Beiersdorf is the international skin care company behind the leading brands NIVEA, ELASTOPLAST, ATRIXO and EUCERIN. Over the past 10 years the company has grown rapidly in the UK by developing a balanced and well managed portfolio of brands. A brand portfolio should consist of a range of products which support each other, irrespective of which categories they operate in.

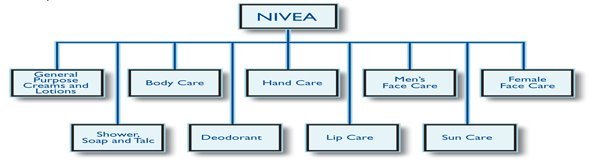

The NIVEA range includes product types ranging from female face and body products to men’s shaving gels, through to deodorants and sun care products.

NIVEA identifies market segments that meet individual consumer needs. Segmentation occurs when a market is split into sub-markets (segments) which can respond in similar ways to different marketing activities. Each segment:

- contains consumers with similar needs or tastes

- is best satisfied by products targeted to meet their specific needs.

This can be at a macro level (e.g. total health and beauty market) and at a micro level (i.e. within a specific category). NIVEA Sun is a major international sun care brand, recognised worldwide as a leader in sun care research and development. The UK market is worth £173.6m with an overall category purchase penetration of 33% (usage penetration is higher).

Sun care is a serious issue for all and the protection message is key to the NIVEA Sun brand proposition. NIVEA Sun appeals to, and is used by men, women and children with quality products to meet all needs. The brand also aims to bring fun to the market through recognising situations when sun care products are applied.

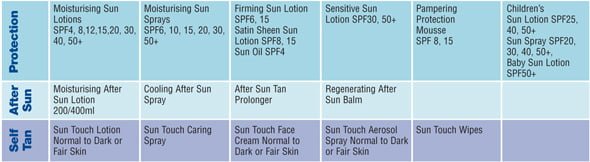

The three main product segments

The diagram above shows the three main product segments that make up the NIVEA Sun range. As you will see, there are a variety of products in each, which can also be segmented as shown.

1. Protection

It is vital that skin is adequately protected against the sun”s harmful effects (although no sunscreen can provide total protection). NIVEA Sun provides products that enable people to be as safe as possible. NIVEA Sun also encourages the use of other forms of protection (e.g. wearing a sun hat and avoiding midday sun). Protection is the largest segment in the sun care market with a purchase penetration of 28%. NIVEA Sun is the protection segment market leader by value (i.e. more money is spent on NIVEA Sun protection products than any other sun care brand in the UK). When choosing sunscreens there are two important factors to consider:

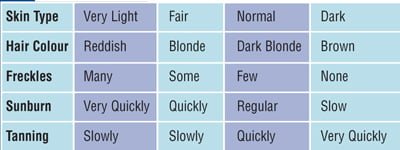

i. skin type

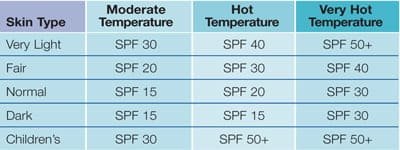

The chart below shows segmentation by skin type. The level of protection required for each segment will vary according to generalised skin types (as seen below):

Skin type applies to children, as well as adults. Children”s skin is thinner and its repair mechanism is not yet fully developed. As a result they require extra protection and sun screens that are specifically developed for their skin.

ii. location

NIVEA Sun provides a range of lotions and sprays targeted at different climates and to users with different skin types. Someone with fair skin may be well protected with a SPF 20 product when in England, but if they were in Barbados they would need SPF 40.

2. After Sun

NIVEA Sun is the market leader within this segment in the UK, which has been growing rapidly.

3. Self-tan

In contrast to protection and after sun, the self-tan category is concerned mostly with cosmetic appeal. Many adults use self-tan to have an all year round sun kissed glow.

Brand Vision

A vision paints a picture of what you are trying to achieve with your brand in a simple sentence. NIVEA Sun’s vision is “To be the Number 1 brand in the UK sun care market in penetration, sales and likeability.”

Penetration relates to the percentage of potential customers that purchase a product. Sales relate either to value (the money spent on the product) or volume (the quantities sold). Likeability is all about enjoyment. If people like a brand/product they will continue to buy it.

One key way to achieve the vision is to provide innovative solutions to market needs. This has been a key success factor for NIVEA Sun. As a brand it has achieved this through continually segmenting its consumers in order to:

- effectively meet consumers’ needs

- identify new market opportunities.

Consumer segmentation

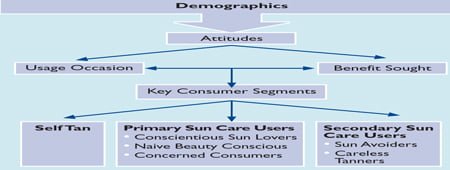

Segmentation has been vital to the success of NIVEA Sun and allowed the brand portfolio to grow to over 40 products, all meeting clear consumer needs. The following factors are used to develop and define the sun care segments:

- Demographics – different groups of consumers behave differently (factors relate to age, gender, etc). Demographic differences relevant to NIVEA Sun include different buying behaviours between men/women and adults with children. There is a stark contrast between awareness and usage of sun care products between men (who prefer convenience) and women (who enjoy more luxurious sun care products). Similarly, adults with children are another broad segment with differing needs.

