Franchise tax is a form of taxation imposed by certain states in the United States on businesses operating within their jurisdiction. Unlike traditional income taxes, which are levied on the profits of a business, franchise tax is typically assessed based on a company’s net worth, capital stock, or a combination of both. This tax is not a tax on the franchise itself but rather a fee for the privilege of doing business in a particular state.

The rationale behind franchise tax is to generate revenue for state governments while also regulating the business environment within their borders. The concept of franchise tax can be traced back to the early 20th century when states began to seek alternative revenue sources beyond property and sales taxes. As businesses proliferated, states recognised the need to impose a tax that would ensure that companies contribute to the public services they utilise.

Franchise tax can vary significantly from one state to another, both in terms of rates and the methods used for calculation. This variability can create complexities for businesses operating in multiple jurisdictions, necessitating a thorough understanding of local tax laws.

Summary

- Franchise tax is a tax levied on businesses for the privilege of operating in a certain jurisdiction.

- Franchise tax is typically calculated based on a company’s net worth or capital stock, and the rates and methods of calculation can vary across different jurisdictions.

- There are differences in franchise tax rates and regulations across different jurisdictions, so it’s important for businesses to understand the specific requirements in each location where they operate.

- Businesses may be eligible for exemptions or deductions from franchise tax based on factors such as industry type, revenue, or size.

- Understanding franchise tax is crucial for business owners as it can have a significant impact on their financial obligations and overall business operations.

How Franchise Tax is Calculated

The calculation of franchise tax can be intricate, as it often depends on various factors, including the type of business entity, its revenue, and its assets. In many states, franchise tax is calculated based on a company’s gross receipts or its net worth. For instance, Texas employs a margin tax system where businesses pay a percentage of their gross receipts after certain deductions.

This means that companies with higher revenues may face a steeper tax burden, while smaller businesses may benefit from lower rates or exemptions. In contrast, California’s franchise tax is based on a flat rate applied to the corporation’s net income or a minimum fee, whichever is higher. This approach can be particularly burdensome for new businesses that may not yet be profitable but still have to pay the minimum franchise tax.

Additionally, some states offer alternative methods for calculating franchise tax, such as using the value of issued shares or total assets. Understanding these various calculation methods is crucial for business owners to accurately assess their potential tax liabilities and plan accordingly.

Differences in Franchise Tax Across Jurisdictions

The differences in franchise tax across jurisdictions can be stark, reflecting each state’s unique economic environment and policy priorities. For example, Delaware is well-known for its business-friendly laws and low franchise tax rates, making it an attractive destination for corporations seeking to incorporate. The state offers a tiered structure where companies with fewer than 5,000 shares pay a nominal fee, while larger corporations may face higher rates based on their total assets or revenue.

Conversely, states like California and New York impose significantly higher franchise taxes, which can deter some businesses from establishing operations there. California’s minimum franchise tax is set at $800 annually, regardless of income, which can be particularly challenging for startups. New York also has a complex structure that includes both a fixed minimum and a variable component based on income and capital.

These disparities highlight the importance of conducting thorough research into the specific franchise tax obligations in each state where a business operates.

Exemptions and Deductions for Franchise Tax

Many jurisdictions offer exemptions and deductions that can significantly reduce the franchise tax burden for eligible businesses. These provisions are often designed to encourage economic development and support small businesses. For instance, some states exempt certain types of entities, such as non-profits or small businesses with revenues below a specified threshold, from paying franchise taxes altogether.

This can provide much-needed relief for startups and emerging companies that are still in the early stages of growth. Additionally, deductions may be available for specific expenses or investments that businesses make within the state. For example, some jurisdictions allow companies to deduct costs associated with research and development or capital investments in infrastructure.

These deductions can incentivise businesses to invest in local economies while simultaneously reducing their overall tax liability. Business owners should carefully review their state’s regulations to identify any potential exemptions or deductions that could apply to their situation.

