In order to make judgements about business activities, individuals require information. Accounting acts as an information system by processing business data so that interested parties can be provided with the means to understand how an organisation is performing.

This case study is intended to provide an understanding of the accounting process and how accounting information meets the needs and requirements of many different groups of people.

Shareholders delegate the day-to-day running of the business to the directors. Every year, the directors are required by law to report to the shareholders; they do this through publishing financial statements. The accounts of limited companies must be audited by a firm who are registered auditors. One of the largest auditors in the UK is KPMG. KPMG has 32 offices throughout Great Britain and over 800 offices world-wide. It is a global advisory firm whose purpose is to turn knowledge into value for the benefit of its clients, its people and its communities.

The role of the auditor

Auditors are firms of accountants who hold a watching brief on behalf of the owners of the company (the shareholders). Auditors are appointed by shareholders, since they require an independent opinion on accounts. The directors of the company prepare and sign the accounts. It is the auditors’ job to certify that these accounts present a true and fair view of the company’s profits and financial position, or to point out any failings where they do not. The principal function of the audit is to add credibility to the accounts published by the directors of a company.

Duties and responsibilities

The principal duty of the auditor is to report on the accounts prepared by the directors. The auditor will do this by issuing a short statement to say whether the accounts give a ‘true and fair view’ of the company’s profit or loss for the year and of its financial position at the end of the year. The auditor also gives his opinion on whether the accounts have been prepared in accordance with the provisions of the Companies Acts.

The words ‘true and fair’ reflect the fact that accountancy is not an exact science and that there may be a number of different ways in which to present broadly similar information. The phrase conveys the idea that the accounts have been honestly prepared to reflect the true trading position and are not misleading to readers. In addition to his basic reporting role, the auditor is required by law to consider whether the company has kept its books in a satisfactory way (‘proper accounting records’), and certain other matters.

What is an audit?

Audit originates from the time of the agricultural economy. Landowners made their money by charging their tenants a proportion of the income they made from the land. In order to find out how much the landowner was due, he employed people to visit their properties and report back how many crops were produced. The landlord then decided what his share was. The term auditor originates from the Latin word audire, meaning to hear the report related by the auditor.

According to the Institute of Chartered Accountants in England and Wales, an audit is ‘an independent opinion on the truth and fairness of the state of the affairs of a company at the period end and of its profit or loss for that period.’ Modern auditing has developed alongside the modern limited company. A company is a separate legal entity quite distinct from its shareholders. The shareholders require safeguards. This is particularly true where the shareholders are not also the directors of the company.

The financial statements prepared by the directors are effectively accounts of their stewardship of the assets in which the shareholders have invested. The Companies Act 1900 first introduced the requirement for an annual audit of those financial statements. The auditor is appointed in most cases by the shareholders and this is a contractual relationship.

KPMG

At the heart of the KPMG Audit Service is its ability to provide an independent audit report combined with a high quality, professional service. KPMG’s specialists take on the role of business advisers, enhancing the quality of a standard audit to provide valuable advice on many business matters.

KPMG’s range of services stands apart from its competitors due to the understanding of the client’s business which its specialists apply to better identify problems. This then enables KPMG to make constructive suggestions for improvements and make available the professional services that are appropriate to the business

Content of accounts

The best way to look at accounts is as a sort of shorthand for what is really going on in a company. The bare figures don’t conjure up the actual day-to-day activities of the organisation, but once you are reasonably familiar with the basic figure work you can begin to look at what lies behind it. The objective of financial accounting is to provide information about a business. This information is given in a set of accounts, which consists of two principal statements:

- The profit and loss account – a summary of the business’s transactions for a given period.

- The balance sheet – a statement of the financial position of the business at a given date (the end of the period covered by the profit and loss account).

Other information contained in the accounts includes an operating financial review, where management describe in words what has happened in the business during the year, a section on directors’ responsibilities and the opinion of the auditors.

