The Capital Adequacy Ratio (CAR) is a critical financial metric that serves as a cornerstone for the stability and soundness of banking institutions. It is defined as the ratio of a bank’s capital to its risk-weighted assets, providing a measure of the bank’s ability to absorb potential losses while continuing to meet its obligations to depositors and creditors. The concept of capital adequacy emerged in response to the need for a robust framework that could safeguard the banking system against insolvency and systemic risks, particularly in the wake of financial crises.

The CAR is not merely a regulatory requirement; it reflects the financial health of a bank and its capacity to withstand economic shocks. The significance of CAR extends beyond individual banks; it plays a pivotal role in maintaining the overall stability of the financial system. By ensuring that banks hold sufficient capital relative to their risk exposure, regulators aim to mitigate the likelihood of bank failures, which can have far-reaching consequences for the economy.

The CAR is a dynamic measure, influenced by various factors including changes in regulatory standards, market conditions, and the evolving risk landscape faced by financial institutions. As such, understanding CAR is essential for stakeholders ranging from bank management and investors to regulators and policymakers.

Summary

- The Capital Adequacy Ratio (CAR) is a measure of a bank’s capital in relation to its risk-weighted assets, used to ensure financial stability and protect depositors.

- CAR is crucial for banks as it indicates their ability to absorb losses and meet financial obligations, reducing the risk of insolvency and promoting confidence in the banking system.

- CAR is calculated by dividing a bank’s capital by its risk-weighted assets, with higher ratios indicating a stronger financial position and ability to withstand economic downturns.

- Regulatory requirements for CAR are set by financial authorities to ensure banks maintain a minimum level of capital to support their operations and protect against potential losses.

- CAR plays a key role in risk management by incentivising banks to maintain a healthy balance between risk and capital, but challenges exist in achieving and sustaining an optimal ratio.

Importance of Capital Adequacy Ratio in Banking

Buffer Against Unexpected Losses

Banks engage in various activities that expose them to credit, market, and operational risks. A robust CAR ensures that banks have enough capital to absorb these losses without jeopardising their solvency. For instance, during economic downturns or periods of financial distress, banks with higher capital ratios are better positioned to weather the storm, thereby protecting depositors and maintaining confidence in the banking system.

Promoting Prudent Risk Management

CAR plays a crucial role in promoting prudent risk management practices within banks. By requiring institutions to maintain a certain level of capital relative to their risk-weighted assets, regulators incentivise banks to assess and manage their risks more effectively. This leads to more informed lending practices and investment decisions, ultimately contributing to a more resilient banking sector.

Enhancing Financial Stability

For example, banks that adhere to stringent CAR requirements are likely to conduct thorough due diligence before extending credit, thereby reducing the likelihood of defaults and enhancing overall financial stability.

Calculation of Capital Adequacy Ratio

The calculation of the Capital Adequacy Ratio involves a straightforward formula: CAR = (Tier 1 Capital + Tier 2 Capital) / Risk-Weighted Assets. Tier 1 capital primarily consists of common equity, which includes common shares and retained earnings, while Tier 2 capital encompasses subordinated debt and other instruments that can absorb losses in times of financial stress. Risk-weighted assets are calculated by assigning different risk weights to various asset classes based on their credit risk profiles.

For instance, government bonds may carry a lower risk weight compared to corporate loans, reflecting their relative safety. To illustrate this calculation, consider a hypothetical bank with £100 million in Tier 1 capital and £50 million in Tier 2 capital. If the bank’s risk-weighted assets total £500 million, the CAR would be calculated as follows: (£100 million + £50 million) / £500 million = 0.3 or 30%.

This indicates that the bank has 30% capital relative to its risk-weighted assets, which is significantly above the minimum requirements set by regulators. Such a high CAR not only demonstrates the bank’s financial strength but also enhances its ability to attract investors and maintain customer confidence.

Regulatory Requirements for Capital Adequacy Ratio

Regulatory requirements for the Capital Adequacy Ratio are primarily established by international frameworks such as Basel III, which was developed by the Basel Committee on Banking Supervision in response to the global financial crisis of 2007-2008. Basel III introduced more stringent capital requirements compared to its predecessor, Basel II, with an emphasis on improving the quality and quantity of capital held by banks. Under Basel III, banks are required to maintain a minimum CAR of 8%, with at least 4.5% consisting of Tier 1 capital.

In addition to these minimum requirements, Basel III also introduced capital conservation buffers and countercyclical buffers aimed at further enhancing banks’ resilience during periods of economic stress. The capital conservation buffer requires banks to hold an additional 2.5% of common equity tier 1 capital above the minimum requirement, while countercyclical buffers can vary based on national economic conditions. These regulatory measures are designed to ensure that banks not only meet baseline capital standards but also have additional resources available during times of economic uncertainty.

