Changes in society, markets and economies have intensified the need for most organisations to be more and more innovative with the products that they offer, in order to attract new customers and increase product holdings. New products and services can provide the mechanisms through which further market growth can be achieved. Increasing competition, which often stems from new products and services, means that innovation in new product development is no longer an option but a necessity.

This case study examines how technology has enabled Intelligent Finance to revolutionise banking, by creating not just a new bank, but a totally new way of banking. Intelligent Finance’s objective is to be the consumer’s champion by placing the needs of customers at the heart of its marketing activity

Identifying a gap in the market

In today’s technology driven, modern world, most organisations operate in highly competitive markets, this is particularly true of the financial services sector. Technology has been one of the key drivers of change within this market and most retail banks now offer on-line banking services. Until recently, most banks operated from the traditional high street branches, offering very similar products and services to their customers. A product can be defined as anything that can be offered for sale, this could be something tangible that can be owned or it may be a service that is performed for the buyer. Most products contain both a tangible and a service element.

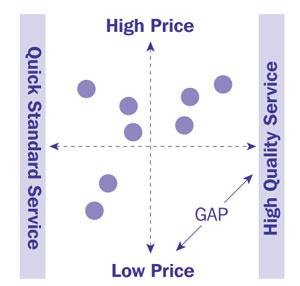

Product positioning is the way in which a product and its associated brand is perceived by customers in relation to other competitive products. Different customers value different combinations of product or service attributes, based on the extent to which it meets their particular need at that given time. For example, the diagram shows that some customers are prepared to pay a particularly high price for a high quality service. While others, prefer a quick standard service, for a low price. If an organisation identifies a group of customers, who require a combination of either goods and or services which is not currently offered, it will have discovered a ‘gap’ in the market.

Intelligent Finance’s Chief Executive, Jim Spowart, has been a pioneer of direct banking. He realised that while people were queuing in banks at the counter, the customers who telephoned got priority. He felt that if telephone banking could be improved, then a fast and efficient service could be delivered to customers, without the overheads of an expensive branch network. This was the beginning of Jim Spowart’s venture into direct banking. Intelligent Finance is the third new generation bank Jim Spowart has set up. It set out to offer something that no other bank was offering, therefore, filling a gap.

By embracing new technology, Intelligent Finance has developed a new approach to delivering both products and services, in a highly innovative way. This looks set to transform the traditional retail bank as we know it – by putting the customer first.

The proposition

Despite the fact that most banks now offer telephone and internet banking services, most continue to function in traditional ways. Placing traditional branch networks at the forefront of their operations. High street branches are an expensive overhead and often offer products which do not always meet the customer’s needs.

Intelligent Finance was launched last year as a division of the Halifax plc. Intelligent Finance offers a phone and internet banking service, with products that give the customer choice, flexibility and the ability to make the most of their own money. Intelligent Finance offers five products; a current account, savings, credit card, personal loan and a mortgage. The innovation is in the way in which the technology has allowed customers to choose to manage their money and allows them to link the products together to ensure that their money works for them in the most efficient way.

Technology has facilitated this revolutionary new system of banking. This allows customers to connect products together, taking account of both their borrowings and savings. This means that by connecting products together, interest is only paid on the balance. For example, a customer may have two products with Intelligent Finance, a personal loan and a current account. The customer has a personal loan for £5,000 and £2,000 in their current account. Intelligent Finance’s integrated approach allows the customer to connect the two accounts together. The £2,000 in the customer’s current account can be offset against the loan, so interest is only paid on the £3,000 personal loan balance and the customer receives no interest on the current account balance. Alternatively, the customer can choose to pay borrowing rates on their loan and receive the same rates on their savings. It is based on the principle that in effect, some of what customers borrow is their own money, so they should not pay or receive different interest rates on it. Given that the amounts can change daily, the system will calculate balances on a daily basis, allowing the customer to receive the best possible rate of interest on their money. The system is unique in that it allows a customer to have a few products or the whole range of products in their plan. Other banks require the customer to have a mortgage to benefit.

Meeting customer needs

The Chartered Institute of Marketing use the following definition to describe marketing. ‘Marketing is the management process responsible for identifying, anticipating and satisfying customer requirements profitably.’ This definition places the consumer at the centre of an organisation’s activities. Intelligent Finance set out to be the consumer champion. Organisations seek to offer customers particular benefits in order to meet their needs. They want the right products, at the right time, in the right place at the right price. This is known as the marketing mix and is made up of the four P’s. To meet the needs of consumers, organisations must:

- develop products to satisfy them

- charge them the right price

- get the goods to the right place

- make consumers aware through promotion.

So how has Intelligent Finance developed a successful marketing mix?

