Methods of analysing marketing opportunities involves collecting, recording and making sense of all the available information which will help a business unit to understand its market. Market research sets out to answer the following questions:

- Who makes up the target audience?

- What do they want?

- When do they need it?

- Where does it sell best?

- How can it be taken to them?

- Why do they want/need it?

- What are our competitors doing?

- How is our market changing?

Market research helps firms to plan ahead rather than guess ahead

In business, demand is always changing and therefore it is essential to know how things are changing. Market research requires a special form of skill and therefore market research companies are often employed because they have the necessary experience and also because market research takes up a lot of time.

Methods used in marketing research

Data gathering involves collecting as much information as possible about the market, usually before any further steps are taken. It relies on desk research and field research. Data is divided into primary and secondary categories.

Primary data are collected in the field. Secondary data are gathered from all the material that is at present available on the subject and is always studied first when doing desk research.

Desk research

This method involves the search for secondary data, whether published or unpublished. A good place to begin is with a company’s records of items such as production, sales, marketing, finance and other data.

Other sources of secondary data are government publications on the Internet such as the government’s Expenditure and Food Survey showing what typical households spend their money on, and Social Trends outlining changes in social patterns in this country.

Commercial research organisations such as Mintel also provide market research reports, many of, which are accessible on the Internet.

Field research

Involves the search for primary information.

Sampling/sample surveys

Is the most common way to gather field data. It involves taking a census of a small sector of the population which represents all of a particular group, e.g. married working women in Bristol aged 30-45 are taken to represent all urban, married working women in the United Kingdom.

Convenience sampling is taking information from any group, which happens to be handy – walking down a high street for example.

Judgement sampling is slightly more refined: the interviewer would select high street respondents on the basis of whether or not they appear to belong to a particular segment or the population – say, middle-class business people.

Quota sampling deals with specific types of respondents – e.g. female students studying the social sciences.

Questionnaires

This is the most popular method of extracting information from people. They are usually conducted by post, telephone or in person. Questionnaires are easy to administer and easy for respondents to deal with.

They simplify the analysis of results and can provide surprisingly detailed information. A useful way of delivering a questionnaire is online. One way of doing this is to ask the public to fill in a questionnaire, which then enables them to register for access to a website.

However, questionnaires are easy to ‘cheat’ on and a market research agency will ensure that ‘control questions’ has been built in to check that the questionnaire has been filled in a suitable fashion.

Postal questionnaires

These are easy to administer but unfortunately, they yield a poor response. They are rarely used on their own: more often they are used to support a programme of telephone or personal interviews.

Benefits include relatively low cost, no interviewer bias, and reaching people who are otherwise inaccessible.

Telephone interviews

These are ideal when specific information is required quickly. However, in the modern age, many consumers are reluctant to ‘waste’ their time answering questions on the telephone.

As the questioner has little evidence of whom they are speaking to it is easy to get false information.

Personal interviews

In a structured interview, the interviewer has to follow a set pattern of questions and responses (e.g. ticking boxes).

In semi-structured interviews, the order and wording of the questions are laid out in an interview guide but the response is open ended, and the interviewee is allowed to reply in his or her own words.

Unstructured interviews are what they sound like – certain topics are covered in a relaxed fashion.

Quantitative market research

This relates to methods such as questionnaires, which can be used to gather a lot of information, but often use fairly closed responses.

Qualitative market research

This relates to more intensive methods involving small samples such as a focus group who come together to discuss their feelings about a particular product.

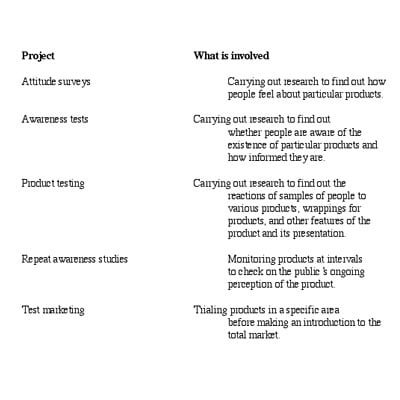

Types of market research projects