Each day, the average consumer makes many decisions and choices about products and brands. When doing so, he or she identifies products in a variety of different ways. A brand comprises a range of features which help to identify the products of a particular organisation. These may include its name, a symbol, term, or other creative element. Branding is important for consumers because it is a form of product differentiation which communicates quickly and effectively a lot of information about a product range – it helps consumers to make key decisions in the market-place.

The Dolmio brand was launched in 1986 when the pasta sauce market was relatively new and worth only £8 million per year. Since that time, Dolmio has been responsible for massive growth in this sector. Today, the market for sauces that are ready for use straight from the jar (known as ‘wet cooking sauces’) is worth £340 million. This is a growth rate of 1,667% in a decade.

No matter how well brands perform, they have to be managed. Before 1994, the Dolmio brand had been responsible for driving the growth in the pasta sauce market, achieving market share of over 40%. However, in 1996, Dolmio suffered a fall in market share at a time when the pasta sauce market was experiencing explosive growth. In particular, market share was lost to the supermarkets’ own brand products and market research revealed that Dolmio was no longer perceived to be significantly different to the competition. The supermarkets’ own brand products were often sold at a cheaper price and were packaged in such a way as to look very similar to the other brands. Market research also showed that pasta was seen as a staple food but that the sauces on offer were not very inspirational.

Understanding consumer requirements is essential for any brand development. It is important to understand how consumers differentiate between brands, as well as the competitive features of the market. The most important aspect of this is understanding how consumers perceive the market-place, the products within it, and the roles and interaction of the brands that operate within it. This provides a solid foundation for any development.

This case study examines the steps taken to regain the initiative in the competitive market in which the Dolmio brand now operates. This involved relaunching the brand with new product variants.

A product portfolio or product range is like a family; each of the children has its own strengths and weaknesses and each needs careful attention and nurturing. It is not a question of simply producing many different products under the same brand name. Markets, consumer tastes and attitudes are constantly changing. This is where the management of the product portfolio becomes important. Managing a brand with a number of extensions involves deciding when to introduce new products, when to relaunch certain products and knowing when they have come to the end of their product lifecycle and need to be taken out of the range.

A new marketing strategy

Relaunching the brand meant developing a completely new way of looking at the pasta sauce market. Dolmio decided to change the objectives for the brand and develop new strategies to achieve them. In 1997, after extensive market research to the problem, Dolmio set its key objectives of growth in the sector through innovation and, in particular, establishing market leadership in the newly emerging non-bolognese sauce markets.

Whenever an organisation sets new objectives, it is necessary to determine whether the objectives have been successful or not. Dolmio decided the success of the new strategy could be measured by:

- growth in the market

- returning Dolmio to profitable growth

- establishing leadership in all categories of the market.

To achieve these new objectives, a new marketing strategy had to be formulated. This was to be achieved through creating a brand image which conjured up ‘The Dolmio Passion for Italian Food’. An innovative new product range of pasta sauce would need to be developed which would provide consumers with new ways of using pasta in their meals. This would represent a whole new way of looking at the pasta sauce market.

Market research

Marketing of Dolmio was to be targeted at anyone who prepares the main family meal of the day. People are always short of time because of today’s hectic lifestyle, but they are constantly looking for new ideas to provide a variety of meals. They do not have as much time as they would like to spend cooking, but still wish to serve up something nutritional and tasty.

Qualitative information involves understanding attitudes, opinions, reactions and suggestions. The ‘What do you think about…?’approach to market research gives consumers the opportunity to offer a variety of opinions, reasons, motivations and influencing factors. Research undertaken for the Dolmio range involved many focus groups of 7-9 consumers in a discussion facilitated by an independent researcher. Such discussions provided useful feedback about product usage. It provided a better understanding of why, how, with who and when products were used and what the motivations behind consumer behaviour were – the sort of information which quantitative research cannot provide. Quantitative research involves facts and figures, such as the number of jars of sauce sold in a given period. It is based on hard facts.

Qualitative research indicated the extent to which consumer needs were satisfied by existing products. However, it was also used to identify where needs were not being satisfied. Research showed that although 80% of Dolmio products were sold for bolognese, only 50% of meals were prepared with mince. This clearly indicated the opportunity to develop a range of products under the Dolmio brand through a brand extension strategy – products which did not need to be used with mince, but could be used on their own, or with fish or meat.

The product portfolio

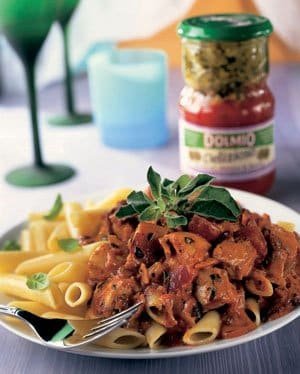

The Dolmio relaunch was based on the development of a broader product portfolio through extending the brand to take advantage of its popularity and strength in the market-place. It retained and improved the Dolmio Sauce for Bolognese with additional varieties including extra ingredients, such as extra mushrooms or extra garlic and onions, to offer the customer a greater choice.

In July 1996, Dolmio Stir-in sauces were launched to increase the use of pasta in the preparation of quick and easy meals. The sauce is stirred into pasta that has already been cooked. These ‘coating’ sauces have become one of the fastest growing parts of the market. (The Stir-in/Pesto sector grew by 65% in 1997 to be worth £28m.) As Dolmio introduced new varieties, this sector grew accordingly.

