Barclays is a global bank. It provides a range of financial services in 56 countries. Barclays provides retail banking services to customers, whether they are individuals or businesses. It offers a broad range of financial products and services including current accounts, savings accounts and general insurance.

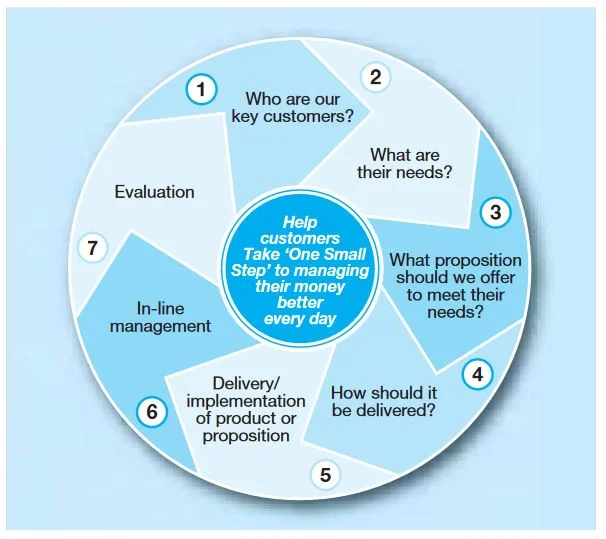

Within the UK, Barclays communications are designed to help customers ‘Take One Small Step’ to managing their money better every day.

Different kinds of customers represent distinct markets for Barclays. The market for personal banking services is very competitive. Personal customers have a choice of banks on the high street or on the web to assist them in managing their finances. For example, they can have their salaries paid into accounts, pay bills through the bank or save money to gain interest on their savings.

There is also a competitive market for business banking services. Businesses require different services such as credit management, payments for suppliers or loans and overdrafts to help them to survive and grow. For example, an expanding business may need a mortgage to buy a new building.

Market segments

Each market is capable of being further subdivided into segments. A market segment is part of a whole customer group that shares particular characteristics. These include such factors as age, life stages, geography or occupation. Within the market of personal banking, the segments could include categories such as students, graduates, ‘new to work’, mature, and families. By identifying different market segments, organisations can ensure they are providing products or services to meet the needs of these customers.

In addition to this, appropriate promotional techniques can be used to reach people in separate segments. Through segmentation, Barclays has been able to devise appropriate banking offers for customers in different segments. This approach is helping Barclays to improve its market share in the student accounts market.

Barclays believes students constitute a very important market segment for the business. Students may be choosing a bank for the first time and Barclays hopes to retain these customers. By focusing on the specific needs of this segment, Barclays hopes to attract more student customers and keep them in the long term. Using market research has enabled Barclays to identify the right product offer that will meet their needs.

The case study shows how market research enabled Barclays to improve its student account offer.

Purpose of market research

The purpose of market research is to gather data on customers and potential customers. The collected data aid business decision making. This, therefore, reduces the risks involved in making these decisions.

In order to create a product proposition that would attract new student accounts, Barclays needed to understand fully the needs of this target market. Before engaging in external market research, Barclays began by asking itself a series of key questions. It did this to ensure the business was fully aware of all the relevant issues and did not make incorrect assumptions.

In asking itself these key questions at the start and reviewing internal customer data, Barclays was able to clarify its rationale for acquiring students. Firstly, students provide an opportunity for developing long-term relationships. As the student market segment increases each year in September/October as the university term starts, Barclays has an annual opportunity to target new student customers who need an account and who might not yet have chosen a bank.

Secondly, the use of this data highlighted that in the years after opening their accounts, Barclays was able to establish a valuable long term relationship with students. This meant that students could now be seen as an extremely important market segment, and attracting new student customers became a significant opportunity.

This internal understanding was vital. With this background, Barclays designed a programme of market research. The purpose of this was to establish what students really needed from a bank. In this way, it could offer appropriate products and services which would add value to students.

Types of market research

Barclays began a process that involved both primary and secondary research.

Primary research

Primary research involves finding out new information. It finds the answers to specific questions for a particular purpose. These enquiries may take the form of direct questioning. For example, it may include face-to-face surveys, postal or online questionnaires, telephone interviews or focus groups. This type of direct contact with people is valuable as it gives specific feedback to the questions asked.

However, it is important that the questions are clear and that the researcher is trained. This will ensure that the results are not influenced. Although primary research can be expensive and time-consuming, the up-to-date and relevant data collected can give organisations a competitive advantage. This is because their rivals will not have had access to it.

Barclays’ primary research process began internally with two key questions:

- Who should our key customers be?

- What are their needs?

The insights from these questions provided a factual basis to work from.

Qualitative and quantitative research

After this, an external agency was employed to carry out an opinion panel. This took the form of an online questionnaire. The results of this delivered data about the market itself, as well as Barclays’ market share among this target audience.

Quantitative research presents information in a numeric way, such as graphs, tables or charts that can be used to analyse the information.

For example, Barclays found from the questionnaire that 81% of students surveyed held a savings account and 32% an investment savings account (ISA). The opinion panel also provided qualitative feedback on what was of interest to students and what they wanted from an account.

