Cash settlement is a financial mechanism that allows for the resolution of contracts without the physical delivery of the underlying asset. Instead of exchanging the actual asset, parties involved in a transaction settle their obligations by transferring cash equivalent to the value of the asset at the time of settlement. This method is particularly prevalent in derivatives markets, where contracts such as options and futures are often settled in cash.

The primary aim of cash settlement is to simplify the settlement process, reduce costs, and mitigate risks associated with the physical transfer of assets. In practice, cash settlement is commonly used in various financial instruments, including stock index futures and options. For instance, if an investor holds a futures contract on a stock index and the contract expires, rather than delivering the actual stocks that comprise the index, the investor receives or pays the difference between the contract price and the index’s current value.

This approach not only streamlines transactions but also allows for greater liquidity in the market, as participants can easily enter and exit positions without the logistical challenges of physical delivery.

Summary

- Cash settlement is a method of settling financial contracts by paying the cash equivalent of the contract’s value rather than delivering the physical asset.

- Cash settlement differs from physical settlement in that it does not involve the transfer of the underlying asset, but rather the payment of the contract’s cash value.

- The process of cash settlement involves determining the contract’s value, calculating any applicable adjustments, and then making the cash payment to settle the contract.

- Cash settlement plays a crucial role in financial markets by providing liquidity, reducing counterparty risk, and allowing for easier hedging and speculation.

- While cash settlement offers advantages such as convenience and reduced logistical challenges, it also has disadvantages such as potential for market manipulation and lack of direct ownership of the underlying asset.

How Cash Settlement Differs from Physical Settlement

The distinction between cash settlement and physical settlement lies primarily in the nature of the transaction’s conclusion. In physical settlement, the actual underlying asset is delivered to the buyer upon contract expiration. This process can involve significant logistical considerations, such as transportation, storage, and insurance costs, particularly for commodities like oil or agricultural products.

Physical settlement requires both parties to manage these complexities, which can lead to increased transaction costs and potential disputes over delivery conditions. Conversely, cash settlement eliminates these logistical hurdles by allowing parties to settle their contracts based on monetary values rather than physical assets. This method is particularly advantageous in markets where the underlying asset is difficult to transport or where market participants prefer not to deal with the physical asset itself.

For example, in the case of a futures contract on a commodity like gold, cash settlement allows traders to speculate on price movements without needing to handle or store the actual gold bars. This difference not only enhances market efficiency but also broadens participation by attracting investors who may lack the resources or desire to engage in physical delivery.

The Process of Cash Settlement

The cash settlement process typically involves several key steps that ensure a smooth transition from contract execution to final settlement. Initially, when a derivative contract is created, both parties agree on specific terms, including the underlying asset, contract size, and settlement date. As the contract approaches its expiration date, market participants monitor price movements closely to assess their positions and potential outcomes.

On the settlement date, the final price of the underlying asset is determined based on a pre-established method, often using a reference price from a reliable source such as an exchange or an index. Once this price is established, the cash settlement amount is calculated by taking the difference between the contract price and the final price. If the contract was profitable for one party, they will receive a cash payment equal to this difference; conversely, if it was unprofitable, they will owe that amount.

The actual transfer of funds typically occurs through a clearinghouse or financial institution that acts as an intermediary, ensuring that both parties fulfil their obligations efficiently and securely.

The Role of Cash Settlement in Financial Markets

Cash settlement plays a crucial role in enhancing liquidity and efficiency within financial markets. By allowing participants to settle contracts without needing to exchange physical assets, cash settlement encourages more trading activity and enables investors to manage their risk exposure more effectively. This mechanism is particularly beneficial in volatile markets where rapid price fluctuations can make physical delivery impractical or costly.

Moreover, cash settlement contributes to price discovery by facilitating a more dynamic trading environment. As traders react to market information and adjust their positions accordingly, cash-settled contracts can reflect real-time valuations more accurately than those requiring physical delivery. This responsiveness helps maintain market integrity and ensures that prices remain aligned with underlying economic fundamentals.

