In today’s competitive business climate no marketplace is completely static and some markets are more dynamic than others. One which has changed beyond recognition over the years, is that of electricity. Since the start of privatisation in 1989, the UK electricity industry has seen many strategic changes in structure, direction and activity. This represents a new challenge for electricity producers who, at the same time, still concentrate upon producing reliable electricity supplies at low prices for their customers.

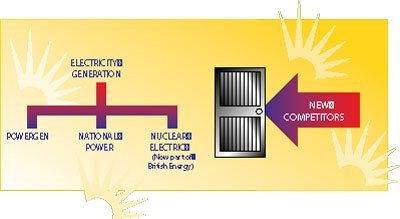

PowerGen is one of the largest privately-owned electricity generating companies in the world. Before privatisation, the Central Electricity Generating Board (CEGB) owned all of the generating capacity in England and Wales. At privatisation, these assets were split between three competing generating companies, PowerGen, National Power and Nuclear Electric. In addition, new competitors were encouraged to enter the market and construct their own generating capacity.

Privatisation has not only introduced competition into the world of electricity generation, it has also introduced it into electricity supply. By the end of 1998, all electricity customers in the UK will be able to choose who supplies them with electricity. Competition occurs when ‘competitors’ supply products that are either similar or substitutable to customers in the same market. The threat posed by competitors will depend upon the willingness of customers to transfer their purchases to other suppliers. In this changing marketplace, PowerGen’s challenge since privatisation has been to try and grow its business when competition in its core markets is increasing.

Market analysis

The starting point in a changing marketplace is to understand how you differentiate yourself from competitors and how competitors differentiate themselves from you. No market can be evaluated without a good understanding of the competition. Similarly, no management team will ever know enough about their competitors. Therefore competitors should never be underestimated!

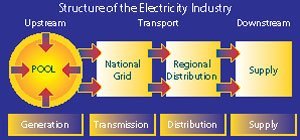

The first task for the newly formed PowerGen was to analyse the market situation it faced upon privatisation. There are four distinct sectors in the privatised electricity industry. These are:

- Generation

- Transmission

- Distribution

- Supply.

Market structure

Among the principal commercial features of the reorganised industry was the introduction of competition in two of these areas – generation and supply. This competition in electricity generation changed the nature and structure of PowerGen’s activities by putting pressure upon market share and the prices it could obtain in the market for its product.

Upon privatisation, there were 10 generating companies bidding to sell the output from their power stations into the electricity Pool – the mechanism through which electricity is traded on a daily basis. Today, this has risen to around 20 companies. As a result PowerGen’s market share fell from 28% in 1990/1 to less than 22% in 1996/7. This will reduce further as new entrant capacity continues to grow and as a result of PowerGen’s divestment of two of its power stations (which it was required to do this by the industry’s regulator in order to speed up the competitive process).

In the area of electricity supply, the sale of electricity and services (including billing and metering) to end consumers is in the final stages of transition to full competition. There are around 30 licensed suppliers (including a number of new independent energy companies) competing for customers in the liberalised part of the market, which currently covers electricity users with a demand of over 100 kW (small industrial and commercial customers and above). In 1998, this choice will be extended to the entire electricity market, including 22 million domestic customers. Since privatisation, PowerGen has successfully competed to maintain its position as the largest supplier to customers in this ‘direct sales’ market.

Competitive developments have resulted, as intended, in significant reductions in electricity prices. These reductions are over 20% for the Regional Electricity Companies for onwards supply to their own customers, and over a quarter for the industrial and commercial customers PowerGen supplies directly.

Strategic options

There are many features of a modern marketplace. If you read business magazines they identify markets and organisations appearing and disappearing overnight. They refer to the changing nature of competitors who are quicker and smarter. To keep up, they emphasise the importance of flexibility, nimbleness and customer focus. ‘Year by year demand increases for organisations to centralise, decentralise, reorganise and reengineer. If they don’t recognise the need for change it might simply be too late.’ (M. Porter)

In the world of increasing competition, PowerGen was faced with having to decide whether to choose a future of its own making or whether to allow the future to shape its activities! It had to broach the issue of where it was going to go and how it was going to get there. According to Michael Porter, an authority in the area of competition ‘The key to growth – even survival – is to stake out a position that is less vulnerable to attack from head to head opponents, whether established or new and less vulnerable to erosion from the direction of buyers, suppliers and substitute goods.’ When facing this tough market situation for its core business, PowerGen had two main strategic options:

- to sustain market share and protect margins in the core business by becoming a low cost and flexible producer

- to broaden the business into new areas of activity.

Core business

PowerGen first concentrated on becoming a low cost and flexible producer. The twin aims were to reduce fixed and variable costs.

- Fixed costs are those costs that do not increase as output increases. Fixed costs do not change over a range of output even though output within that range will vary.

- Variable costs are those that increase as output increases, because more of these factors need to be employed as input to increase output.

Fixed costs were cut dramatically and productivity increased by some 150%. The performance of PowerGen’s existing plant portfolio was also improved, in particular, through benchmarking its major coal-fired plant against a number of American coal stations considered to be the most commercially efficient in the world.

Bench-marking is a method which identifies ‘best practice’ in other organisations with a view to developing such methods within your own business. PowerGen’s main variable cost is its fuel costs. These were reduced through a reshaping of the company’s fuel and plant mix. Whereas the industry was dependent on one major coal supplier pre-privatisation, PowerGen can now turn to a wider mix of suppliers and fuels, which now include the use of gas.