Impact of Franchise Tax on Businesses

Franchise tax can have a significant impact on a business’s financial health and operational decisions. For many companies, especially those with tight profit margins or limited cash flow, the burden of franchise tax can influence where they choose to incorporate or operate. High franchise taxes may deter businesses from establishing themselves in certain states, leading them to seek more favourable environments elsewhere.

This can ultimately affect job creation and economic growth within those jurisdictions. Moreover, the complexity of calculating and complying with franchise tax obligations can divert valuable resources away from core business activities. Companies may need to invest in accounting services or legal counsel to ensure compliance with varying state regulations, which can add to operational costs.

As such, understanding the implications of franchise tax is essential for business owners who wish to optimise their financial strategies and maintain competitiveness in their respective markets.

Compliance and Reporting Requirements for Franchise Tax

Compliance with franchise tax regulations involves adhering to specific reporting requirements set forth by each jurisdiction. Businesses are typically required to file annual reports detailing their financial performance and any relevant information necessary for calculating their franchise tax liability. The deadlines for these filings can vary significantly from state to state, necessitating careful attention to ensure timely submissions.

Failure to comply with franchise tax requirements can result in penalties, interest charges, or even the suspension of a business’s right to operate within that state. Some jurisdictions may impose additional fees for late filings or non-compliance, further exacerbating the financial burden on businesses. Therefore, it is crucial for business owners to establish robust accounting practices and maintain accurate records throughout the year to facilitate compliance with these requirements.

While both franchise tax and income tax serve as revenue sources for state governments, they differ fundamentally in their structure and application. Income tax is levied on the profits generated by a business during a specific period, meaning that companies only pay taxes when they are profitable. In contrast, franchise tax is often assessed regardless of profitability, which can create challenges for businesses that are still in the growth phase or experiencing financial difficulties.

The distinction between these two types of taxation can influence strategic decision-making within a company. For instance, businesses may prefer to operate in jurisdictions with lower franchise taxes if they anticipate fluctuating revenues or if they are in an industry characterised by high volatility. Understanding these differences allows business owners to make informed choices about where to establish their operations and how to structure their financial planning.

Importance of Understanding Franchise Tax for Business Owners

For business owners, comprehending the intricacies of franchise tax is paramount for effective financial management and strategic planning. A thorough understanding of how franchise tax operates within their jurisdiction enables entrepreneurs to anticipate potential liabilities and budget accordingly. This knowledge can also inform decisions regarding expansion into new markets or states where franchise taxes may differ significantly.

Moreover, being well-versed in franchise tax regulations allows business owners to take advantage of available exemptions and deductions that could alleviate their overall tax burden. By proactively managing their franchise tax obligations, companies can optimise their cash flow and reinvest savings into growth initiatives or operational improvements. Ultimately, an informed approach to franchise tax not only enhances compliance but also contributes to the long-term sustainability and success of a business in an increasingly competitive landscape.

Franchise tax is a mandatory fee imposed by some states on businesses operating within their jurisdiction. This tax is typically based on the net worth or capital of the business and is separate from income tax. Understanding the financial implications of franchise tax is crucial for businesses looking to expand through franchising. For further insights into financial management, particularly profit and loss accounts and balance sheets, businesses can refer to the article Profit and Loss Accounts Balance Sheets. This resource provides valuable information on how to effectively manage finances and make informed decisions to drive business growth.

FAQs

What is Franchise Tax?

Franchise tax is a tax levied on businesses for the privilege of operating in a particular state. It is not based on income or profits, but rather on the business’s net worth or capital stock.

Which businesses are subject to Franchise Tax?

Franchise tax is typically imposed on corporations, limited liability companies (LLCs), and other types of business entities that are registered to operate in a particular state.

How is Franchise Tax calculated?

The calculation of Franchise Tax varies by state, but it is often based on the business’s net worth or capital stock. Some states may also have alternative calculation methods based on factors such as gross receipts or assets.

What is the purpose of Franchise Tax?

The purpose of Franchise Tax is to generate revenue for the state government and to regulate the presence of businesses within the state. It also serves as a way to maintain a record of businesses operating within the state.

Are there any exemptions or deductions for Franchise Tax?