Demographic segments are broad. As research shows, the level of awareness of sun care transcends income and social class.

- Attitudinal this is the most important segmentation variable. Consumers’ attitudes towards sun care influences their purchases. NIVEA Sun conducts market research to understand user attitudes. This involves questionnaires using a nationally representative sample, and more intensive research with small groups, to discuss individual skin protection habits and preferences. This has identified 5 distinct groups for protection and after sun:

- Concerned Consumers ‘a good tan is not important’. These consumers are conscious of the harmful effects of the sun and purchase sun protection products that are most likely to offer high sun protection factors

- Sun Avoiders – avoid sunbathing and using sun protection when in the sun – it is seen as a chore. These are unlikely to purchase a sun care product. Through education, this segment may be convinced to protect using more easy-to apply products such as sprays.

- Conscientious Sun Lovers – adore sunshine and like to use a trustworthy brand with suitable protection factors. They know about sun care and use this knowledge to purchase suitable products for their skin.

- Careless Tanners – adore the sun but don’t protect against harmful dangers. Tanning is important to this group, not protection. They don’t worry about the long-term damage to their skin and may purchase a low SPF product, if any at all.

- Naive Beauty Conscious – like to have a good sun tan. They recognise that sun protection is important but fail to understand about Sun Protection Factors (SPFs). These consumers may still be interested in the core features of a sun protection product (e.g. SPF) and be more inclined to purchase an added-value offering such as a mousse.

Consumer segments were identified by analysing answers to questions about attitudes.

The two main aspects of attitudes relate to:

- Usage occasion (when) e.g. holiday, outdoor sports, gardening, working etc. This relates to the Sun Protection Factor (SPF) required, e.g. the SPF required for a holiday in Egypt differs greatly to outdoor work in the UK. This is one of the reasons why NIVEA Sun produce a wide range of sun protection from SPF 4 to 50 . Research has shown that consumers often purchase a variety of SPF’s for differing needs and occasions. This factor alone however is not an accurate means of segmenting markets.

- Benefit sought – protection is the primary benefit but the preference by which this is delivered will vary by segment, e.g. convenience is important to men (so they choose spray applicators). Parents want to provide maximum protection for children (high SPFs and coloured products are therefore important).

The benefit sought differs across the attitudinal segments. Whilst ‘Concerned Consumers’ want a very functional product providing ‘adequate protection’ (e.g. SPF 30), ‘Naive Beauty Conscious’ may want a more luxurious sun protection product (e.g. mousse). This also applies to consumers with special skin types, who require a more specialised product. Recognising that this is a separate segment, NIVEA Sun has formulated sensitive skin products.

Brand strategy

The key proposition of the NIVEA Sun brand is protection. The main elements of this proposition include:

- making sun care simple

- educating that protection can lead to safer tanning

- reinforcing the immediate protection message.

This last point relates to the immediate protection formula which was developed by NIVEA Sun and launched in 2005 to provide proven instant and full UVA and UVB protection. This was researched and developed following consumer studies which found that consumers often failed to apply sun screens 20-30 minutes before sun exposure (despite packaging instructions).

NIVEA Sun follows a strategy of product innovation, in order to achieve its long-term objectives. This takes the form of timely new product launches to enable the brand to more closely meet the needs of different types of consumers.

Some good examples of innovative launches include:

- spray products that are easy to apply (particularly appealing to men)

- a coloured formulation for children’s sun products (making application more fun)

- reformulation of the products to offer immediate protection.

For 2006, NIVEA Sun has developed ‘Long Lasting Water Resistance’ for children, a product which has increased the water resistance of sun protection from 80 minutes to 120 minutes. This allows children to be safer in the sun for longer. In addition NIVEA Sun creates innovative marketing communication. Women are the main purchasers of sun care for the family. This is reflected in above-the-line (advertising) communications, generally targeted towards a female audience. However, in 2005, NIVEA Sun targeted male consumers with its immediate protection message in press advertising. This was presented in a fun and ‘non-serious’ way in order to appeal to a male audience.

Children are not purchasers of sun care. However, NIVEA Sun recognises it can play an important part in educating children from a young age to be safer when in the sun. Every year, a ‘Sun Sense’ primary school resource pack is distributed to over 10,000 teachers to communicate this key message. Continual segmentation is vital to fully understand consumer needs and changing habits. This helps provide appropriate products to meet their needs.

Conclusion

Segmentation is the tool that enables NIVEA Sun to identify different groups of customers, and provide the best possible products to meet individual requirements. The sun care market consists of different consumers with differing needs. The UK has the biggest sales of NIVEA Sun across Beiersdorf within Europe. Understanding segmentation enables NIVEA Sun to maintain a Number 1 value position in protection and after sun in the UK.