Legal compliance refers to the adherence to laws, regulations, and guidelines that govern various sectors and activities within a jurisdiction. It encompasses a wide array of legal obligations that organisations and individuals must follow to operate within the law. The concept of legal compliance is not static; it evolves with changes in legislation, societal norms, and technological advancements.

For instance, the introduction of new data protection laws, such as the General Data Protection Regulation (GDPR) in the European Union, has necessitated that businesses reassess their data handling practices to ensure compliance. At its core, legal compliance serves as a framework that helps maintain order and fairness in society. It is designed to protect the rights of individuals and entities while promoting ethical behaviour.

Understanding legal compliance requires a comprehensive grasp of the specific laws applicable to a given context, which can vary significantly across different industries and regions. For example, environmental regulations may impose strict guidelines on manufacturing processes, while financial regulations focus on transparency and accountability in financial reporting. Thus, organisations must remain vigilant and informed about the legal landscape relevant to their operations.

Summary

- Legal compliance refers to the adherence to laws and regulations set by the government and other regulatory bodies.

- Legal compliance is important as it helps businesses and organisations avoid legal penalties and maintain a good reputation.

- Types of legal compliance include environmental, data protection, health and safety, and employment laws.

- Legal compliance in business involves ensuring that all business activities and operations are in line with the relevant laws and regulations.

- Legal compliance in healthcare, finance, and employment sectors requires specific knowledge and understanding of industry-specific laws and regulations.

Importance of Legal Compliance

The significance of legal compliance cannot be overstated, as it plays a crucial role in safeguarding an organisation’s reputation and operational integrity. Non-compliance can lead to severe consequences, including hefty fines, legal action, and damage to an organisation’s credibility. For instance, companies that fail to comply with environmental regulations may face not only financial penalties but also public backlash, which can tarnish their brand image for years.

This underscores the necessity for businesses to prioritise compliance as part of their strategic planning. Moreover, legal compliance fosters trust among stakeholders, including customers, employees, investors, and regulators. When an organisation demonstrates a commitment to adhering to laws and ethical standards, it builds confidence in its operations and practices.

This trust can translate into customer loyalty and employee satisfaction, both of which are vital for long-term success. In contrast, a lack of compliance can lead to a toxic workplace culture and high employee turnover, as individuals may be reluctant to associate with an organisation that does not uphold ethical standards.

Types of Legal Compliance

Legal compliance can be categorised into several types, each addressing different aspects of law and regulation. Regulatory compliance involves adhering to laws set forth by governmental bodies or regulatory agencies. This includes industry-specific regulations such as those governing healthcare practices, financial reporting standards, and environmental protection laws.

For example, the Financial Conduct Authority (FCA) in the UK imposes strict regulations on financial institutions to ensure consumer protection and market integrity. Another important category is contractual compliance, which pertains to the obligations outlined in contracts between parties. This type of compliance is critical in business transactions where parties must adhere to agreed-upon terms to avoid disputes or legal repercussions.

For instance, a supplier must comply with the terms of a contract regarding delivery schedules and product quality to maintain a good relationship with a retailer. Additionally, there is compliance with employment laws, which encompasses regulations related to worker rights, workplace safety, and anti-discrimination laws. These laws are designed to protect employees from unfair treatment and ensure safe working conditions.

For example, the Health and Safety at Work Act 1974 in the UK mandates that employers take reasonable steps to ensure the health and safety of their employees while at work.

Legal Compliance in Business

In the realm of business, legal compliance is paramount for maintaining operational legitimacy and fostering sustainable growth. Companies must navigate a complex web of local, national, and international laws that govern their activities. This includes compliance with tax laws, consumer protection regulations, intellectual property rights, and competition laws.

For instance, businesses must ensure that their advertising practices do not mislead consumers or violate fair trading standards. Furthermore, corporate governance plays a significant role in legal compliance within businesses. Companies are required to establish internal policies and procedures that promote ethical behaviour and compliance with applicable laws.

This often involves creating a compliance programme that includes training for employees on relevant legal obligations and establishing mechanisms for reporting non-compliance or unethical behaviour. A robust compliance programme not only mitigates risks but also enhances an organisation’s reputation as a responsible corporate citizen. The consequences of failing to comply with business regulations can be dire.

Companies may face investigations by regulatory bodies, resulting in fines or sanctions that can cripple their operations. Additionally, non-compliance can lead to civil lawsuits from consumers or competitors seeking damages for perceived wrongdoing. Therefore, businesses must invest in legal expertise and resources to ensure they remain compliant with evolving regulations.

