CIMA, the Chartered Institute of Management Accountants, is the world’s largest professional body of management accountants, with over 203,000 students and members in 173 countries. CIMA offers a professional accounting qualification with an emphasis on management. This makes it suitable for people with the ambition to become accountants or managers in business. Many CIMA members study for the qualification after completing a degree. Others may start straight from school as there are no minimum entry requirements.

Management accounting and financial accounting are not the same. Financial accountants look at the past performance of a business and report on its current state. Management accountants help businesses to make decisions about the future using both financial and non-financial data. CIMA’s members are at the heart of business, helping them to maintain financial control and stability at all stages of the business cycle. Members work in private, public and not-for-profit businesses in all sectors of the economy. Employers recognise that CIMA members can add value to a business as they are professionally qualified accountants who can not only report on the business but also support the business.

Ethical and professional standards

CIMA members and students uphold the highest ethical and professional standards. Ethics, in business, may be defined as taking decisions for the right moral reasons, taking into account the wider needs of all stakeholders. Ethics is central to the work of CIMA members.

The largest body of accountants in the world is the American Institute of Certified Public Accountants, the AICPA. The AICPA and CIMA have joined together to form a joint venture which powers a new designation for management accountants, the Chartered Global Management Accountant (CGMA). CGMA is designed to elevate management accounting and recognises the unique role played by management accountants in businesses around the world who are guiding critical business decisions and driving strong business performance.

This case study examines how CIMA qualified management accountants apply ethical standards to help support and direct strategic decision making and the setting of business strategies.

Business strategy

A mission statement and business aims identify the core purpose of the business and the goals that it wants to achieve. Business strategy refers to the set of plans that a business adopts in order to achieve its aims. A mission statement outlines the core values of a business and can form the backbone for all strategic decisions. CIMA’s mission is ‘Helping people and businesses to succeed’. This mission is supported by CIMA’s aim ‘Our goal is to establish management accounting, represented by the CGMA designation, as the most valued profession in business’. These values shape the way CIMA does business and will affect the organisation’s objectives and tactics.

Objectives and tactics

An objective is an outcome which allows a business to achieve its aim. For example, a company objective could be to cut carbon emissions by 5% over the next two years. Tactics are the short-term plans put in place to achieve stated objectives. For example, carbon emissions could be reduced through the increased use of video conferencing to reduce the need for employees to travel to meetings.

Management accountants have a central role to play to help a business achieve its objectives. In fact, management accountants use their business knowledge and financial expertise to guide business strategies. Their business insight aids strategic decision making which in turn helps a business to progress towards achieving its aims and objectives. Every business will have many different strategies. Strategies can be set at different levels throughout a business. These include:

- Corporate strategies which aid the achievement of the main aims of the whole business.

- Divisional strategies which aid the achievement of the objectives for a specific part of the business, for instance, the UK division of a global company.

- Departmental strategies which aid the achievement of objectives for a specific department within a business, for instance, the marketing department.

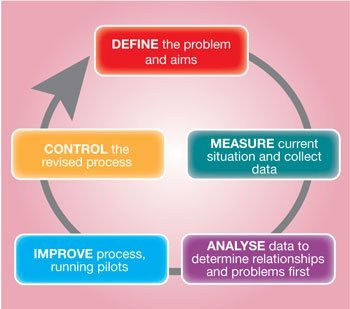

Business strategies are a means of gaining competitive advantage in the marketplace. There are many ways that a business can try to achieve this. For example, a business with a growth strategy could look to sell new goods or services or enter new markets. Adding value is a key element in any successful business strategy. CIMA qualified management accountants guide the setting of business strategies by establishing where value can be added, for instance, through creating efficiencies. Such efficiencies include improving processes to reduce waste or shortening supply chains. Michael Tan is a CIMA member. His CIMA training has helped him add value to Agilent Technologies, Malaysia. Agilent provides high-tech measurement devices to companies such as Samsung and Nokia. As a supply chain manager, Tan developed a ‘war on waste’ (WoW) project that delivered big improvements to Agilent. Over a four-year period he cut the manufacturing cycle by 43% and reduced inventory – the amount of goods held in stock – by 36%, a reduction worth $44 million. Amongst the key strategies used was a ‘Lean Six Sigma’ approach. This approach combined lean principles with Six Sigma. A successful lean approach involves reducing material waste and the time spent on nonessential activities which do not add value. Six Sigma is an approach that measures error rates to quantify how far any process is from being perfect. Changes are then made to reduce the level of errors and, most importantly, the level of re-working they cause. The diagram illustrates the stages of this approach.

Strategic planning

Planning is a vital tool to aid strategic decision making. Good planning enables businesses to put together more accurate forecasts for the future direction of the business. Management accountants play a key role here by identifying and assessing risks. In particular, they look at the probability of other events taking place that could help or hinder the business. Risks can be identified within the business, called the internal environment. For example, the culture of an organisation could have an impact on business strategies. Risks can also be identified in the external environment. For example, the current pessimistic economic climate will have major implications for a business. A business needs to monitor both to see how changes might affect its plans.