Some states may offer exemptions or deductions for certain types of businesses, such as small businesses or non-profit organizations. It is important for businesses to consult with a tax professional to understand the specific exemptions and deductions available in their state.

What are the consequences of not paying Franchise Tax?

Failure to pay Franchise Tax can result in penalties, interest, and potential legal action by the state government. It can also lead to the suspension or revocation of the business’s right to operate within the state.

Shell A3 ePoster Edition 14 "Balancing stakeholder needs"

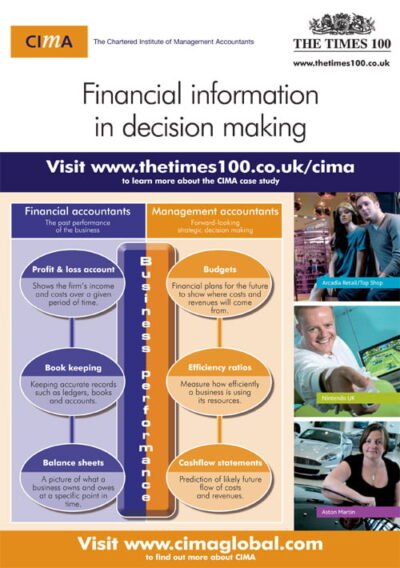

Shell A3 ePoster Edition 14 "Balancing stakeholder needs"  CIMA A3 ePoster Edition 13 "Financial information in decision making"

CIMA A3 ePoster Edition 13 "Financial information in decision making"  Unison A3 ePoster Edition 17 "Developing responsiveness through organisational structure"

Unison A3 ePoster Edition 17 "Developing responsiveness through organisational structure"  New technology development in the primary sector (MP3)

New technology development in the primary sector (MP3)  Foreign Commonwealth Office A3 ePoster Edition 14 "Delivering the mission statement"

Foreign Commonwealth Office A3 ePoster Edition 14 "Delivering the mission statement"  London 2012 - achieving the vision (PDF)

London 2012 - achieving the vision (PDF)  Tesco A3 ePoster Edition 14 "How training and development supports business growth"

Tesco A3 ePoster Edition 14 "How training and development supports business growth"  The Editions Collection Business Case Studies eBook

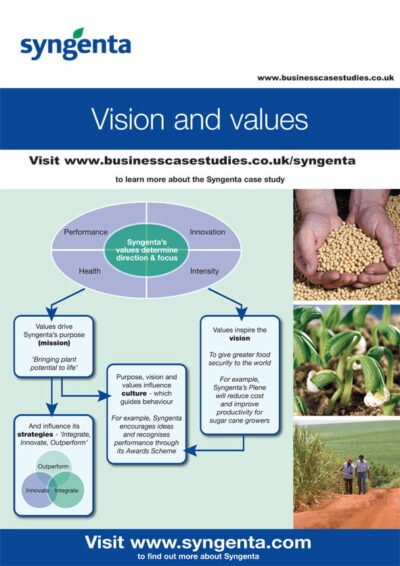

The Editions Collection Business Case Studies eBook  Syngenta A3 ePoster Edition 17 "Vision and values"

Syngenta A3 ePoster Edition 17 "Vision and values"  Powering forward with a new vision (PDF)

Powering forward with a new vision (PDF)  The Finance Collection Business Case Studies eBook

The Finance Collection Business Case Studies eBook  OPITO A3 ePoster Edition 15 "Sectors of industry"

OPITO A3 ePoster Edition 15 "Sectors of industry"  Tesco A3 ePoster Edition 13 "Recruitment and selection at Tesco"

Tesco A3 ePoster Edition 13 "Recruitment and selection at Tesco"  Driving forward environmental aims and objectives (PDF)

Driving forward environmental aims and objectives (PDF)  Syngenta A3 ePoster Edition 14 "Developing an effective organisational structure"

Syngenta A3 ePoster Edition 14 "Developing an effective organisational structure"  Implementing a new vision at Virgin Trains (PDF)

Implementing a new vision at Virgin Trains (PDF)