Barclays is a major global financial services provider. It operates in over 50 countries and employs more than 156,000 people. In 2008, Barclays had an income of £23 billion, generating a profit before tax of just over £6 billion.

In the UK, Barclays has 741,000 business customers. Many of these customers run relatively small enterprises; some are new business start-ups. Barclays offers a dedicated banking service for smaller enterprises called Local Business. This is provided through the bank’s UK retail banking division.

Even during the downturn, many people are choosing to start their own businesses. Barclays estimated that more than 436,000 new businesses started up in England and Wales in 2008. However, the number of businesses that ceased trading also rose in 2008. While the majority of these businesses closed voluntarily, setting up in business also carries risks.

This case study looks at the challenges of setting up a new business. It looks at some of the decisions that must be made by a budding entrepreneur. It outlines some of the services and support that are offered to business start-ups by a financial institution like Barclays.

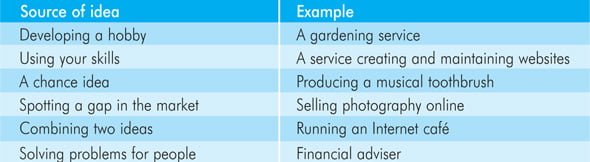

An obvious starting point is the business idea. Many people think that they might have spotted a business opportunity. Translating that thought into action is another matter. There are many ways of coming up with a bright idea.

Many people are inspired by existing businesses. Tim O’Neil runs T&T Vision, a business that sells spectacles through an online shop on eBay. Tim got the idea for his business in his first year at university. His father bought a pair of reading glasses online. This seemed a good idea for an e-commerce business.

Before setting up a new business, there are important questions to answer. This requires market research to systematically gather, record and analyse data about the market for the planned goods or services. This is an ongoing process as markets are always changing. However, some market research is essential before starting any new business.

The research should attempt to answer questions such as:

- What is the target market for the new business’ products?

- Who else is in this market? Is the idea already in the market? Can the new business offer something that existing businesses are not providing?

- Where are the customers based? What is the best way of reaching them?

- What do they really want? Can the product be improved?

- When do they want it? How should the product be sold or distributed?

- How much are these customers prepared to pay?

- How are they reached? What is the best way of promoting the product?

Secondary (or desk-based) research will answer many of these questions. Secondary research involves scanning already published materials such as reports, patents and statistical data.

This research will help a business to decide on its marketing mix. The marketing mix (or the four Ps), sets out the business offer in terms of:

- Product

- Price

- Promotion

- Place (where the product will be sold or the service provided).

If the initial market research suggests the idea is a good one, then the entrepreneur must consider the practicalities of setting up the business. There are three main types of business forms:

- A sole trader is simple to set up – there is no complicated paperwork. The owner of a sole trader enterprise, such as plumbers, window cleaners and professional writers, has complete control of the business. However, there is nothing to prevent a sole trader from taking on employees and many do. The sole trader takes all the profits (after tax) but is liable for all debts the business incurs. This means that if the business makes a substantial loss, the sole trader may be forced to sell personal assets such as their house to cover the business debts. In the worst cases, sole traders may face bankruptcy.

- A partnership consists of between two and 20 partners. Partnerships are a common form of business for many enterprises offering professional services, such as doctors’ surgeries, accountancy practices and design businesses. Partners can bring more capital and a wider range of skills, work and ideas to the business. However, partners can and do fall out. Like sole traders, most partnerships also have full liability for any business debts.

- A limited company is a legal entity. This means, for example, that if a company owes someone money, the creditor can take the company to court. Because of its legal status, it is more complicated and more expensive to set up a limited company. Any new (or small) business choosing this form of structure will become a private limited company. The entrepreneur setting up a new company is likely to retain a large shareholding but may offer shares to some investors in return for capital. However, unlike the public limited companies (PLC) listed on the stock market, these shares cannot be sold to the general public.

A limited company is owned by its shareholders, who are entitled to a share of any profits and a say in the running of the business. The main advantage of this type of business ownership is that it offers shareholders limited liability.

Shareholders are not responsible for the full amount of any debt incurred by the business. The liability of each shareholder is limited to the amount of capital they have invested in the business. This is why this form of business is attractive to many entrepreneurs.

Many businesses fail in their first year of trading. There are many reasons, but typical ones include:

- Lack of understanding of the market a failure to carry out market research

- Underestimating the strength of the competition

- Failure to secure adequate finance

- Inaccurate estimates in constructing budgets, for example, revenue forecasts are too high and/or cost estimates too low.

business plan before agreeing to any loan request. Many banks provide tools to help owners draw up business plans.

It is important for a new business to have a clear budget. A budget is based on the business objectives and identifies key factors, such as what money is needed, for what purpose and where it will come from.