PowerGen has also invested in state-of-the- art gas-fired plant which is much more efficient than conventional power stations. With more than £1.1 billion invested in over 3,000 MW of gas plant, gas accounts for over a third of the company’s generation output. Instead of following ‘best-practice’ bench-marks of other organisations, the operating and maintenance arrangements at PowerGen’s gas-fired stations have enabled the company to set its own bench-marks for the world’s best commercial practice.

Another major advantage of using gas for power stations is that it is much more environmentally friendly than coal-fired generation. A gas-fired station emits virtually no sulphur dioxide, half the carbon dioxide and a quarter of the nitrogen oxides of an equivalent coal-fired station. This has been particularly important because of the tighter environmental limits set for power generating activities at the time of privatisation.

New business

While PowerGen’s strategy for the core business has been successful in helping it to manage the reduction in market share, it has not been sufficient on its own to deliver future growth for the company. For the longer-term PowerGen had to look for new ‘earning streams’ by expanding its activities into new areas which were still related to the company’s core areas of expertise.

If an organisation has succeeded in one area of business, it does not automatically follow that they will be successful in another. PowerGen was aware of how easily a diversification programme can go wrong, having seen the mistakes of some other diversifying utilities. In the search for new business activities PowerGen imposed two strict criteria:

- Investments would have to add material shareholder value. The risk-adjusted returns had to be equal or better than those available from new investment in the core UK electricity business.

- New activities would have to be in related areas to the core business, which could utilise the core skills and expertise that already exists within the company and which support the company’s existing portfolio.

PowerGen approached its new business development in two phases. The first was to establish a balanced portfolio of new businesses based in the UK that would offer short to medium term earnings growth. The second was to develop an international power generation business that would bear fruit in the longer term.

Upstream and downstream

PowerGen’s interest in gas-fired generation made it one of the largest users of gas in the UK. Broadening its activities across the gas chain, both upstream and downstream was a logical step.

Upstream has involved developing a balanced portfolio of production and development assets in the North and Irish Seas, which provide gas for the core business. PowerGen has committed more than £375 million to the acquisition of upstream assets in the North and Irish Seas. These investments are already contributing to earnings.

Downstream, PowerGen is the owner of a gas marketing and transportation business. This company, Kinetica, has grown into a leading independent gas supply company, with 10% of the competitive gas market, supplying 11,400 customers on 26,500 sites.

PowerGen’s third major new business activity in the UK is the rapidly growing area of combined heat and power (CHP). CHP schemes provide industrial customers with dedicated, high efficiency generating plants which meet their electricity and heat needs. PowerGen has established itself as a major player in the larger end of the CHP market. Three of PowerGen’s CHP schemes are already under way and contributing to earnings, with three others under construction. By establishing these new UK-based businesses, PowerGen has been able to focus more clearly on both the longer-term and its international power generation interests.

International power

Ten years ago the concept of an international power generation business did not exist. Electricity industries throughout the world were nationally based and monopolistic. Increasingly, in recent years, electricity markets have been opened up to foreign investment as governments have sought efficient and competitive alternatives to meeting demand for new power station capacity. PowerGen’s strong background enabled it to compete in such markets. For example, it could offer:

- broad engineering and operational experience

- commercial and management expertise

- a proven track record in project management

- a robust balance sheet

- customer focus

- first-hand experience of the privatisation process and life in the private sector.

No project is without risk. PowerGen had to be careful in determining which project opportunities to become involved with. In particular, it had to assess the critical risks, external threats and responses to its strategies. To do this, PowerGen identified a wide range of criteria that needed to be met before an international power project was pursued. It broke these down into four categories:

- It needed to be satisfied that country risks – i.e. political, economic, regulatory and fiscal risk – were manageable.

- It needed to be comfortable with the project risks. For example, in terms of fuel supply and income/cost streams.

- The project developer is usually a consortium. PowerGen needed to be happy with its own level of involvement in the project, both in terms of specific responsibilities and equity (shareholding) involvement. Securing the role of operation and maintenance contractor is generally a crucial factor when deciding to invest, as much of PowerGen’s expertise lies in power plant operation.

- It needed to ensure that financing was available for each project.

Following these criteria, PowerGen has grown in five years from not having a single megawatt of generating capacity overseas, to having a commercial interest in some 7,700 MW of generating capacity operational, under construction or committed in Germany, Portugal, Hungary, India, Indonesia, Australia and Thailand.

These projects include:

- the acquisition of power station and mining assets near Leipzig which made PowerGen one of the first UK companies to invest in eastern Germany

- becoming the lead project developer in a venture to build a 990 MW gas-fired plant in Portugal.

- the development of a gas-fired power station in India which will make PowerGen the first foreign independent power project operator in India.

These and other projects have put PowerGen in the top five of international independent power project developers.

Conclusion

The power industry has gone through a period of unprecedented change over recent years. PowerGen has had to think through much confusion, uncertainty and resistance in order to make key decisions which reflected its own circumstances. From the beginning it set out to be a quality, low cost producer which could bench-mark itself alongside the best in the world. Its strategies have been based upon:

- customer focus

- low-cost operations

- the investment in cost-effective generation technologies

- fuel diversity

- effective project management

- growth though new business development in the UK and other countries.

The process has enabled PowerGen to limit its loss of market share while at the same time maintaining its profitability in the increasingly competitive UK generation market. Therefore it has a range of businesses and opportunities which offer earnings growth for the future.