Qualitative research provides information on consumer perceptions, such as:

- how they feel about products and services

- what do they like or do not like

- what they would want from a new product.

The panel produced valuable insights which Barclays used to help re-evaluate its existing student account. It then used the information to develop new features and benefits to meet the established needs.

Testing

The enhanced student account proposition was then tested directly with 100 existing and new Barclays Student Additions account holders. This was carried out through bank branches and an online questionnaire. The sample group provided more qualitative feedback about what motivated students to choose a particular bank.

Although small, the sample allowed Barclays to get a feeling for how students would respond to the proposition. For Barclays, it was important to know what motivated a student to choose a bank. Using existing students meant the bank was able to assess if the new offer would meet their needs. The expectation was that new and future students would also find it attractive.

Secondary research

Secondary research focuses on existing information. It uses published data that previous research has already discovered. This covers a wide range of materials, such as:

- market research reports

- sales figures

- competitor marketing literature

- government publications, e.g. national statistics.

Secondary research may be quicker to carry out but may give less specific outcomes for the topic in question. This part of Barclay’s research revealed that student accounts in 2009 amounted to 0.4 million out of a total market of 5.4 million new accounts.

Research findings

Numeric data gives a factual basis for planning – a snapshot of a situation. On the other hand, qualitative information can find out the things that really matter to consumers. For example, 80 out of 100 consumers questioned might say they preferred one brand of coffee over another. However, more valuable information comes from understanding what it is they prefer. Is it the smell, the taste, the packaging or the price?

To meet student needs for a valuable, helpful financial service, Barclays needed to understand what students really wanted. By using student focus panels and staff working in branches with a high proportion of student customers, Barclays was able to discover students’ concerns, priorities and strengths of feeling.

Research outcomes

The outcomes of the opinion panel and the sample of student customers showed that:

- students relied heavily on different forms of credit. These included an easily manageable bank overdraft to finance their time at university

- students wanted and often needed to own high-tech gadgets and electrical goods, such as laptops

- students wanted to have separate accounts to manage their student borrowing and spending

- any incentives offered would not alone motivate students to choose that product. They were expected as part of any deal.

This insight was a real help to Barclays when considering the most attractive proposition for students. Its objectives were to attract new student accounts. It also wanted to retain students as customers for life in a profitable relationship that met their financial needs.

Barclays could now start to put together an offer that would embrace the main concerns of the target market. These concerns were financial security, credit availability, flexible banking and the right sort of incentives.

Implementation and evaluation

In 2009, Barclays set up a working group to oversee the setting up of the new student proposition. It used the insight from the research to establish the key features and benefits of the student account. These features are valid for the life of students’ studies:

- no monthly fee to keep costs down for students

- an interest-free overdraft facility of up to £2,000 from starting the account. Previously this started at £500 in the first year and increased through the years of study. This extension helps students manage their finances.

- mobile banking and a network of local branches for ease of access to accounts.

Incentives

Of several incentives tested with students, Barclays found that an incentive based on a mobile or telecoms offer would have the most appeal. This idea was tested further with students on a university campus. The students expressed a clear preference for an incentive offering mobile broadband:

‘The broadband offer looks good…I”d definitely go in to find out more.” “It”s good if the broadband offer is for the life of the account´¦you may be in halls for the first year but not after that.’

To establish this incentive, Barclays researched broadband providers. It then entered into a partnership with Orange – the UK”s number 1 broadband provider. Orange’s strengths were a good business fit for Barclays and ensured that the offer had credibility and perceived value. Students who signed up for a Barclays student account were able to obtain a 25% discount on the monthly cost of whichever Orange mobile broadband scheme they chose.

Communicating the proposition

Having developed a student banking proposition that Barclays felt confident would appeal, it began to communicate the message and promote the new student offer. An innovative marketing plan was launched which involved:

- a word-of-mouth campaign through ‘100 voices’ which encouraged students to share their experiences of managing money whilst at college or university

- promotional literature available in branches nationwide. This proved useful information for Barclays colleagues as well as for students and their parents to take away

- online advertising through barclays.co.uk

- direct mail to prospective students through the summer before going to university.

Conclusion

The Barclays student account proposition shows how it is crucial for a business to listen to its market. To do this effectively means targeting specific market segments to discover their needs.

Barclays’ new student account proposition was an ‘insight-led’ approach.

Using carefully constructed and phased market research, the bank was able to gain an overall insight into the thinking of students. In the early stages of the research, it was discovered that the student segment provided an opportunity to develop a long-term relationship. It was found that students were not necessarily ‘here today, gone tomorrow’. If the bank made a valuable and relevant offer, students were likely to remain lifelong customers.

Barclays’ initial target was to increase the overall number of student accounts by 25%. This target was exceeded with an increase of 34%. As a result, Barclays increased its market share in the student market, moving from third to second among the top four market leaders.

The process of meeting customer needs is an ongoing one. Barclays has a continuing plan for re-evaluating its student proposition to ensure it remains relevant to the target audience.