Early-stage enterprises, or start-up businesses tend to be much more fluid and reactive than

established businesses. This means they can change their models quickly to react to and gain from changing markets. But how do you know which start-up businesses to invest in? Over recent years Enterprise Investment Scheme (EIS) opportunities have become more accessible. By investing in EIS you can increase your chance of success by diversifying your portfolio. Here we will look at some of the benefits of investing in early-stage enterprises.

Limitless Opportunities

With any investment strategy the plan is straightforward: buy at a low price with the potential to yield large profits when the value goes up. Early-stage enterprises have a good track record of doing exactly that.

There are so many new businesses operating in different industries and areas. Investing in these new companies is not only exciting but varied. With so many product sectors, including technology, healthcare and AI, there are almost limitless opportunities to invest in that suit your budget and needs.

In addition, start-up businesses can also provide an opportunity to invest in innovative ideas and emerging technologies. The investments made in these companies can bring new services and products to market and perhaps they might even be something that could change the world.

Be More Than Just A Financial Investor

Although most early-stage businesses do need financial support there are additional needs they can have which you may benefit from. This could be expert coaching, guidance and/ or an introduction to your business network.

Why not take a place in the decision-making stages of these businesses in their infancy? You can share in the excitement, participate in the business’s growth and journey and grow your business network. Not only that but there is huge potential to generate significant profits from investing in start-ups.

Enterprise Investment Scheme (ESI) enables you to discover opportunities to be more than just a financial investor. With the EIS scheme explained, you’ll understand that this government-backed initiative provides individual investors various tax reliefs. The level of involvement goes beyond traditional investment models, allowing you to have a meaningful impact on the success of the companies you support.

Diversify Your Portfolio

Diversifying your portfolio helps to spread the risk and has the potential to improve returns.

Diversification also means you can take advantage of ever-changing market conditions which can benefit from those opportunities.

Investing in EIS is a way to diversify your portfolio and also obtain tax relief. Oxford Capital’s Growth EIS offers an opportunity to invest and explains the benefits of EIS tax relief. With over 50 years of Venture Capital experience, they are a reliable specialist that can help you invest in early-stage businesses with the potential to generate profit and diversify your portfolio.

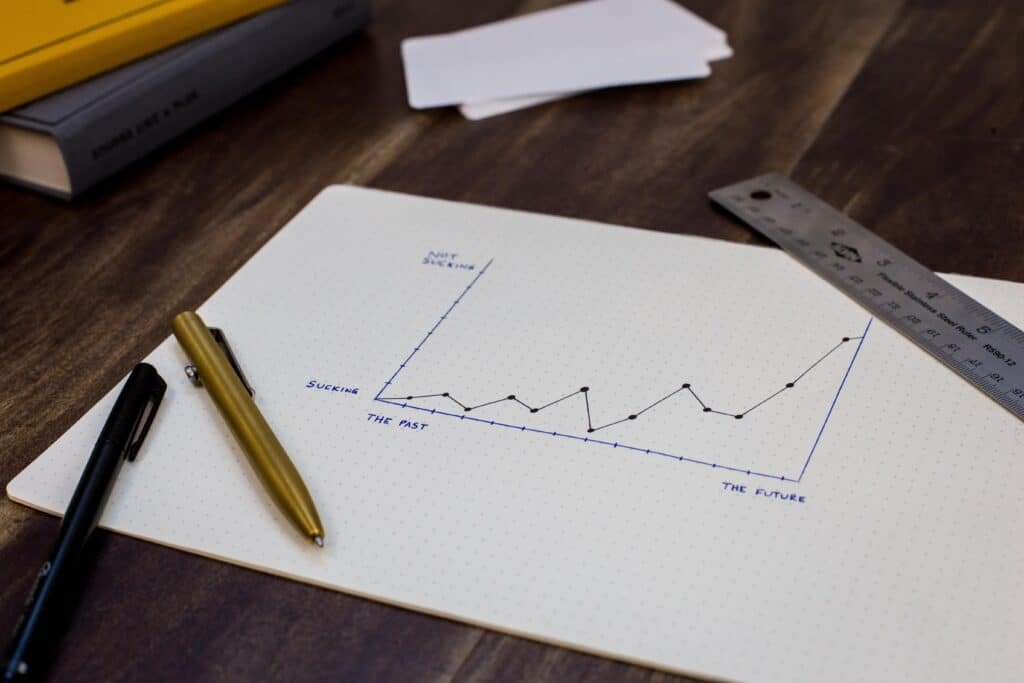

High Growth Potential From High Risk

Early-stage businesses often have high growth potential compared to established enterprises so there is the possibility of very high returns on an initial investment. Often the value of early-stage companies increases quickly due to the potential for growth and the interest and excitement around innovative ideas. It is this combination of factors that is attractive to investors looking for above-average returns on their capital. By investing in a company at the start it increases the chance to invest in shares at preferential values, which has the potential to lead to large gains if the company is acquired or listed.

Although the value of start-up businesses can increase quickly it is important to note that no

investment is risk-free. Research into every company, and their funding history, is essential before investing.

EIS schemes provide benefits like zero capital gains tax and other compensation. So while there is potential for loss when investing in a start-up the tax benefits and reliefs can help mitigate any damage.

Zero capital gains tax signifies that individuals or entities are exempt from paying taxes on profits from asset sales. This exemption occurs when the capital gains tax rate is zero percent. Special provisions or incentives in tax-favoured accounts or investment programs may lead to a zero capital gains tax rate in specific situations. Staying informed about tax laws and seeking professional advice is crucial due to potential changes in laws and rates.

How To Ensure Profit When Investing In Early-Stage Enterprises

Ensuring profit in early-stage enterprise investments involves a multifaceted approach. Thorough due diligence is paramount, encompassing comprehensive research into the company’s management, business model, market potential, and financial health. Evaluating the leadership team’s experience and capabilities is essential, as is gaining a deep understanding of the target market and industry dynamics.

Diversifying your investment portfolio across multiple early-stage enterprises helps mitigate risk and increases overall stability. Active engagement in the growth of invested companies, including attending shareholder meetings and providing strategic guidance, enhances the likelihood of success. A long-term investment perspective is advisable, recognizing that early-stage enterprises often require time to mature and become profitable.

In Conclusion

Start-up businesses are often involved in new technology and innovation in growing sectors. When larger enterprises recognise the benefits of such technology or new products they may look to acquire those businesses. Therefore, an investment in an early-stage company has the potential to provide opportunities for significant returns.