Legal Compliance in Healthcare

Legal compliance in healthcare is particularly critical due to the sensitive nature of patient information and the potential consequences of non-compliance on public health. Healthcare providers must adhere to a myriad of regulations designed to protect patient rights and ensure quality care. In the UK, the National Health Service (NHS) operates under strict guidelines that govern patient confidentiality, informed consent, and clinical governance.

One of the most significant pieces of legislation affecting healthcare compliance is the Data Protection Act 2018, which incorporates GDPR principles into UK law. Healthcare organisations must implement stringent measures to safeguard patient data from unauthorised access or breaches. This includes ensuring that electronic health records are securely stored and that staff are trained on data protection protocols.

Failure to comply with these regulations can result in substantial fines and loss of trust from patients. Moreover, healthcare providers must also comply with clinical standards set by regulatory bodies such as the Care Quality Commission (CQC). These standards encompass various aspects of patient care, including safety protocols, staff qualifications, and treatment efficacy.

Regular inspections by the CQC assess whether healthcare facilities meet these standards; non-compliance can lead to enforcement actions or even closure of facilities deemed unsafe for patient care.

Legal Compliance in Finance

Transparency in Financial Reporting

One key aspect of financial compliance is ensuring transparency in financial reporting. Companies are required to provide accurate financial statements that reflect their true financial position. This is governed by accounting standards such as International Financial Reporting Standards (IFRS) or UK Generally Accepted Accounting Principles (GAAP).

The Consequences of Non-Compliance

Non-compliance with these standards can lead to severe penalties and loss of investor confidence. Additionally, financial institutions must implement robust AML policies to prevent illicit activities such as money laundering or fraud. This involves conducting thorough due diligence on clients and monitoring transactions for suspicious activity.

Anti-Money Laundering Regulations

Regulatory bodies impose strict penalties on institutions that fail to comply with AML regulations; for example, banks found guilty of facilitating money laundering may face substantial fines or restrictions on their operations.

Legal Compliance in Employment

Legal compliance in employment encompasses a wide range of laws designed to protect workers’ rights and promote fair labour practices. Employers must adhere to regulations concerning wages, working hours, workplace safety, anti-discrimination policies, and employee benefits. In the UK, legislation such as the Employment Rights Act 1996 outlines fundamental rights for employees, including protection against unfair dismissal and entitlement to redundancy pay.

One critical area of employment law is anti-discrimination legislation, which prohibits unfair treatment based on characteristics such as age, gender, race, disability, or sexual orientation. Employers are required to implement policies that promote equality in hiring practices and workplace culture. Failure to comply with these laws can result in costly legal disputes and damage to an organisation’s reputation.

Moreover, workplace safety regulations are paramount in ensuring a safe working environment for employees. The Health and Safety at Work Act 1974 mandates that employers take reasonable steps to protect their employees from hazards while at work. This includes conducting risk assessments and providing necessary training on health and safety protocols.

Non-compliance can lead not only to legal repercussions but also to workplace accidents that jeopardise employee well-being.

Tips for Ensuring Legal Compliance

To ensure legal compliance effectively, organisations should adopt a proactive approach that involves regular assessments of their policies and practices against current laws and regulations. One essential tip is to stay informed about changes in legislation that may impact operations. This can be achieved through subscribing to industry newsletters, attending relevant seminars or workshops, and engaging with legal experts who specialise in specific areas of law.

Another crucial strategy is to develop a comprehensive compliance programme tailored to the organisation’s specific needs. This programme should include clear policies outlining legal obligations across various functions within the organisation. Training sessions should be conducted regularly to educate employees about their responsibilities regarding compliance and ethical behaviour.

Additionally, organisations should establish mechanisms for reporting non-compliance or unethical behaviour without fear of retaliation. Creating a culture of transparency encourages employees to speak up about potential issues before they escalate into significant problems. Regular audits should also be conducted to assess compliance levels and identify areas for improvement.

Finally, engaging external legal counsel can provide valuable insights into complex regulatory environments and help organisations navigate potential pitfalls effectively. By prioritising legal compliance as an integral part of their operations, organisations can mitigate risks while fostering a culture of integrity and accountability.

Legal compliance is crucial for businesses to operate successfully and avoid costly penalties. In a related article on managing quality, safety, customer service, and cost, the importance of adhering to regulations and standards is highlighted. By ensuring legal compliance in all aspects of business operations, companies can maintain a positive reputation, build trust with customers, and ultimately achieve success. It is essential for businesses to understand the legal requirements relevant to their industry and take proactive steps to comply with them.

FAQs

What is legal compliance?

Legal compliance refers to the process of ensuring that an organization or individual adheres to the laws, regulations, and standards set forth by the government and relevant authorities. It involves understanding, implementing, and monitoring the necessary measures to ensure that all legal requirements are met.

