This case study focuses on the recent process of change in the banking industry. Ten years ago, nearly all personal banking operations were carried out in High Street branches. If customers wanted to talk to a bank official about their financial arrangements, they had to queue or make an appointment. In terms of the customer/seller relationship, the power was very much in the hands of the ‘big banks’.

During the 1980s, ‘marketing’ became a major driving force for change in the way organisations operated. The new emphasis was to be on the customer and meeting customer needs. Organisations needed to re-organise in order to place the customer in the driving seat.

This case study examines how First Direct became the catalyst for change in the banking industry. From the beginning, First Direct has been breaking the mould of traditional banking and maintains a philosophy of providing and anticipating the financial services people require.

After carrying out market research, First Direct created telephone banking as the logical step to meeting customer requirements for personal service. This was to be the major breakthrough in marketing orientation that shook up the banking industry in the 1990s. Then, like other successful organisations, First Direct went on to introduce further changes in ever more sophisticated ways – most recently PC Banking.

Starting the revolution – 1989

When First Direct was launched on 1st October, 1989, 24-hour person to person telephone banking was untested and a completely new idea for the vast majority of the banking public. By offering people a full range of banking and financial services, normally only available from High Street branches, telephone banking sparked off a revolution in the banking world that has been growing ever since. It has now become the preferred method of banking for an increasing number of the UK’s 36 million banking customers.

At first, it was the ‘early adopters’, i.e. people who always like to try out new products or new ways of doing things, who joined First Direct, but as telephone banking became more established, the ‘followers’ joined. Telephone banking became an accepted, alternative way of carrying out day-to-day transactions.

Many banks initially thought that a purely telephone-based operation would never work because customers would be reluctant to organise their finances with someone they could not see. Now, however, the majority of High Street Banks and Building Societies have recognised the need to introduce this service – in order to continue winning new customers and retain those customers who want to change to telephone banking.

The telephone has now been accepted as a convenient and effective delivery channel for personal banking by both the banks and the public who use them. Whilst this will continue to be the case for the foreseeable future, the market for alternative channels is developing rapidly. People’s attitudes have changed towards the way they carry out banking. Banks once had a very staid, old fashioned image, with restrictive opening hours and a reputation for poor customer service. Customers accepted this because there was no viable alternative on offer to them. With the advent of First Direct’s new telephone banking service, however, people are now aware that an alternative banking method exists.

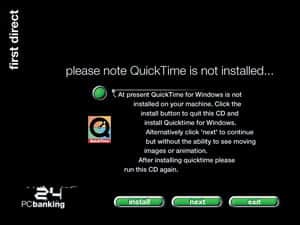

Nowadays, the technology available to people in their own homes is becoming increasingly sophisticated. The modern consumer has access to an increasing number of delivery channels, including the PC. First Direct’s PC Banking service allows customers to access their account via their PC providing they have Windows 95 and a modem. First Direct then sends the software that needs to be installed.

Marketing

Perhaps the most important ingredient of marketing is market research. Market research is a systematic process which sets out to find out detailed information about the marketplace and, in particular, to identify the needs and requirements of customers. First Direct carries out extensive market research amongst customers and non-customers on a regular basis. This includes both quantitative surveys (e.g. questionnaires that can be analysed in a quantitative way) and qualitative research (more detailed research with focus groups of both customers and non-customers to find out their opinions and views). First Direct sends out two major questionnaires to find out customer perceptions of the bank.

- The questionnaire First Impressions is sent to all new customers, three months after opening an account.

- The questionnaire First Response is a quarterly survey of 2000 customers who have banked with First Direct for 12 months or longer.

Another important source of feedback to First Direct comes from customers who spontaneously phone or write with suggestions for new services they would like to see introduced. These ideas are logged and trends identified. Banking Representatives, the people who speak to the customers, are also a vital source of information. They had noticed that customers were making balance enquiries by telephone and then immediately typing the information directly into their own PCs – a strong indication that PC Banking would be welcomed as an additional service.

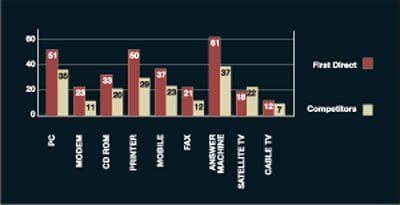

Market research

The aim of the market research was to find out whether PC Banking would provide a popular service. The surveys showed that, compared to other banks, First Direct customers are more likely to have PCs, use the Internet and want to use PC Banking. First Direct customers tend to be the first to buy and use the latest technology. This was attributed to the large number of ‘early adopters’ who initially came to First Direct because of the innovative, forward-thinking image First Direct projected. Key survey results in January 1996, showed that:

- 44% of First Direct customers said they would be very or fairly likely to use a PC Banking service

- 6% said they would move bank to use PC Banking

- 51% of customers owned a desk top PC compared to 35% of other bank’s customers

- 23% owned a modem compared to 11% amongst other banks.

The most important finding from the market research was that PC Banking was the most desirable new technological service that customers wanted to see First Direct providing.