Additionally, cash settlement reduces counterparty risk since transactions are often cleared through centralised clearinghouses that guarantee performance, further bolstering confidence among market participants.

Advantages and Disadvantages of Cash Settlement

The advantages of cash settlement are manifold. One of the most significant benefits is its ability to streamline transactions by eliminating the need for physical delivery. This simplification reduces transaction costs and logistical complexities associated with transporting assets.

Furthermore, cash settlement enhances liquidity in financial markets by allowing participants to enter and exit positions more easily without being encumbered by physical assets. However, there are also disadvantages associated with cash settlement that warrant consideration. One notable concern is that it may lead to increased speculation in certain markets, as traders can take positions without any intention of holding or delivering the underlying asset.

This speculative behaviour can contribute to heightened volatility and may distort prices away from their fundamental values. Additionally, while cash settlement reduces some risks associated with physical delivery, it does not eliminate counterparty risk entirely; if one party defaults on their obligation, it can still have significant repercussions for market stability.

Examples of Cash Settlement in Different Financial Instruments

Cash settlement is prevalent across various financial instruments, each demonstrating its unique applications and implications. In equity markets, options on stock indices are commonly settled in cash. For instance, consider an investor who holds a call option on the FTSE 100 index with a strike price of 7,000 points.

If at expiration the index is at 7,500 points, the investor would receive a cash payment reflecting the difference of 500 points multiplied by the contract size. This example illustrates how cash settlement allows investors to profit from price movements without needing to buy or sell individual stocks. In commodities markets, cash-settled futures contracts are also widely used.

For example, crude oil futures traded on exchanges like the New York Mercantile Exchange (NYMEX) can be settled in cash based on the final price at expiration rather than requiring physical delivery of barrels of oil. This arrangement enables traders to speculate on oil prices without dealing with storage or transportation issues associated with actual oil shipments.

The Impact of Cash Settlement on Investors and Traders

The impact of cash settlement on investors and traders is profound and multifaceted. For individual investors and institutional traders alike, cash settlement provides a flexible mechanism for managing risk exposure and implementing trading strategies without being burdened by physical asset considerations. This flexibility allows for more sophisticated trading strategies that can be executed quickly in response to market movements.

Moreover, cash settlement can enhance portfolio management by enabling investors to hedge against adverse price movements efficiently. For instance, an investor holding a diversified portfolio may use cash-settled options to protect against potential declines in market value without needing to liquidate their holdings physically. This capability not only preserves capital but also allows investors to maintain their long-term investment strategies while navigating short-term market fluctuations.

The Future of Cash Settlement in the Financial Industry

As financial markets continue to evolve with advancements in technology and changing regulatory landscapes, the future of cash settlement appears promising yet complex. The rise of digital assets and cryptocurrencies has introduced new dynamics into traditional financial systems, prompting discussions about how cash settlement mechanisms may adapt to accommodate these innovations. For instance, blockchain technology could facilitate instantaneous cash settlements through smart contracts, potentially reducing counterparty risk and enhancing transparency.

Furthermore, as global markets become increasingly interconnected, regulatory frameworks surrounding cash settlement may also evolve. Authorities may seek to implement stricter guidelines to mitigate risks associated with speculative trading practices while ensuring that market integrity remains intact. As such developments unfold, market participants will need to remain vigilant and adaptable to leverage the benefits of cash settlement while navigating potential challenges that arise in this dynamic environment.

In conclusion, cash settlement serves as a vital component of modern financial markets, offering numerous advantages while also presenting certain challenges. Its ability to streamline transactions and enhance liquidity has made it an essential mechanism for traders and investors alike. As we look ahead, ongoing innovations and regulatory changes will shape how cash settlement functions within an ever-evolving financial landscape.

