The capital market enables individuals and organisations with spare capital (money which they want to invest) to channel these funds to businesses and other organisations that need investment capital (money for expansion or other purposes). This case study explains the operation of Investment Trusts, which are a key part of the market.

The need for funds

Businesses sometimes need funds above the income they get from trading to help them grow and also carry out their day-to-day trading activities. Businesses acquire funds from several sources:

- shareholder capital – where investors give the company money in exchange for shares (long-term)

- loan capital (medium-term)

- bank overdrafts and trade credit (short-term).

This study concentrates on longer-term funds. Without long-term funds, businesses would struggle to buy expensive capital equipment, build new premises, expand into foreign markets, or acquire other businesses.

Investment Trusts as sources of funds

Investment Trusts provide invaluable funds to businesses by acting as intermediaries. They channel funds from financial institutions and households to businesses through the Stock Market and these funds can help businesses grow and expand.

Investment Trusts provide their investors with investments tailored to investors’ individual requirements eg the degree of risk an investor is willing to take and the rate of return he/she expects. Investors aim to gain from holding Investment Trusts in two ways:

- they often receive a dividend – their share of the profit earned by the Investment Trust in a given period eg 6 months or a year

- the value of their investment may grow over time if the share prices of the companies in which they have invested go up, particularly if their Investment Trust has invested for growth. However, the value of investments can go down as well as up, and this is the risk that Stock Market investors take.

Setting up and managing Investment Trusts

An Investment Trust is a public limited company in its own right and is listed on the London Stock Exchange. As such, it has an independent board that protects shareholders’ interests and appoints the investment management company. Investors buy shares in the company. An Investment Trust does not make or sell physical goods. Its sole purpose is to use shareholders’ money to invest in the shares of other companies.

Investment Trusts are closed-ended funds: at launch, they issue a fixed number of shares to raise the initial pool of investment capital, the value of which will increase or decrease according to how well it is invested. Typically, an Investment Trust holds shares in 50 or 60 different companies at any one time; each of these will form part of its investment portfolio. Investing in a wide spread of different companies helps to spread risk for investors, as they are not relying on the performance of just one company.

Investment Trusts are just one way of spreading risk through the Stock Market. Other methods include Unit Trusts and OEICs, which can also invest in 50 or more companies on behalf of investors.

Whilst Investment Trusts are closed-ended, Unit Trusts and OEICs are open-ended. This means that, unlike Investment Trusts, they expand or contract in size as people invest in or sell their investments.

Reasons for investing in an Investment Trust

Investment Trusts are attractive to investors for several reasons. Some people buy Investment Trusts to build up a pool of capital for some future event such as paying for their children’s university education, while others invest in this way to provide a pension. Investors can also benefit from investing in Investment Trusts in a tax efficient manner such as in an Individual Savings Account (ISA) which allows individuals to invest £7,000 every year without paying any tax on the dividends paid or on the profits when they sell their shares. It is not only individuals that buy shares in Investment Trusts. Financial institutions such as Pension Funds also buy shares in Investment Trusts, seeing them as attractive ways of accumulating funds for their members. However, they are aware that the value of their investment can go down as well as up.

Investment Trusts are an ideal way of investing because Investment Trusts:

- may hold shares in 50 or more different companies at any one time. This means investors can enjoy all the advantages of stock market investment – the potential for greater returns than bank or building society accounts – whilst spreading the risk; it is safer than investing directly in the shares of just a few quoted companies

- have tended to deliver, on average, excellent returns over the longer term – well above that available from deposit accounts, inflation and many other forms of stockmarket investment

- tend to have low costs to the investor

- permit small scale investment. Investors can invest as little as a £250 lump sum or perhaps just £25 per month

- and are well placed to ensure good rates of return over the longer-term period of 5 years or more; may suffer downturns when financial markets fall eg in times of recession or crisis.

Income and growth

Recent years have been characterised by low levels of inflation. In a low inflation world, people are increasingly attracted towards different forms of investments, whether for income, growth or both.

Many investors want a high level of income and have a lump sum to invest for this purpose. Some Investment Trusts are therefore organised so as to squeeze as much income out of their investments as possible. For example, High Income Investment Trusts invest most of their assets in high yielding shares (these are shares that pay big dividends as a percentage of their share price). Their priority is to generate a high and rising income stream.

