There is an element of risk in an activity when the outcome cannot be predicted with any certainty, or when the outcome is known but its full consequences are not. As individuals we have widely different attitudes to taking risks. For example, it is possible to identify three different positions.

- The risk lover – Someone who enjoys a gamble, even when mathematical analysis shows that the odds are unfavourable.

- The risk-neutral person – Will gamble only if the odds on a gain are favourable. The person will not be concerned with the range of possible outcomes, only with the odds being in their favour.

- The risk-averse person – Will gamble only if the odds are strongly favourable.

Organisations also take risks. Some are prepared to take large risks and stand or fall by their ability to choose the right outcome – many of them fail. More typical organisations will take calculated risks. For example, insurance companies calculate insurance premiums on the basis of detailed statistical tables.

Financial institutions have to be very careful because they are dealing with funds which have been entrusted to them for safe keeping. For example, customers who deposit money in a bank account would be horrified if they found that a large proportion of this money was being used for speculative purposes. Generally speaking, therefore, financial institutions lean towards the risk-averse position.

Focusing on the way that Building Societies reduce their risk

This case study focuses on the way in which a particular type of financial institution, Building Societies, are able to reduce their financial risks today by using the London International Financial Futures and Options Exchange (LIFFE).

LIFFE carries out a range of financial activities and is Europe’s leading futures and options exchange and the third largest exchange of its type in the world. LIFFE opened for trading in 1982 and in each successive year, its business has gone from strength to strength. Its principal function is to enable organisations and individuals to reduce their risks to either interest rates or share prices. This form of activity is known as hedging. LIFFE has over 200 member firms, over 70% of which are foreign-owned and include most of the world’s leading financial institutions.

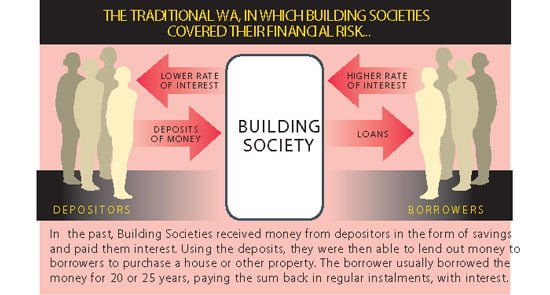

Using the case of Building Societies will give a good understanding of the general principles involved in reducing risks through LIFFE. In this way, the Building Societies were able to operate comfortably for many years. Interest rates tended to move up and down during this period. However, this did not present a problem for Building Societies. They simply charged variable interest rates to borrowers and offered variable rates to depositors. They made sure that the interest rate charged to borrowers was always higher than that paid out to depositors.

During the 1980s, however, there was a considerable change when the Conservative government encouraged increasing competition in the Financial Services markets. Prior to the 1980s, financial service organisations had tended to specialise so that:

- if you wanted a loan you went to a finance house or bank

- a mortgage – to a building society

- an insurance policy – to an insurance broker, or insurance company.

One particular area of competition has seen the emergence of banks into the mortgage market, offering fixed rate mortgages i.e. the rate of interest remains fixed for a specific period of time. You can see why this is attractive to customers. It provides them with a lot more security and predictability. They know exactly how much they will need to pay out – not just this year, but for a given period, normally up to five years. In a competitive environment, it is necessary to rival competitors’ offers. Building Societies have, therefore, moved into fixed rate mortgages.

An increased element of risk

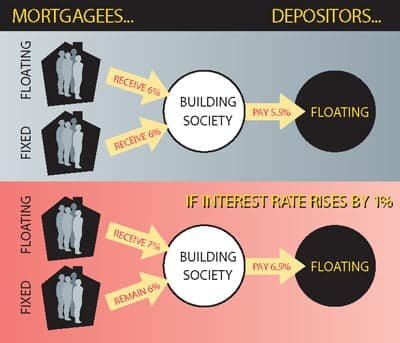

With fixed rate mortgages, Building Societies are now exposed to the risk of interest rates rising. You can see how this risk arises in our illustration (above). In the top half of the diagram, you can see that a Building Society is paying five and a half per cent interest to depositors. At the same time, it is receiving a 6% interest rate from mortgages whether they have a variable (floating) or fixed rate mortgage.