If you are interested in learning more about successful business management strategies, you may want to check out the article 5 Secrets of Successful Marijuana Business Management. This article provides valuable insights into how to effectively manage a business in a challenging industry. Cash settlement is a crucial aspect of business management, and understanding how to handle finances is key to success. Additionally, exploring ways to save money and maximise profit, as discussed in the article 4 Ways to Help Your Small Business Save Money and Maximise Profit, can also be beneficial for businesses looking to improve their financial health. Furthermore, partnering with companies like UpperKey for London property investment, as highlighted in the article UpperKey: Your Partner in London Property Investment, can provide opportunities for diversifying investments and generating additional income streams.

FAQs

What is cash settlement?

Cash settlement is a method of settling a financial transaction by transferring the equivalent cash value of an asset, rather than physically delivering the asset itself.

How does cash settlement work?

In a cash settlement, the parties involved agree to exchange the cash value of an asset based on its current market price, rather than transferring the actual asset. This can be used in various financial transactions, such as futures contracts and options.

What are some examples of cash settlement?

Examples of cash settlement include settling a futures contract by paying or receiving the difference between the contract price and the market price at the time of settlement, or settling an options contract by paying or receiving the difference between the strike price and the market price at the time of exercise.

What are the advantages of cash settlement?

Cash settlement can provide greater flexibility and liquidity in financial transactions, as it eliminates the need for physical delivery of assets. It also reduces the risk of potential complications or costs associated with delivering and storing physical assets.

What are the disadvantages of cash settlement?

One potential disadvantage of cash settlement is that it may not fully capture the value of the underlying asset, particularly if there are significant fluctuations in the market price between the time the contract was entered into and the time of settlement. Additionally, it may not be suitable for all types of assets or transactions.

OPITO A3 ePoster Edition 16 "Roles and Responsibilities"

OPITO A3 ePoster Edition 16 "Roles and Responsibilities"  Using new product development to grow a brand (MP3)

Using new product development to grow a brand (MP3)  An integrated approach to Customer Service (PDF)

An integrated approach to Customer Service (PDF)  CMI A3 ePoster Edition 15 "The importance of effective management"

CMI A3 ePoster Edition 15 "The importance of effective management"  Managing stock to meet customer needs (PDF)

Managing stock to meet customer needs (PDF)  A truly global market (PDF)

A truly global market (PDF)  CMC A3 ePoster Edition 14 "Enterprise in the fast lane"

CMC A3 ePoster Edition 14 "Enterprise in the fast lane"  Royal Bank of Scotland A3 ePoster Edition 12 "Motivation"

Royal Bank of Scotland A3 ePoster Edition 12 "Motivation"  CIMA A3 ePoster Edition 14 "Improving strategic decision making"

CIMA A3 ePoster Edition 14 "Improving strategic decision making"  Syngenta A3 ePoster Edition 13 "Feeding and fuelling the world through technology"

Syngenta A3 ePoster Edition 13 "Feeding and fuelling the world through technology"  Enterprise Rent-A-Car A3 ePoster Edition 13 "Using a range of management styles to lead a business"

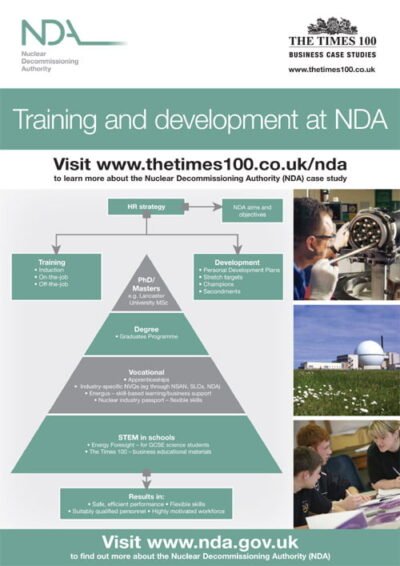

Enterprise Rent-A-Car A3 ePoster Edition 13 "Using a range of management styles to lead a business"  NDA A3 ePoster Edition 15 "Training and development at NDA"

NDA A3 ePoster Edition 15 "Training and development at NDA"  Intellectual Property Office A3 ePoster Edition 13 "Intellectual property rights and entrepreneurship"

Intellectual Property Office A3 ePoster Edition 13 "Intellectual property rights and entrepreneurship"