Capital gains represent the profit realised from the sale of an asset, such as stocks, real estate, or other investments, when the selling price exceeds the purchase price. This concept is fundamental in the realm of personal finance and investment, as it directly influences an investor’s overall return on investment. The nature of capital gains can vary significantly depending on the type of asset involved and the duration for which it has been held.

Understanding capital gains is crucial for anyone looking to navigate the complexities of investment and taxation. The significance of capital gains extends beyond mere profit; it also plays a pivotal role in economic growth and wealth accumulation. When individuals invest in assets that appreciate over time, they contribute to market liquidity and stimulate economic activity.

Moreover, capital gains can serve as a barometer for market performance, reflecting investor confidence and broader economic trends. As such, comprehending the intricacies of capital gains is essential for both individual investors and policymakers alike.

Summary

- Capital gains refer to the profit made from the sale of an asset, such as stocks, property, or investments.

- Capital gains are calculated by subtracting the purchase price from the selling price of the asset, taking into account any additional costs or expenses incurred during the transaction.

- Types of capital gains include short-term and long-term gains, with different tax implications for each.

- Capital gains tax is levied on the profit made from the sale of an asset, and the rate varies depending on the individual’s tax bracket and the type of asset sold.

- Strategies for minimizing capital gains tax include holding onto assets for the long term, making use of tax-advantaged accounts, and offsetting gains with losses.

How Capital Gains are Calculated

Calculating capital gains involves a straightforward formula: subtracting the original purchase price (or cost basis) of an asset from its selling price. This calculation can become more complex when considering additional factors such as transaction costs, improvements made to the asset, or depreciation. For instance, if an investor purchases a property for £200,000 and later sells it for £300,000, the capital gain would be £100,000.

However, if the investor spent £20,000 on renovations, the adjusted gain would be £80,000. It is also important to consider the holding period of the asset when calculating capital gains. The distinction between short-term and long-term capital gains can significantly affect tax liabilities.

Short-term capital gains arise from assets held for one year or less and are typically taxed at ordinary income tax rates. In contrast, long-term capital gains apply to assets held for more than one year and often benefit from lower tax rates. This differentiation underscores the importance of strategic planning in investment decisions.

Types of Capital Gains

Capital gains can be categorised into two primary types: realised and unrealised gains. Realised gains occur when an asset is sold for a profit, while unrealised gains refer to the increase in value of an asset that has not yet been sold. For example, if an investor holds shares in a company that have appreciated in value but has not yet sold those shares, they possess unrealised gains.

These unrealised gains can influence an investor’s net worth and financial planning but do not incur tax liabilities until realised. Another important distinction is between short-term and long-term capital gains. Short-term capital gains arise from assets held for one year or less and are taxed at the individual’s ordinary income tax rate.

Long-term capital gains, on the other hand, apply to assets held for more than one year and are generally taxed at a lower rate. This differentiation incentivises investors to hold onto their investments longer, promoting stability in financial markets.

Capital Gains Tax: What You Need to Know

Capital gains tax (CGT) is a tax levied on the profit made from the sale of certain assets. In the UK, individuals are allowed a certain annual exemption known as the “annual exempt amount,” which means that only gains above this threshold are subject to taxation. As of the 2023/2024 tax year, this exemption stands at £12,300 for individuals and £6,150 for trusts.

Understanding these thresholds is crucial for effective tax planning, as many investors may find that their capital gains fall below this limit and thus incur no tax liability. The rates at which capital gains are taxed can vary based on an individual’s overall income level. Basic rate taxpayers typically pay 10% on their long-term capital gains, while higher rate taxpayers face a 20% tax rate.

For certain assets such as residential property that is not your primary residence, these rates can be significantly higher—up to 28% for higher earners. This tiered structure highlights the importance of understanding one’s tax bracket and how it interacts with capital gains.

Strategies for Minimising Capital Gains Tax

Investors can employ several strategies to minimise their capital gains tax liabilities effectively. One common approach is to utilise tax-efficient accounts such as Individual Savings Accounts (ISAs) or pensions. Investments held within these accounts can grow free from capital gains tax, allowing individuals to maximise their returns without incurring immediate tax liabilities upon sale.

Another effective strategy involves timing the sale of assets to align with personal income levels. For instance, if an investor anticipates a lower income year—perhaps due to retirement or a career change—they might choose to sell assets during that period to take advantage of lower tax rates on their capital gains. Additionally, offsetting capital gains with capital losses from other investments can further reduce taxable income.

This practice, known as “tax-loss harvesting,” allows investors to strategically manage their portfolios while minimising tax exposure.

Reporting Capital Gains on Your Tax Return

Reporting capital gains on your tax return is a critical aspect of compliance with tax regulations. In the UK, individuals must report any realised capital gains exceeding the annual exempt amount on their Self Assessment tax return. This process involves detailing each asset sold during the tax year, including the purchase price, sale price, and any associated costs such as fees or improvements made to the asset.

It is essential to maintain accurate records of all transactions related to investments to ensure proper reporting and compliance with HM Revenue and Customs (HMRC) regulations. Failure to report capital gains accurately can result in penalties or interest charges on unpaid taxes. Therefore, investors should consider keeping detailed records of purchase receipts, sale confirmations, and any documentation related to improvements or expenses incurred during ownership.

Impact of Capital Gains on Investments

Capital gains play a significant role in shaping investment strategies and influencing market behaviour. Investors often seek assets with strong potential for appreciation, as these investments can yield substantial returns over time through realised capital gains. The prospect of capital gains can drive demand for certain assets, leading to increased prices and market volatility.