But look what happens if interest rates in the economy rise by 1%. In this new situation, the building society will be paying out 6.5% in interest to depositors (they are paid a variable rate). Under the old system, this would have been covered by mortgagees having to pay 7% in interest (floating). However, in the new competitive environment, the Building Society that chooses to offer a fixed 6% mortgage is disadvantaged. As a result, the money they are taking in from lending operations (fixed at 6%) does not cover what they are paying out on borrowing operations (6.5%). Building Societies therefore needed a way to reduce their risk if interest rates rose. This is because they could not increase the rates of existing fixed rate mortgages.

The solution

This is where the London International Financial Futures and Options Exchange helps out. By using the services of LIFFE, Building Societies are able to take the risk out of their activities – i.e. the traditional risk aversion strategy.

LIFFE has quickly established itself as one of the world’s leading futures markets. Futures are contracts – that are legally binding agreements – to buy/sell or borrow/lend “something” in the future. In the context of this case study that “something” is a contract to secure a future interest rate.

Hedging is an action which is taken to avoid making a financial loss, in this case, because of adverse movements in interest rates. This is achieved by setting up an identical, but opposite, contract in the futures market to the one in the ‘cash’ market, i.e. the ‘cash’ market here is the mortgage market.

Interest rate futures are bought and sold according to an index pricing system. If interest rates are currently 6%, then the index price of interest rate futures is calculated as: 100 – 6 = 94.00 This figure of 94.00 is not a figure in £ or pence, it is just an index figure for use in calculations. You can see how it is used in example (1) overleaf. First it must be noted that interest rate futures are always sold/bought in ‘contracts,’ each contract, for sterling, has an underlying value of £500,000. When you become a party to an interest rate contract, you are agreeing to pay/receive the difference in the value of that contract at a specified time in the future.

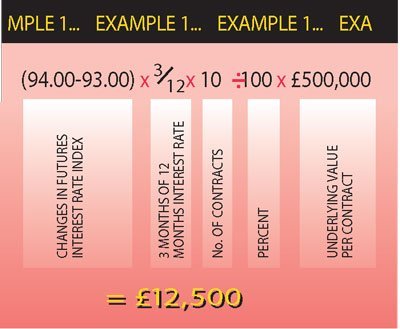

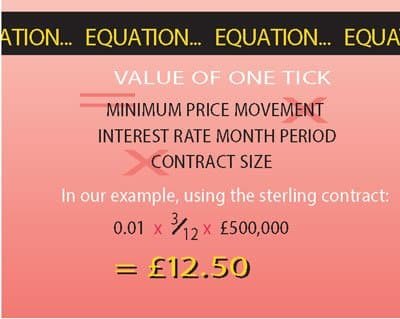

So if a building society wanted to protect itself against a rise in interest rates over the next three months on a sum of £5 million, then it could sell 10 sterling three month interest rate futures contracts. If the current interest rate is 6%, but it then rises to 7%, i.e. the index falls from 94.00 to 93.00, the building society will receive the difference between 94.00 and 93.00 (or the equivalent of 1% in interest on £5,000,000 over three months). A movement of 0.01 in the futures price index is the smallest amount that it is allowed to move and is called a ‘tick.’ To calculate the monetary value of a one tick movement, we can use the following equation:

The first trader to respond by calling, for example, “Buy 10” or “Sell 10”, becomes the counterparty to the deal. The broker then informs his or her client that the order is filled. Both parties then input the trade details into the matching system. Matched trades are passed to the clearing house which acts as a central counterparty.

Traders

There are many conventions in open outcry trading, including the order in which the words of the quotes are said and how the hand signals are made. Prices are generated simply by supply and demand and so are adjusted according to the relative balance between buyers and sellers. LIFFE lengthens the trading day by the use of APT or Automated Pit Trading, a computer based trading system designed to incorporate the methods and advantages of an open outcry marketplace.

This case study has highlighted just one of the important products traded by LIFFE. There are many more. The products that are traded at LIFFE are based on a wide variety of international interest rates and equity products denominated in the world’s leading currencies.

With interest rate contracts denominated in Sterling, Deutschmark, Japanese yen, Swiss franc, ECU and Italian lira, LIFFE provides the most comprehensive range of financial futures and options products of any exchange in the world. In addition to these interest rate contracts, LIFFE provides options on over 70 UK equities, a futures contract and options on the FT-SE 100 Index and a future on the FT-SE Mid 250 Index. LIFFE has also recently merged with the London Commodity Exchange, now offering LIFFE Commodity Products on Cocoa, Coffee, White Sugar, Wheat, Barley, Potatoes and Baltic Freight.