Products, price and place

Intelligent Finance’s proposition combines both service and tangible products, which results in an integrated product – one could not operate as efficiently, or in the same way, without the other. In this case, transactions and accounts are totally integrated.

Flexible technology enabled Intelligent Finance to develop this new product offering. The systems enable the bank to deliver choice and flexibility to customers who can mix and match their products.

Customers can connect products and make their money work for them. For example: Jim and Sarah have a current account, a savings account and a mortgage with Intelligent Finance. In an average month they have £1,200 in their current account and £4,000 in their savings account. They also have a mortgage of £55,000 with Intelligent Finance, customers can choose not to earn interest on their current account and savings, the combined balance of the money that they have in their current and savings account (£5,200) would connect to work with their mortgage helping to reduce the amount of interest that they have to pay. Therefore, they only pay interest on £49,800. If any of the amounts change, this is calculated daily and interest is calculated on the new balances.

Price

Customers can make their money work much harder with Intelligent Finance. The bank’s product proposition means that customers can choose to pay less interest on their borrowing or earn more interest on their savings. Without the overheads of traditional high street branch networks, Intelligent Finance is more cost efficient, therefore, Intelligent Finance is able to pass on these savings to its customers.

Place

Market research revealed that the most successful banks were those that operated multi-delivery channels, including both phone and the internet. If customers were able to speak to someone on the phone, it seemed to be the key difference between success and failure. Intelligent Finance followed this model and customers have a range of ways to connect to the bank: phone, internet, or WAP technology. This means that customers can make banking a part of their busy lives. In modern society, people now have less time to visit high street banks. However, they can still telephone the bank and speak to someone if they wish. Intelligent Finance offers banking for a 21st century lifestyle.

Intelligent Finance uses three distribution channels to sell its products and customers can use a number of communication channels to enquire about these.

- Direct Channels: Customers enquire directly by phone or on the web.

- Professional Advisors: Intelligent Finance has a sales force who promote the Intelligent Finance product to professional advisors throughout the UK. These professional advisors sell products from a variety of financial services institutions in order that their customers can make an informed choice. The advisor may earn a commission on each product sold.

- Affinity Partners: Intelligent Finance has a number of partnerships with external companies. These partnerships are with organisations who can provide added value to each other’s membership base. For example, the Living Well Health Clubs, promote Intelligent Finance to its membership base, achieving cost effectiveness through distribution, while gaining direct access to the club’s membership database. Living Well can obtain advantage by being associated with a strong reliable brand.

Promotion

Promoting Intelligent Finance was an enormous challenge. Even though the bank provides the reassurance of being associated with the Halifax, which was already a well established household name, Intelligent Finance came to the market offering a radical and new approach to banking.

Therefore Intelligent Finance needed to create a new brand identity, capable of promoting the bank not just to potential consumers, but also, to professional advisors, who would have the ability to bring in large volumes of business. The bank concentrated on the end benefits to the customer, comparing it to buying a sports car – the customer does not need to know what goes on under the bonnet, simply that it looks good and goes fast.

Intelligent Finance recently completed a very successful campaign, which uses its customers to explain the merits of its product proposition. The campaign provided a good explanation of the product and appealed both to new and existing customers.

Competitive advantage

In a highly competitive market, developing and maintaining competitive advantage involves continuing to lead the field. In just twelve months, Intelligent Finance has revolutionised the banking sector.

Since it’s launch in November 2000 Intelligent Finance has achieved almost 9% market share of the total UK net mortgage lending and mortgage sales, equivalent to an additional 800 bank branches. It has also had 80,000 current account applications. However, in a competitive environment, competitors will be looking to catch up with Intelligent Finance and overtake them. Therefore, Intelligent Finance needs to continue to look to the future and develop its products and systems to continue to meet consumer needs.

Conclusion

Technology has facilitated this new approach to banking. Intelligent Finance can now use the intelligence and information that telenet banking can provide – through measuring the number of hits on the web and the length of time of the hits etc – to continue to develop its products and services. Intelligent Finance knows that just as it has embraced technology, it is now a driver of change within its market. The challenge it faces is to continue to develop its product proposition. Intelligent Finance must continue to deliver the right product, at the right time, to the right place, at the right price – if it is to remain the consumers champion.

Tesco A3 ePoster Edition 18 "Visions, values and business strategies"

Tesco A3 ePoster Edition 18 "Visions, values and business strategies"  Primark A3 ePoster Edition 16 "Engaging with stakeholders"

Primark A3 ePoster Edition 16 "Engaging with stakeholders"  Vodafone A3 ePoster Edition 13 "Stakeholders in recycling and re-use at Vodafone"

Vodafone A3 ePoster Edition 13 "Stakeholders in recycling and re-use at Vodafone"