Moreover, understanding capital gains can inform decisions about portfolio diversification and risk management. Investors may choose to balance their portfolios by including a mix of growth-oriented assets—those expected to generate significant capital gains—and income-generating investments such as bonds or dividend-paying stocks. This strategic approach allows investors to mitigate risks associated with market fluctuations while still pursuing growth opportunities.

The distinction between long-term and short-term capital gains is crucial for investors due to its implications for taxation and investment strategy. Short-term capital gains arise from assets held for one year or less and are taxed at ordinary income rates, which can be significantly higher than long-term rates. This difference incentivises investors to adopt a longer-term perspective when managing their portfolios.

Long-term capital gains are generally taxed at reduced rates, making them more favourable from a tax perspective. Investors who hold onto their assets for longer periods not only benefit from lower tax liabilities but also have the potential to ride out market volatility and realise greater overall returns. This long-term approach aligns with investment philosophies that emphasise patience and strategic planning over short-term speculation.

In conclusion, understanding capital gains is essential for anyone involved in investing or personal finance. From calculating gains accurately to navigating the complexities of taxation and reporting requirements, knowledge in this area empowers individuals to make informed decisions that can significantly impact their financial futures. By employing effective strategies for minimising tax liabilities and recognising the importance of both long-term and short-term perspectives, investors can optimise their portfolios while contributing positively to economic growth.

Capital gains refer to the profit made from selling an asset, such as property or shares, at a higher price than it was purchased for. This article on genuine photography in a technological age explores the importance of authenticity in the digital age, which can also be applied to understanding the true value of assets when calculating capital gains. By focusing on genuine photography, businesses can build trust with customers and increase their overall value proposition.

FAQs

What is capital gains?

Capital gains refer to the profit that an individual or entity makes from the sale of a capital asset, such as stocks, bonds, real estate, or valuable items.

How are capital gains taxed?

In the UK, capital gains tax is typically levied on the profit made from selling assets. The tax rate varies depending on the individual’s income tax band, with a lower rate for basic rate taxpayers and a higher rate for higher and additional rate taxpayers.

What is the annual tax-free allowance for capital gains?

As of the 2021/2022 tax year, individuals in the UK have a tax-free allowance of £12,300 for capital gains. This means that they can make up to this amount in profit from the sale of assets before being subject to capital gains tax.

Are there any exemptions from capital gains tax?

Certain assets, such as personal belongings worth less than £6,000, cars, and gifts between spouses or civil partners, are exempt from capital gains tax. Additionally, there are specific reliefs and exemptions available for certain types of assets, such as business assets or investments in certain tax-efficient schemes.

How can individuals reduce their capital gains tax liability?

Individuals can reduce their capital gains tax liability by making use of tax-efficient investment vehicles, such as ISAs or pensions, and by taking advantage of available reliefs and exemptions. It is advisable to seek professional tax advice to explore all available options for minimising capital gains tax.

Targeting sponsorship within a specialist market niche (PDF)

Targeting sponsorship within a specialist market niche (PDF)  Sponsoring the Nationwide Football League (PDF)

Sponsoring the Nationwide Football League (PDF)  Lean production (PDF)

Lean production (PDF)  CMC A3 ePoster Edition 14 "Enterprise in the fast lane"

CMC A3 ePoster Edition 14 "Enterprise in the fast lane"  Roles, responsibilities and career development (MP3)

Roles, responsibilities and career development (MP3)  Npower A3 ePoster Edition 14 "Developing people through decision making"

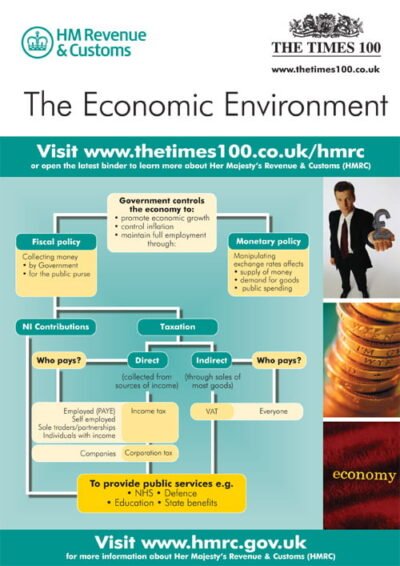

Npower A3 ePoster Edition 14 "Developing people through decision making"  HM Revenue & Customs A3 ePoster Edition 12 "The economic environment"

HM Revenue & Customs A3 ePoster Edition 12 "The economic environment"  Devising a communications plan (PDF)

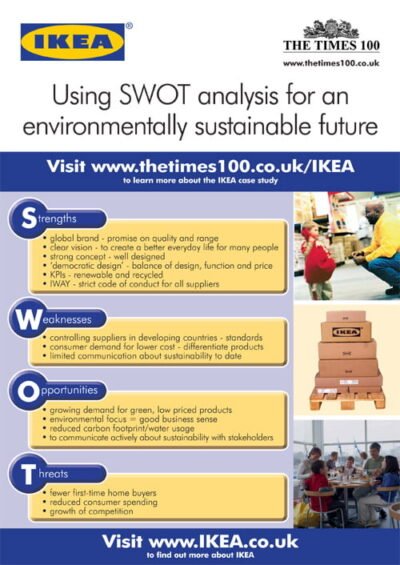

Devising a communications plan (PDF)  IKEA A3 ePoster Edition 14 "SWOT analysis and sustainable business planning"

IKEA A3 ePoster Edition 14 "SWOT analysis and sustainable business planning"