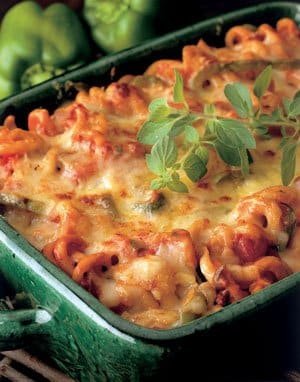

The third member of the product portfolio family is Dolmio Pasta Al Forno. This range provides yet another way of preparing a pasta meal by adding the sauce to pre-cooked pasta and then baking it in the oven. Although essentially a very simple and quick cooking process, ideal for the busy homemaker with children, it was recognised that producing a bubbling dish straight from the oven was rewarding to consumers and could be used to reinforce the idea of family meal times.

Finally, Dolmio developed Dolmio Pasta Sauces for more inspired meals, aimed at the slightly more confident cook. These were designed to be used with or without meat, straight from the jar or as a base which consumers can customise by adding their own chicken, fish or vegetables. Dolmio’s aim was to offer a full range of products that could satisfy more meal occasions, from traditional to inspirational, from a family meal to a special occasion for adults. To enable the launch of so many new lines, eight old lines needed to be discontinued.

Revising the marketing mix

Packaging

The packaging of any fast moving consumer good (FMCG) brand is crucially important. All elements of the packaging needed to be redesigned for the launch. A distinctive new multifaceted jar was used which looked better on the supermarket shelf and felt better in the hand. The packaging was slightly different for each member of the product range – emphasising the characteristics of the particular product and ensuring it was aimed at its relevant target audience. For Dolmio Bolognese, for example, the emphasis was on the ingredients, providing reassurance of quality. Dolmio Pasta Al Forno focused on the end product, showing an image of the oven dish and the traditional family meal time. Dolmio Pasta Sauce portrays a couple enjoying a special meal together and Dolmio Stir-in depicts a contemporary Italian street scene.

Promotion

An extensive promotional campaign was undertaken to support the relaunch using both above and below the line techniques. Above the line advertising, such as TV and radio advertisements, is when media time or space is purchased. Below the line advertising includes promotions or mail-shots. The strategy was to focus on developing the emotional relationship with consumers through ‘The Dolmio Passion for Italian Food’.

The campaign was to be through eighteen consumer press titles, both newspapers and magazines, covering a readership of 11 million people. This is an effective way of targeting a particular segment of the market. All eighteen ran special features which were a cross between advertising and education, providing recipes and cooking hints. These are sometimes called through the line activities. Sampling was another key element of the promotion strategy, aimed at getting as many consumers as possible to try the product in many specially selected venues in multiple grocery outlets and shopping centres. Over 920,000 samples were distributed with money-off coupons. Dolmio also launched its own Dolmio Roadshow, which travelled all over the country.

The television advertising campaign which accompanied the relaunch tried to create a strong sense of authenticity using visual style, characters and settings. The brand identity or personality is important in stimulating interest and curiosity. It makes the product different and elevates the brand’s status within the sector.

Distribution

The Dolmio sauce range is stocked in all grocery retail outlets. During 1997, the number of Dolmio product lines increased, although there was little change in the competition. A major constraint for a FMCG is that the product’s exposure to the consumer is governed largely by the amount of space that the retailer makes available. Whilst the manufacturer would obviously like the retailer to increase the amount of space on the shelves for its products, it has no control over this.

Price

Dolmio prices have increased slightly during 1997 to reflect the quality of ingredients in recipes. The growth in sales demonstrates that price, although important, is not the only influencing factor in the purchasing decision. Quality is also a determining factor.

Results of the Dolmio relaunch

To assess the results of the new campaign and the success of the new members of the product portfolio, based on extending the brand, Dolmio collected a great deal of market research information which was both quantitative and qualitative. Such feedback is invaluable to any organisation aiming to satisfy its customers.

The value of sales in 1997 showed an explosive growth rate, far above expectations, as did the volume of sales. However, a crucial consideration here is the switching and incremental sales analysis. Clearly, simply switching business from other Dolmio lines is no good. To be successful, the growth has to be achieved by encouraging more consumers to buy sauces more frequently.

Dolmio retained the market leadership in 1997 and grew a market share to 37% compared to supermarket own brands with 28% and the leading branded competitor with 18%. A key feature has been the repeat purchase figures. This is very dependent on the product performance, such as quality of ingredients and ease of use. Persuading consumers to try a new product can be difficult enough, but if it is to be a long-term success, they must develop a pattern of repeating purchases.

Conclusion

Branding provides consumers with an assurance that they are purchasing a product they like and can rely on. When faced with competition from own label brands, strong branding can foster loyalty and encourage repeat purchases.

The new Dolmio product portfolio provided consumers with many new ways to enjoy pasta. Success or failure can only really be judged with reference to the original objectives. Intensive consumer research by Dolmio provided the basis for the brand relaunch to represent a new way of looking at the pasta sauce market. Extending the brand involved targets for the sales growth of Dolmio and growth in market share to extend market leadership.

Dolmio has indeed returned to growth with considerable increases in value and volume figures, providing fresh impetus to the sector and growth in all markets. However, the process does not stop there. Innovation and new product development are a continuous process. In 1998, Dolmio continued with innovation and launched a new range of ‘Delizioso’ cooking sauces. These unique products satisfy consumer need, extend the Dolmio brand and consolidate market position.