Other investors are more concerned about the growth of their investments over time. If the companies in which an Investment Trust invests do well, the value of the investment portfolio will also grow and so should the value of the shares in the Investment Trust. However, if the companies that the Investment Trust invests in perform poorly, the value of the shares in the Investment Trust will go down. There are at least 200 growth Investment Trusts from which to choose. Investors’ choice of trust will depend on the length of time for which they want to invest and the level of risk they want to take.

Understanding risk

There are many specialist Investment Trusts which invest only in one sector. For example, you can invest in a trust which buys shares only in pharmaceutical companies or hi-tech industries. Other examples include trusts which buy shares only in financial institutions or communications companies.

Because these Investment Trusts focus on specific fields they are not spreading their risks. They are therefore considered to be medium to high risk.

Investors putting their money into Investment Trusts need to understand the level of risk they are taking. Big risks can deliver high returns but can also lead to significant losses. For example, the financial press became excited about the prospects of new technology shares, particularly those associated with the Internet. Many investors saw this as a chance of making lots of money quickly. However, for many companies in this sector, the bubble soon burst. This was because the cost of promoting a new company to the public is very high and the length of time required for them to take off is years, rather than months. This caused serious cash flow problems for several ‘star’ companies. Share prices, which had risen at high speed, came crashing back to earth with a bump.

Because the fund managers of major Investment Trusts have a good understanding of risk, many of them were able to anticipate the risk involved in investing too heavily in new technology companies. So at a time when the shares of well established companies were falling as a result of all the hype associated with the so called ‘new economy’, wise and experienced fund managers were also investing in strong companies in the ‘old economy’. Experienced Investment Trust managers have a very good idea of the risk associated with particular investments and, unlike short-term speculators, they often take a long-term view in order to protect their investors.

An investment risk pyramid

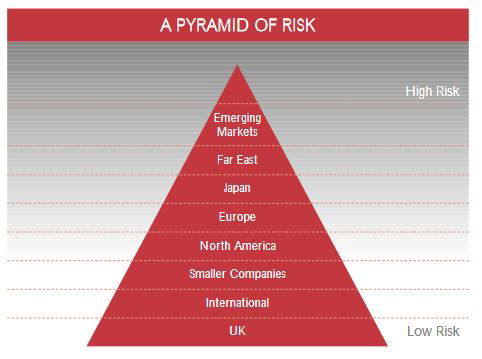

The level of risk that an Investment Trust takes is to some extent dependent on where it invests.

This investment risk pyramid indicates the level of risk generally involved in investing in different parts of the world:

The pyramid shows that Investment Trusts specialising in Emerging Markets (eg South America) are exposed to far greater risks than those which, for example, invest in a portfolio of leading UK companies or a balanced portfolio of shares from across the globe.

Spreading risk

Let’s take a look at how an Investment Trust can spread risk and secure good returns in terms of both income and growth. Some Investment Trusts spread risk by investing in countries all over the world. An Investment Trust investing globally might spread its investments in the following countries: UK 38 rest of Europe 25 USA 23 Japan 9 rest of Asia 3 elsewhere 2

When choosing a company in which to invest, fund managers carry out a detailed analysis of the:

- company’s strength of management

- markets in which it operates

- general business environment.

Fund managers also scrutinise, among other factors, trends in the:

- balance sheet

- value of earnings per share

- dividends paid to shareholders

- company’s cash flow

- company’s level of debt.

Investment Fund Managers also take into account changes in the exchange rate against the pound. This is vital, because while a company may be successful in its own country it may prove to be a poor investment if the currency in which it operates is losing value against the pound.

Conclusion

Investment Trusts play a vital role in helping well-managed businesses to secure finance. At the same time, they provide attractive opportunities to many investors – from young adults saving for their future to parents saving for their child’s education or to provide an income for those already in retirement. They also provide a service to large financial institutions that are responsible for providing income and growth for pension funds and other investments.

The fund manager plays a vital role in delivering returns to shareholders. Fund Managers constantly keep their shareholders in mind, knowing that their own performance is judged daily by the value of the Investment Trust, which is reported on in the financial press and through other media. Fund managers need to have a keen understanding of all that is happening in the world that affects the economy, including political, social and technological changes.

In addition, the Investment Trust must produce a formal annual report to shareholders once a year, hold an annual general meeting for shareholders to express their views once a year, as well as regularly communicate with shareholders eg newsletters or updated reports on the company’s website.