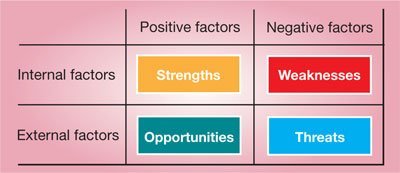

A common method used to review changes in the internal and external environment is a SWOT analysis. SWOT looks at the internal strengths and weaknesses of an organisation and at its external opportunities and threats. The SWOT analysis is used to show the results of an audit of internal and external factors. Managers then analyse the findings to set and improve business strategies.

Sustainable growth

Management accountants look at this data and balance short and long-term plans and goals to ensure sustainable growth. Organisations that have the best prospects of emerging with success from a recession are those that manage to cut costs and improve efficiency whilst still investing in the future. As part of this process, they must also consider the ethical impact of any strategic decisions they make. This is a delicate balancing act, but one for which CIMA management accountants are trained and thrive upon.

Rob Johnson is a CIMA member. He works as a strategic planning manager at EE, overseeing EE’s five year plan. He chose the CIMA qualification because of ‘the importance it places on financial skills, while also placing emphasis on strategy along with its strong commercial focus’. His role specifically involves identifying risks and opportunities. He then uses both financial and non-financial data to make business plans to minimise risk and exploit the opportunities identified.

Adding value

In the current low growth economic climate, many organisations are finding that growth and profitability will not be achieved through sales growth in their traditional markets. Some are looking to new markets but most are looking to increase the efficiency of their operations and to focus on higher value activities, products, customers and delivery channels.

A key role for management accountants is to analyse processes and suggest where efficiencies can be made to improve performance, both financial and non-financial. Such ‘lean’ approaches divide processes into three types:

- waste, which should be minimised

- those that are essential but don’t add value

- those that add value.

Financial and non-financial data

Management accountants use both financial and non-financial data when assessing methods of adding value. Non-financial data includes both human and environmental implications. Decisions will weigh-up the likely benefits and problems to the business of taking certain actions, including any ethical factors. CIMA fellow Paul Walsh is the CEO at drinks maker Diageo. To operate the company’s distillery in Fife (Scotland) costs £5 million in energy bills and uses 1.8 billion litres of water annually. An unpredictable energy market and ambitious sustainability targets created a challenge for Diageo. A new strategy was required to ensure the company could achieve its sustainability targets. Sustainability involves minimising negative impact on the environment whilst also ensuring that future generations can prosper.

Diageo executives created a team of senior employees to plan possible solutions to the challenges the company was facing. The team behind the investment project included CIMA finance professionals, senior managers, engineers and process chemists. To demonstrate the investment that would be required for each possible strategy the team used cost scenario planning. The result of the planning was a £65 million investment in an environmentally-focused approach to the plant’s processes. The investment in innovative ‘green’ technologies includes a waste water treatment plant, a biomass boiler and steam and electrical generation plant, leading to a plant that recycles 31% of its water and 85% of its steam and electrical power.

The fact that the most ambitious plan was chosen by the board of directors demonstrates their confidence in the team’s environmental planning and financial projections. Paul Walsh commented that the strategy: ‘demonstrates the need for holistic management; you cannot just look at the P&L, you cannot just look at your margins, you have got to have a far broader view’. Paul Walsh and the CIMA professionals within the team used their expertise to create an investment plan that will add value in the long-term. Their ethical decision making supports the company’s environmentally-focused strategy.

Evaluating business strategies

Whatever business strategy is chosen, its progress will need to be checked and its outcome and effect evaluated. This is often done against KPIs (key performance indicators). These are set as targets by organisations so that they can not only monitor progress, but tie progress (or lack of it) to specific areas or processes. The distance between actual achievements and KPIs will show managers exactly how well a strategy is playing out, and in what areas changes need to be made. If targets are not met, managers will then need to establish why. Possible reasons for a strategy not being achieved include:

- the objectives may have been too ambitious

- the corporate culture may need changing

- the strategy may have been poorly communicated

- the plan may have been poorly executed

- there could be changing external factors outside of the control of the business.

Changes in external factors can have a huge impact on a strategy so these need to be regularly monitored. This allows a business to identify problems and change its tactics quickly so that the objectives are still achieved. Evaluating plans provides data that is vital in setting future strategies.

Conclusion

Management accountants have a vital role to play in planning and setting business strategies. They use both financial and nonfinancial data to ensure strategic decisions are made that add value and minimise potential risks to the business. This case study shows the varied roles that CIMA qualified management accountants hold within different sectors, demonstrating how they use their financial expertise and business acumen to guide decision making. Their success in setting appropriate strategies helps secure their business’ future in a volatile and challenging global economic climate.

Ethical decision making is at the heart of the CIMA qualification. Upholding these ethical principles is vital for CIMA to achieve its aim:

‘CIMA members throughout the world have a duty to observe the highest standards of conduct and integrity and to uphold the good standing and reputation of the profession’.

In an ever changing global environment, being ethical not only helps maintain corporate image, it also enables businesses to maintain a competitive advantage over rivals.