The business landscape is becoming increasingly saturated with companies left to question how they can stand out against the crowd. Here are some ways that businesses can stand out from the competition and stay ahead of the market curve.

1. Work on your customer care

Make sure you are looking after your customers. It is not enough just to acquire customers in the first place but also presale and after the point of sale.

A great customer service experience will make customers more likely to recommend your services and return for repeat business.

One of the most important things you can do as a business is to serve your customers’ needs and expectations by listening to them and knowing what they want. This will not only help you have an edge against your competitors, but investors love to know that your business is bringing value to your customers. It is compelling for investors to hear first-hand from customers about what your service has to offer.

2. Try to gain a competitive edge

Working to develop a competitive advantage can make sure that you stay ahead of the market curve and overtake your competitors. What this looks like will depend on the nature of your business. For example, you might need to stay abreast with all technological advances across all aspects of your business, from management to marketing.

Outsourcing research or product development could help your business stay ahead of the curve without taking away precious time and energy from your day-to-day business operations. Whichever area you want to focus on improving, be it HR capabilities, marketing or social media, there are different agencies or freelancers you can outsource to, helping you do it at a high level.

3. Hire the right people

Your hiring decisions are among the most important decisions you will make as someone who runs a business. The wrong employee has the potential to negatively impact the company’s reputation leading to lost business.

That’s why you need to think carefully about who you choose to help you make your business dreams a reality.

Consider what the key criteria are for your ideal staff members: a relevant college degree, industry experience, an aptitude for learning, and an all-rounder. Whatever the criteria, screen your potential candidates carefully.

When looking to bring on talent, make sure that you are offering competitive pay rates and benefits. Think about how you can make your company stand out to new employees – why would they choose to work for you rather than a competitor?

A great team is also reassuring for investors as investors want to know that their money is in good hands. Putting faces to names and letting the investors get to know your team can be a way to assure them of the trust you have in your team and can instil confidence.

4. Look for funding

Before approaching investors, see if there are alternative funding sources that you can try. This could be granted from local organisations, investments from your personal network or even funding through a competition.

Any funding you have been able to secure before approaching investors could work in your favour as it makes your company seem more legitimate and encourages investors to follow suit.

5. Avoid having debt in the business (most of the time)

It’s not ideal to have debt in the business, whether it is from making losses or having loans that are unrepaid. Equally, no one wants to find out that the business founders have maxed out on their credit cards or are using payday loans to get through the month. So having a positive cash balance is always attractive to investors since it shows a sustainable business model and good cash management by the business.

However, it is not always a bad thing to have debt in the business, since some companies will make losses before they make profits and perhaps they need to gain investment to become profitable. So relaying this to investors could be key.

6. Commit to research and development

If you want to stay ahead of other businesses in the sector and make yourself stand out to investors, it might be worth investing in research and development (R&D).

Doing this helps you develop new products and services that can meet the changing needs of the customer. It allows you to offer services which are superior and more innovative than those of your competitors. If you can offer something that no one else can, which is meeting key customer demand, you will likely gain the interest of investors.

7. Quality, not quantity

If other companies in your industry are focusing on cost efficiency and mass production, it may be time for you to focus on better quality and creativity. Investing money to improve the quality of your products and services is a way to meet customer demands and improve their experience. If you are offering something which is genuinely bringing value, even if you increase prices, your customers will appreciate quality over quantity.

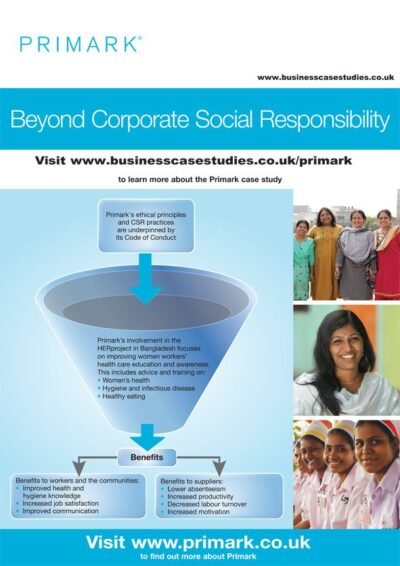

Primark A3 ePoster Edition 17 "Beyond corporate social responsibility"

Primark A3 ePoster Edition 17 "Beyond corporate social responsibility"  Parcelforce A3 ePoster Edition 13 "Customer service as strategy"

Parcelforce A3 ePoster Edition 13 "Customer service as strategy"