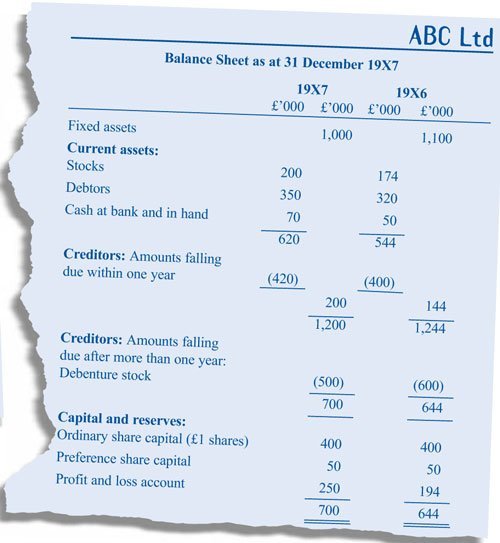

Balance Sheet

The balance sheet gives a snapshot of a company’s financial position on one particular date – the last day of its financial year. Everything the company owned on this date and everything it owed on this date will be shown in the balance sheet, grouped under a number of different headings.

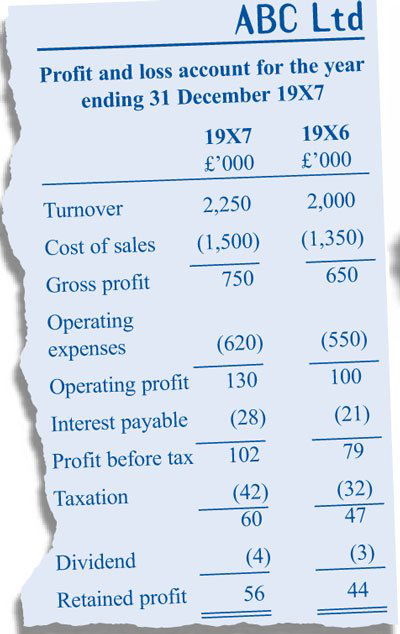

Profit and loss account

A profit and loss account shows the results of a company’s trading over the last financial period (i.e. the period between two balance sheets). Usually, this means a year, although the year end date can be chosen by the company. December 31 and March 31 are popular, although it could be April 1 or November 5 etc. The profit and loss account shows the effect on the company’s revenue account of all the transactions over the past year.

The profit and loss account measures the profit or loss made on the goods or services sold during the period. It does not measure the cash flows into and out of the business. This is an essential difference. Cash flow is a vital part of the financial management of the business and is not dealt with here. To manage a business both profit and cash must be considered.

Analysing accounts

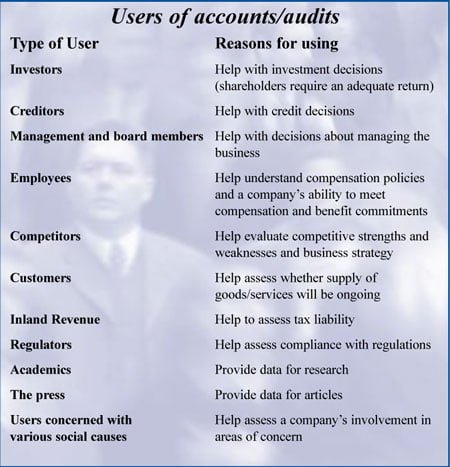

Financial statements are prepared primarily for the members of the company, but they will inevitably be used by other interested parties. For example:

- Present and potential investors (and their advisers) will want to know whether the business is a good investment.

- Lenders and suppliers will want to know if the business is a good credit risk.

- The Government will want to make sure that the correct amount of tax is being paid.

As part of their analysis, they will most certainly calculate ratios, i.e. they will relate one figure in the accounts to another. Financial ratio analysis is an analysis of financial ratios computed from an entity’s financial statements.

Accounting ratios help to summarise and present financial information in a more understandable form. They assist in assessing a business’s performance by identifying significant relationships between different figures. Ratios do not provide answers, but help to focus attention on important areas.

