the day to day decision-making process and their interests are represented and protected by a board of directors who are paid to manage the company on their behalf. The board has a legal, or statutory, responsibility to ensure they run the business effectively and create long-term value. They must also ensure they represent the interests of all shareholders.

This case study focuses on Cadbury Schweppes, a major global company which manufactures, markets and distributes branded beverage and confectionery products in over 200 countries. To meet the need to create long-term value for its shareholders, Cadbury Schweppes has introduced a business process called Managing for Value, which now underpins every business decision made and unites every business unit within the group behind this objective.

The interests of shareholders

Having made an investment in a business, shareholders are concerned with assessing the profitability of their investment. The decisions made by managers determine what they can expect in terms of dividends, profits, and capital growth, both of which are reflected in the share price.

Therefore, when shareholders look at the Annual Report of a company in which they have invested, they will be mainly concerned with measures, for example, historically, earnings per share, price/earnings ratio, intangible and tangible assets and dividend yield. A basic method of evaluating investments and making a judgement about the competence of the organisation in which they have invested is to make comparisons across similar companies.

Cadbury Schweppes, for example, has more than two billion shares. Though individuals and employees hold many of these, more than 85 per cent are owned by UK and USA institutions, such as insurance companies, banks and pension funds. It is important that the shareholders trust managers at Cadbury Schweppes to make decisions and manage the company to create value on their behalf.

It is also important for the company’s stability that shareholders continue to hold shares. Investors have a number of different companies and investment options to choose from and, if a company in which they have invested is not producing returns for them, they may sell their shares and invest elsewhere. Sales by large institutional shareholders can create uncertainty about the company’s performance and future and cause the share price to fall. This can limit the company’s ability to grow and develop. Continued confidence and stability are important.

Managing For Value (MFV)

MFV places the focus of management attention firmly on the creation of value and provides businesses with a consistent framework and set of principles for making and evaluating strategic decisions. A value-based approach such as MFV is used by a number of successful companies, such as Coca-Cola and Boots.

Many companies that manage for value focus most of their attention on strategy and financial performance. However, Cadbury Schweppes adopted a more holistic approach, combining fundamental strategic change with cultural change and involving people throughout the company, in the belief that everyone has a part to play in creating value for shareholders.

Since introducing MFV in 1997, Cadbury Schweppes has simultaneously developed a stronger strategic focus, sharpened its business culture, strengthened its leadership, encouraged share ownership amongst employees and introduced new pay and benefits schemes to ensure the interests of its employees are in line with those of shareholders.

Training programmes have taken place throughout the business which collectively aims to sharpen and re-focus the culture of the company and influence the way people behave in support of MFV.

Background to MFV

Since the mid-eighties, Cadbury Schweppes has focused on growing its two core businesses, beverages and confectionery, through acquisition, capital investment and joint partnerships. This focus had strengthened the company’s competitive position globally but had not maximised returns for its shareholders.

MFV was adopted in 1997 when executive members of the board of Cadbury Schweppes and the top 40 managers from around the world met to discuss progress over the previous decade and determine the direction for the business going into the 21st century.

A fundamental conclusion was that while the company recognised its ultimate responsibility to shareholders, it was not maximising their returns. Emphasis had been on increasing scale and there was a change from a ‘scale-driven’ strategy to a ‘value-driven’ strategy. Despite this change in focus, Cadbury Schweppes’ strategic direction has remained the same. It still:

- focuses on core growth markets in beverages and confectionery

- builds strong brands

- grows by innovation in products, packaging and route to market

- seeks value enhancing acquisitions.

But the process through which it achieves its strategy is now Managing for Value.

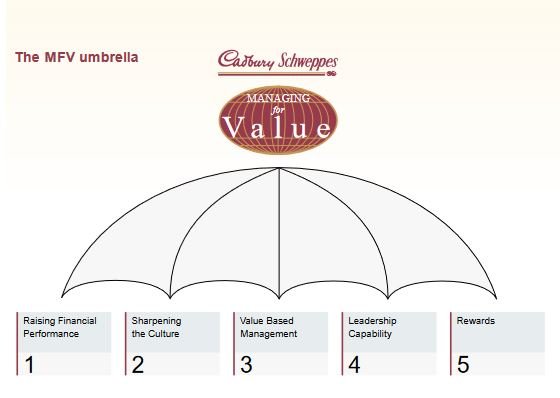

The MFV umbrella

In Cadbury Schweppes, MFV has five elements. The individual parts are closely related and at times overlap.

1. Raising financial performance

In order for Cadbury Schweppes to stretch itself to meet its objective of delivering superior returns and to help measure its progress towards MFV, it has set three demanding financial targets. These are:

- to increase earnings per share by at least ten per cent each year

- to generate £150 million of free cash flow every year. Free cash flow is the money left in the business after tax and dividends have been paid and after investments have been made in plant, machinery and other equipment

- to double the value of shareholders’ investments every four years.