A budget also considers the assumptions a business may need to make about variable factors, such as interest rate changes or volume of sales. A detailed budget plan with clear targets will help give a business control by:

- Ensuring money is spent on the right activities

- Drawing attention to waste or loss

- Focusing on areas of the business that need review, for example, if revenue is not meeting the target or if costs are rising.

A budget will also take into account expected cash flow so the business can assess if its income will cover its expenditure. Difficulty with cash flow is common. It is unlikely that a new business will make a profit in its first few months of trading. It takes time to build up a business and win new customers.

Many new businesses offer credit terms to customers so they must wait to be paid. The result is that the business is often short of cash. Barclays, like other banks, can offer support in several areas. Its business managers can:

- Advise owners on ways of managing the business if debtors are slow in paying up

- Give guidance on effective ways of preventing late payments

- Help a business create systems for its customers to pay online, speeding up payment and leaving no room for the excuse that ‘the cheque is in the post’.

Some new businesses need little start-up capital. An online retail business like T&T Vision does not require substantial funds to buy premises or a large selection of stock for display. Other types of business require significant finance for premises, equipment and stock before they can start trading.

The owners of any new business, whether sole trader, the partners in a partnership or the shareholders in a limited company will be expected to provide some capital. However, there are other sources of business finance available to meet day-to-day expenses or to buy more expensive capital items:

- An overdraft. This arrangement, agreed in advance with a bank, allows a business to spend more than the funds available in its account up to an agreed limit. The business can dip into this ‘pot’ as and when it needs to, for example, to pay a pressing bill. The flexibility of an overdraft means the business can pay the bill immediately and the overdraft is automatically repaid once sufficient funds are deposited in the business” account. However, a business pays interest on the amount it owes. Interest rates on overdrafts can be higher than on other, less flexible, ways of borrowing.

- A business credit card enables a business to borrow flexible amounts quickly and for a short period of time. Banks will usually place tight limits on the amount that a new business can borrow on a credit card. If the amount borrowed is paid back in full at the end of each month, the business does not pay any interest. However, interest is charged on any remaining balance until the amount is repaid. Like overdrafts, these interest rates can be higher than other ways of borrowing because of the flexibility of the arrangement.

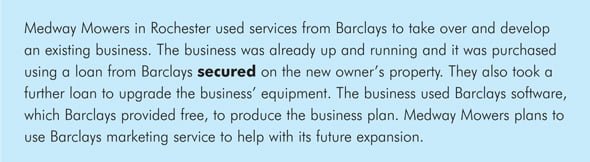

- A bank loan. Most banks offer bank loans for business. They are useful for borrowing larger amounts, for example, to pay for set-up or expansion costs. Barclays Barclayloan for Business is for businesses wishing to borrow between £1,000 and £1,000,000. The loan can be for up to 20 years and is repaid through regular repayments including interest. The advantage of this type of arrangement is that a business can borrow a larger sum of money. Also, businesses can choose fixed interest rates so that repayments are the same every month. The business owner can also request a two-year capital repayment ‘holiday’ with Barclays where they just pay the interest. For loans up to £25,000, they can even request a complete repayment holiday where they pay nothing for six months before beginning to make repayments. Both of these repayment holiday options help cash flow. As with any loan, the business owners are liable for the debt if the business cannot make the repayments.

Other financing options from banks, such as commercial mortgages, are used to help purchase business premises. The premises will be used as security for the loan and if there is sufficient equity in the property (the difference between the mortgage value and what the property is worth) then the business can often top up the commercial mortgage to release cash for other business purposes.

Financial help may also be available from government agencies and charities such as The Prince’s Trust. Many people seek these sources of loans and grants and the business may have to meet conditions. For example, it may have to be located in an area of economic deprivation or the owner may have to be under a certain age.

One avenue not usually open to business start-ups is venture capital. As the television programme Dragons’ Den shows, venture capitalists put money into an enterprise in exchange for a share of the business. They would always expect to see some evidence of business success before investing.

- A business needs a means of handling payments from its customers, of making payments to its suppliers and of managing its cash flow.

- For new business start-ups, Barclays offers free banking services (for at least twelve months) plus the support of a local business manager and other experts. Through its Local Business brand, it aims to provide support to help businesses prosper in their first trading months and years.

Starting up in business is an exciting challenge. However, it is necessary to have a good idea, a clear understanding of the market and financial knowledge and skills to support the business development.

A detailed business plan will help a business avoid failure by:

- Researching the market

- Assessing the competition

- Predicting revenue and costs accurately

- Securing adequate finance.

Barclays, as a major bank, provides a wide range of services to support new businesses from initial ideas to running the business. It helps entrepreneurs to plan and monitor to achieve their goals and avoid unnecessary risks. Barclays regularly runs free seminars around the country to help new and existing entrepreneurs with their businesses.