Why is legal compliance important?

Legal compliance is important for businesses and individuals to avoid legal penalties, fines, and reputational damage. It also helps to create a fair and ethical working environment, build trust with stakeholders, and maintain a good standing within the industry.

What are examples of legal compliance requirements?

Examples of legal compliance requirements include data protection laws, health and safety regulations, employment laws, environmental regulations, tax laws, anti-discrimination laws, and industry-specific regulations. These requirements vary depending on the nature of the business and its operations.

How can businesses ensure legal compliance?

Businesses can ensure legal compliance by conducting regular audits, staying informed about changes in laws and regulations, implementing policies and procedures, providing training to employees, seeking legal advice when necessary, and maintaining accurate records and documentation.

What are the consequences of non-compliance?

The consequences of non-compliance can include legal action, fines, penalties, loss of business licenses, reputational damage, and in severe cases, imprisonment. Non-compliance can also lead to financial losses, operational disruptions, and a negative impact on the overall business performance.

Syngenta A3 ePoster Edition 13 "Feeding and fuelling the world through technology"

Syngenta A3 ePoster Edition 13 "Feeding and fuelling the world through technology"  Syngenta A3 ePoster Edition 14 "Developing an effective organisational structure"

Syngenta A3 ePoster Edition 14 "Developing an effective organisational structure"  A customer-centred approach to providing insurance (MP3)

A customer-centred approach to providing insurance (MP3)  Foreign Commonwealth Office A3 ePoster Edition 14 "Delivering the mission statement"

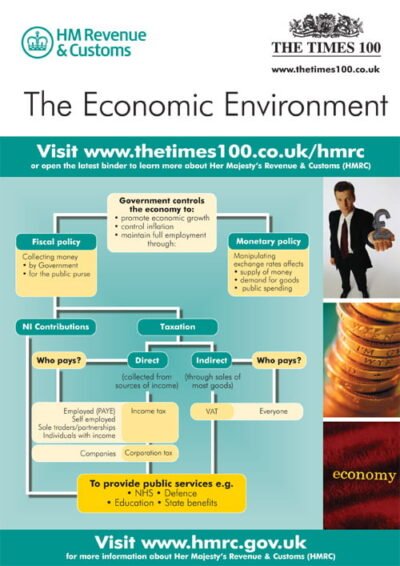

Foreign Commonwealth Office A3 ePoster Edition 14 "Delivering the mission statement"  HM Revenue & Customs A3 ePoster Edition 12 "The economic environment"

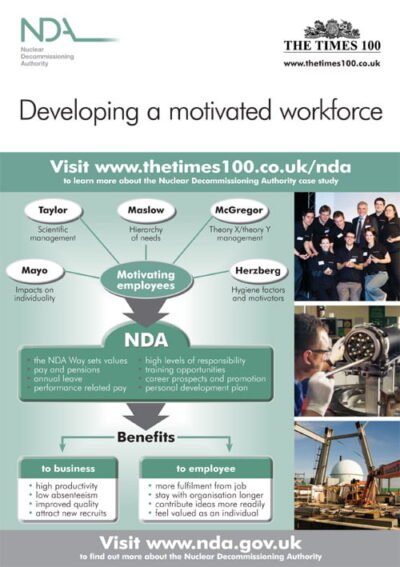

HM Revenue & Customs A3 ePoster Edition 12 "The economic environment"  NDA A3 ePoster Edition 14 "Developing a motivated workforce"

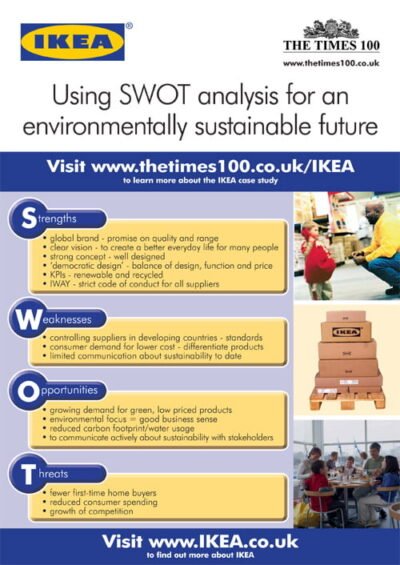

NDA A3 ePoster Edition 14 "Developing a motivated workforce"  IKEA A3 ePoster Edition 14 "SWOT analysis and sustainable business planning"

IKEA A3 ePoster Edition 14 "SWOT analysis and sustainable business planning"  IKEA A3 ePoster Edition 13 "Building a sustainable supply chain"

IKEA A3 ePoster Edition 13 "Building a sustainable supply chain"