Impact of Capital Adequacy Ratio on Financial Stability

The Capital Adequacy Ratio has profound implications for financial stability at both micro and macro levels. At the micro level, a higher CAR indicates that individual banks are better equipped to absorb losses without resorting to government bailouts or emergency interventions. This fosters confidence among depositors and investors, reducing the likelihood of bank runs and promoting stability within the banking sector.

For example, during the European sovereign debt crisis, banks with strong capital positions were able to navigate turbulent market conditions more effectively than those with weaker capital bases. At the macro level, a well-capitalised banking system contributes to overall economic stability by ensuring that credit flows remain uninterrupted during periods of stress. When banks maintain adequate capital levels, they are less likely to engage in excessive risk-taking or tighten lending standards excessively during downturns.

This stabilising effect is crucial for sustaining economic growth and preventing prolonged recessions. Furthermore, regulatory authorities closely monitor aggregate CAR levels across the banking sector as an indicator of systemic risk; significant declines in CAR can signal potential vulnerabilities that may require preemptive regulatory action.

Role of Capital Adequacy Ratio in Risk Management

The Capital Adequacy Ratio is intrinsically linked to effective risk management practices within banks. By establishing a clear framework for assessing capital adequacy relative to risk exposure, banks are encouraged to adopt comprehensive risk management strategies that encompass credit risk, market risk, operational risk, and liquidity risk. A robust CAR compels banks to evaluate their risk profiles continuously and adjust their capital structures accordingly.

For instance, if a bank identifies an increase in credit risk due to deteriorating economic conditions or rising default rates among borrowers, it may choose to bolster its capital reserves by retaining earnings or issuing new equity. This proactive approach not only strengthens the bank’s CAR but also enhances its ability to manage potential losses effectively. Additionally, banks may employ sophisticated risk modelling techniques to assess their exposure across various asset classes and adjust their lending practices accordingly.

By integrating CAR into their risk management frameworks, banks can create a more resilient organisational culture that prioritises long-term sustainability over short-term gains.

Challenges in Maintaining a Healthy Capital Adequacy Ratio

Despite its importance, maintaining a healthy Capital Adequacy Ratio presents several challenges for banks. One significant challenge is balancing the need for adequate capital with the desire for profitability. Banks operate in highly competitive environments where profit margins can be thin; thus, holding excess capital may be perceived as a drag on returns on equity (ROE).

This tension can lead some institutions to adopt aggressive growth strategies that prioritise asset expansion over prudent capital management. Moreover, fluctuations in market conditions can impact both the numerator and denominator of the CAR calculation. For instance, during periods of economic expansion, asset values may rise rapidly, leading banks to take on additional risks without proportionately increasing their capital bases.

Conversely, during economic downturns, asset values may decline sharply, resulting in increased risk-weighted assets and potentially eroding capital ratios. This cyclical nature of banking operations necessitates vigilant monitoring and strategic planning to ensure that CAR remains within acceptable thresholds.

Conclusion and Future Outlook for Capital Adequacy Ratio

As we look towards the future, the Capital Adequacy Ratio will continue to play an essential role in shaping the landscape of banking regulation and financial stability. The ongoing evolution of financial markets and emerging risks—such as those posed by technological advancements and climate change—will necessitate continuous adaptation of regulatory frameworks governing CAR. Regulators may need to consider incorporating new risk factors into their assessments while ensuring that existing standards remain relevant in an increasingly complex financial environment.

Furthermore, as banks increasingly embrace digital transformation and innovative financial products, there will be a growing need for enhanced transparency and disclosure regarding capital adequacy metrics. Stakeholders—including investors, customers, and regulators—will demand greater clarity on how banks assess their risks and manage their capital positions. In this context, fostering a culture of accountability and sound governance will be paramount for maintaining trust in the banking system.

In summary, while challenges persist in maintaining healthy Capital Adequacy Ratios amidst evolving market dynamics, the fundamental principles underpinning CAR will remain vital for ensuring the resilience and stability of financial institutions in an ever-changing world.

The Capital Adequacy Ratio is a crucial metric for assessing a bank’s financial health and stability. It measures a bank’s capital in relation to its risk-weighted assets, ensuring that it has enough buffer to absorb potential losses. To delve deeper into the importance of financial management in banking, one can explore the article on business loans. This article highlights the significance of securing appropriate funding to support business operations and growth, which directly impacts a bank’s capital adequacy. Understanding the intricacies of financial management is essential for maintaining a healthy Capital Adequacy Ratio and ensuring long-term sustainability in the banking sector.