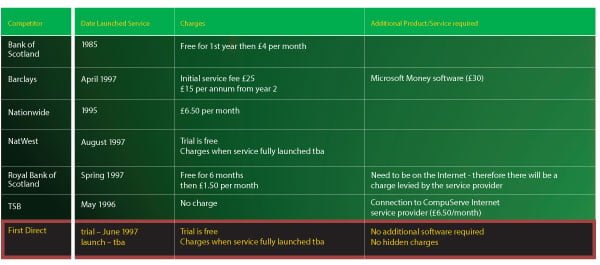

Competitor analysis – what is happening in the marketplace?

Effective market research not only analyses customers and their characteristics, but it should also look at the competitors’ ability to meet consumer requirements. Market research in the form of competitor analysis reveals where an organisation stands in relation to rival offers to consumers.

First Direct was not the first bank to introduce a PC Banking service. The decision was made to wait until sufficient research had been carried out to enable the company to provide a service that would meet the very high standards that customers expected. PC Banking also needed to equal the service already offered over the telephone. If this was not the case, First Direct’s reputation as ‘The UK’s leading telephone bank’ could be damaged.

Other banks, including Barclays and TSB already had PC Banking services. Therefore it was important to introduce a service that not only fitted in with First Direct’s reputation but one that would stand out amongst its competitors. First Direct therefore engaged in a detailed development period in order to:

- make the best possible use of the latest technology (including the use of the ‘Java’ programming language) and the most up-to-date security methods to protect the customer

- meet customers’ expectations of a high standard of service.

Matching PC Banking with First Direct’s overall strategy

The overarching brand value of First Direct is to provide customers with a ’Gateway to Autonomy’. In simple terms, this involves enabling the customer to become ’master’ of his or her own finances; to have individual control. First Direct’s PC Banking services therefore needed to support this brand value. It needed to provide customers with a service that offers simple, hassle free products, allowing them to bank at a time and place convenient to them and in a way that suits them best.

Initially, during the trial period, functionality was very limited, allowing customers to view balances and transactions, download transactions to their own PC software and view online help and information. Customers could also access the electronic mail system, enabling them to request information or make a query regarding their account. They could also comment on what they thought of the service.

Now, as the level of functionality has increased, customers can carry out a wide range of transactions over their PC, including transferring money between accounts, opening new accounts, paying bills, accessing on-line help and applying for personal loans, Visa cards and annual travel insurance. One of the key advantages of PC Banking is that it gives First Direct a visual presence. First Direct will become more tangible to some of its customers because they are able to see their personal details and transactions on their computer screens.

Communication

Once First Direct had decided to develop a PC Banking service, it became necessary to develop efficient channels of communication, informing customers and potential customers about the new service:

- Banking Representatives were informed of what to tell customers enquiring about the initial plans for a PC Banking service. Those customers who expressed an interest were logged and kept informed of progress. They were then mailed as soon as First Direct had established the details of the service and invited to participate in the trial.

- A PC Banking support team was set up to answer more detailed queries.

- Statement inserts were sent out once plans for the trial were finalised – thus raising awareness of the new service.

- A Public Relations programme was put in place to announce plans to the press.

Administration and management of change

First Direct has ensured that the PC Banking and telephone banking channels are fully integrated. When a customer carries out a transaction via their PC, if they then call in to query something, the Banking Representative will be able to see exactly what transactions the customer has just carried out. In the short term, little impact is expected on the telephone side. However, in the medium term, as functionality is increased, it is expected that people using the PC Banking service will call less often. A high proportion of calls are balance only enquiries. With people calling less often, operators will be freer to take more detailed calls.

Resources

ICL, the information technology company, was brought in to develop PC Banking alongside First Direct. ICL is experienced in designing and building integrated systems and adapting them to the needs of individual companies. ICL helped set up a new telephone support number providing a technical backup service – for customers who experience technical problems – especially during set-up. Another telephone help line number is for the First Direct PC Banking Support Team. This is made up of First Direct staff who have been trained to run the PC Banking help desk service. They had to understand the hardware requirements needed to install the software and access the system, understand other jargon such as ’browser based software’ and also know what Java is – the language that PC Banking is largely written in. They assist customers with banking related enquiries whilst using the PC Banking system, e.g. being unsure how to access or carry out a particular transaction whilst on-line. In addition to the specialised numbers, users can also get assistance from the on-line help, sending an electronic message and by telephoning the telephone Banking Representatives.

An internal ’Cybercafe’ was set up for a week with exhibits and displays explaining what PC Banking is all about and how it works. This was to ensure that when customers called in, everyone would be aware of the service and would either be able to answer questions or know who to transfer the query to. An internal magazine was also produced and distributed which gave a better idea of the look and feel of the new service, including pictures and graphics of PC Banking screens.

Conclusion

In this ‘age of information and technology’ customers continually require new technological services. Today’s ‘next best thing’ may be obsolete tomorrow. One of the aims of marketing is to find out what customers will be buying tomorrow and in the months and years to come. First Direct prides itself on being a forward thinking, innovative company. Therefore it continually looks at new technological developments, evaluates new opportunities, analyses what customers want and how it can meet these demands.

First Direct is now looking to take the next step into TV Banking. First Direct, as a division of Midland Bank, is working with BIB, a company that is co-owned by BSkyB, British Telecom, Midland and Matushita, to develop interactive TV. The system is to be launched in 1998. Customers will be able to access their accounts via their TV sets with a set top box. This state of the art technology will also enable people to download cash onto Mondex cards. Watch this space!