Ratios

Ratios divide into three main areas:

- profitability

- liquidity and working capital

- gearing.

Profitability ratios

Profitability ratios measure rate of return earned on capital employed, and analyse this into profit margins and use of assets. These ratios are frequently used as the basis for assessing management’s effectiveness in utilising the resources under their control.

- Return on capital employed (ROCE) measures return achieved by management from assets which they control, before payments to providers of financing for those assets, i.e. lenders and shareholders. Usually year end capital employed is used to compute this ratio.

- Profit margin is often seen as a measure of quality of profits. A high profit margin indicates a high profit on each unit sold. Asset turnover is often seen as a quantitative measure, indicating how intensively the management is using the assets. A trade-off exists between margin and asset turnover. Low margin businesses, e.g. food retailers, usually have high asset turnover. Conversely, capital-intensive manufacturing industries usually have relatively low asset turnover but higher margins, e.g. electrical equipment manufacturers.

Liquidity and working capital ratios

Liquidity ratios are used to assess a company’s ability to raise cash to meet payments when due. In practice, information contained in the cash flow statement is often more useful when analysing liquidity.

‘Liquidity’ implies the ability to convert assets readily into cash or to obtain cash. The short-term liquidity of an entity is measured by the degree to which it can meet its short-term obligations. Short-term is generally viewed as one year, or the organisation’s normal business cycle if longer. A lack of liquidity may mean that an organisation cannot pay its current debts and obligations.

- The current ratio is of limited use as some current assets, e.g. stocks, may not be readily convertible into cash, other than at a large discount. Hence, this ratio may not indicate whether or not the company can pay its debts as they fall due.

- The quick ratio omits stocks and is therefore a better indicator of liquidity. It is, however, subject to distortions, e.g. retailers have few debtors and utilise cash from sales quickly, but finance their stocks from trade creditors.

- Stock turnover and debtor days give an indication of whether a business is able to generate cash as fast as it uses it. They also provide useful comparisons between businesses, e.g. on effectiveness in collecting debts and controlling stock levels.

Gearing

Gearing ratios examine the financing structure of a business. They indicate to shareholders the degree of risk attached to the company and the sensitivity of profits and dividends to changes in profitability and activity level.

If a business is highly geared, this usually indicates increased risk for shareholders as, if profits fall, debts will still need to be financed, leaving much smaller profits available to shareholders. Highly geared businesses are usually more exposed to insolvency if there is an economic downturn. However, returns to shareholders will grow proportionately more in highly geared businesses where profits are growing.

Conclusion

Ratios are a tool to assist analysis. They focus attention on trends and weaknesses and facilitate comparison over time and between companies.

Ratios may change over time or differ between companies because of the nature of the business or management actions in running the business. But ratios alone don’t tell us enough about a company. It is important to gain a good understanding of the industry in which the company operates, to enable us to interpret the ratios.

This information can be obtained from many sources including newspapers, trade magazines, the Internet and the library. Even then, do financial statements tell the whole story? In many industries, particularly service industries, non-financial (or operating) ratios provide useful indicators of success. For example, in the health service, one might monitor the average number of days a patient stays in hospital. And what about companies such as Microsoft? Microsoft is worth far more than the net assets in its balance sheet. What do its financial statements tell us? Is this information sufficient to help the users of accounts?

Driving change through training and development (PDF)

Driving change through training and development (PDF)  The importance of quality in creating competitive advantage (MP3)

The importance of quality in creating competitive advantage (MP3)  Building a workforce for the future (PDF)

Building a workforce for the future (PDF)  Legal Services Commission A3 ePoster Edition 15 "The advantages of centralisation"

Legal Services Commission A3 ePoster Edition 15 "The advantages of centralisation"  Davis A3 ePoster Edition 14 "Managing firms through the business cycle"

Davis A3 ePoster Edition 14 "Managing firms through the business cycle"  Recruitment and selection in the energy industry (PDF)

Recruitment and selection in the energy industry (PDF)