2. Sharpening the culture

In order to deliver these superior returns, Cadbury Schweppes needed to become an organisation where all its employees were more accountable, aggressive and adaptable in pursuit of goals. This included finding better ways of doing things, being innovative and open to new ideas and taking responsibility for delivering results. Cadbury Schweppes has promoted the MFV process internally through communication and training in its business

units around the world.

3. Value Based Management

Value Based Management (VBM) is a systematic way of analysing a business, the market in which it operates, its strengths and weaknesses together with those of its competitors. The VBM approach focuses everybody on what they can do to maximise returns for shareholders.

At its most practical level, this is about everyone understanding what creates the most value in his or her area of responsibility and subsequently working to achieve it. The emphasis is on the employee feeling a responsibility toward the business in such a way that they would base their judgement on the question ‘if this was your business, what would you do?’

What drives value in one part of the business may be different within another and this means all situations must be judged on their own individual merits. For example, in one business the creation of value may be through new product development, while in another it may involve focusing on a few core existing brands. Better strategies are sought to produce changes in competitive performance, returns and ultimately the ability of the business to create long-term growth in value. VBM is a method of making strategic decisions based on whether a chosen path will create or destroy value.

4. Leadership capability

Able leadership is required to ensure Cadbury Schweppes achieves its goals. The company identified that it needed leaders who were capable of motivating their teams, achieving objectives and delivering results and who are accountable, aggressive, adaptable, assertive, motivating, forward thinking, mature and international in their outlook.

5. Rewards

To make MFV work, Cadbury Schweppes recognises the need to align the interests of employees as closely as possible with the interests of shareholders. This involves rewarding (pay and benefits) employees for the creation of value and encouraging greater share ownership amongst employees so that they benefit from the results of MFV as employees and as owners of the business.

Examples of MFV in action

MFV is producing a deeper understanding of the relative profitability of brands and market sectors as business units implement a VBM approach to developing business strategies and identifying opportunities to create value.

A number of business units have identified opportunities to increase value by launching new products, re-branding and re-packaging existing products and switching marketing support and attention to brands that research shows create a greater return. For example, in the UK chocolate manufacturers, Cadbury Ltd, Turkish Delight, Caramel and Cadbury’s Buttons were identified as brands that generated a high return and they have received greater marketing support, which is helping to boost sales.

Another example is a new range launched by UK sugar confectionery Trebor Bassett Ltd. Trebor’s VBM analysis identified an opportunity to re-brand and relaunch a range of products that had historically been produced under different brand names and sold at different price points. The new product range called Bassett’s Fundays markets 25 packs of Trebor Bassett’s popular products – ranging from Fruit Gums to Mint Imperials – in one clearly branded format which are now sold at one price.

Feedback shows that STC behaviours are having an impact. Employees are using them to challenge the way they operate and interact with each other and to focus on working more effectively and producing better results. For example, the launch in Australia of a new product called Cadbury Favourites was undertaken much more swiftly than usual and using less money because the employees involved approached the task more accountably, aggressively and with adaptability.

Sales teams throughout the group are now focused on the value generated by sales, not just the amount of stock sold. Targets and bonuses for salespeople in a number of the group’s business units are now measured on the value generated by the sale instead of the traditional approach of measuring the amount – volume – sold. This new approach is helping ensure the performance of salespeople is clearly linked to value creation.

MFV has produced a better understanding of the utilisation of company assets. For example, the cost of building a new high speed production plant needed by Mott’s, a North American beverages business, was cut in half when it was built in Mexico, close to the American border, with under-utilised plant and machinery collected from other parts of the group.

MFV is also helping employees focus on the impact efficiency has on financial performance. For example, factory workers at Cadbury Ltd have launched an aggressive ‘offensive’ on waste. Teams have appointed ‘waste Champions’ to lead the assault and reduce waste in factories to a minimum as one of their contributions to MFV.

Conclusion

Managing for Value has realigned Cadbury Schweppes’ focus with the interests of its shareholders. Though radical, rigorous and sometimes demanding change that is difficult and uncomfortable for people, it is helping to ensure that Cadbury Schweppes maximises the value to be gained from the scale developed by its management over the previous ten years.

creative thinking and a willingness to look for radical solutions. Employees have embraced the shareholder value concept and expectations of higher performance have been raised throughout the company.

In its first full year, 1998, MFV helped to address many issues and generated a good set of trading results which met rigorous targets, despite a number of turbulent economies. Double-digit growth in earnings per share – and free cash flow of £157 million – means the business is on track to double shareholder value within targeted dates.

Cadbury Schweppes’ MFV programme has received support externally as well as internally. Management Today magazine said the move towards a value-based culture has created ‘renewed vigour and momentum’ in Cadbury Schweppes and, according to Marketing magazine, it has ‘put a firecracker under the company’.