FAQs

What is Capital Adequacy Ratio?

The Capital Adequacy Ratio (CAR) is a measure of a bank’s capital in relation to its risk-weighted assets. It is used to ensure that banks have enough capital to absorb potential losses and protect depositors.

Why is Capital Adequacy Ratio important?

The Capital Adequacy Ratio is important because it helps to ensure the stability and solvency of banks. It provides a measure of a bank’s ability to absorb losses and continue operating without risking insolvency.

How is Capital Adequacy Ratio calculated?

The Capital Adequacy Ratio is calculated by dividing a bank’s capital by its risk-weighted assets. The capital is typically divided into Tier 1 and Tier 2 capital, with Tier 1 capital being the most secure and readily available for absorbing losses.

What is the minimum Capital Adequacy Ratio required for banks?

The minimum Capital Adequacy Ratio required for banks is set by regulatory authorities in each country. In the UK, the minimum requirement for the Capital Adequacy Ratio is set by the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA).

What are the consequences of a low Capital Adequacy Ratio?

A low Capital Adequacy Ratio can indicate that a bank is at risk of insolvency or may not have enough capital to absorb potential losses. This can lead to regulatory intervention, restrictions on lending, and a loss of confidence from depositors and investors.

Shell A3 ePoster Edition 14 "Balancing stakeholder needs"

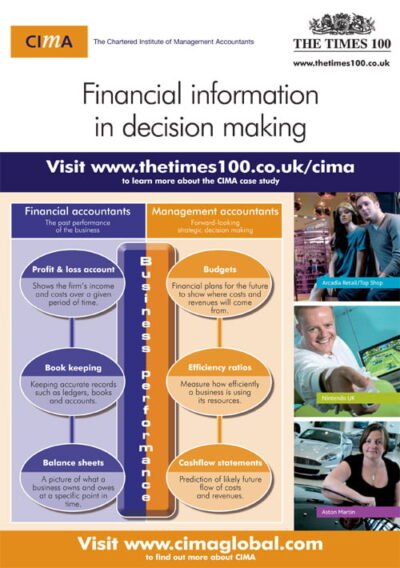

Shell A3 ePoster Edition 14 "Balancing stakeholder needs"  CIMA A3 ePoster Edition 13 "Financial information in decision making"

CIMA A3 ePoster Edition 13 "Financial information in decision making"  Unison A3 ePoster Edition 17 "Developing responsiveness through organisational structure"

Unison A3 ePoster Edition 17 "Developing responsiveness through organisational structure"  New technology development in the primary sector (MP3)

New technology development in the primary sector (MP3)  Foreign Commonwealth Office A3 ePoster Edition 14 "Delivering the mission statement"

Foreign Commonwealth Office A3 ePoster Edition 14 "Delivering the mission statement"  London 2012 - achieving the vision (PDF)

London 2012 - achieving the vision (PDF)  Tesco A3 ePoster Edition 14 "How training and development supports business growth"

Tesco A3 ePoster Edition 14 "How training and development supports business growth"  The Editions Collection Business Case Studies eBook

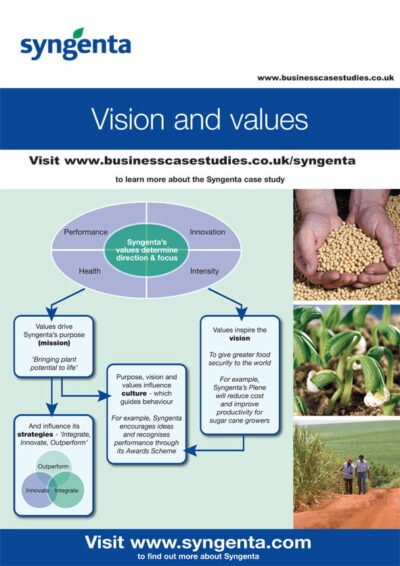

The Editions Collection Business Case Studies eBook  Syngenta A3 ePoster Edition 17 "Vision and values"

Syngenta A3 ePoster Edition 17 "Vision and values"  Powering forward with a new vision (PDF)

Powering forward with a new vision (PDF)  The Finance Collection Business Case Studies eBook

The Finance Collection Business Case Studies eBook  OPITO A3 ePoster Edition 15 "Sectors of industry"

OPITO A3 ePoster Edition 15 "Sectors of industry"  The Operations Collection Business Case Studies eBook

The Operations Collection Business Case Studies eBook