It is easy for consumers in a changing world to take availability and choice for granted. This can be best characterised by examining markets in the private sector, where it is clear few organisations are free from wide scale competitive pressures. Competition exists wherever products are developed as close substitutes for others. Some competition is more direct than others. As an example, two brands of micro washing-up liquids would be considered to be in direct competition. However, indirect competition might involve deciding to go to the cinema on a Saturday afternoon instead of visiting the local pizza bar. Competition occurs when consumers are faced with a range of alternative options and where choices have to be made.

Competition exists at all times in all industries and the best organisations devise a series of competitive tools which enable them to deal with their competing forces. It must strike a balance between market opportunities and competitive threats, since wherever market opportunities exist competition tends to be fierce. Once a business has analysed and understood the nature of its competition it has to make decisions about what elements it wishes to adapt or change, so that it can strengthen and develop its competitive position.

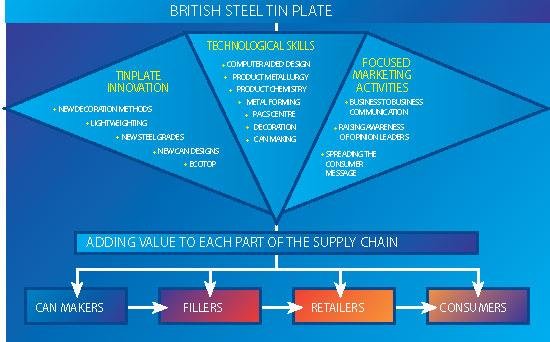

This case study looks at how an organisation, utilising a range of strategies, added value to each part of the supply chain and won market share in a highly competitive market. It focuses on the competitive activities of British Steel Tinplate in the canned drinks beverage markets and illustrates how the Company successfully combined innovation, technological skills and focused marketing activities to improve its market position.

British Steel Tinplate is one of Europe’s leading suppliers of high quality steel tinplate, with two manufacturing plants in South Wales. Tinplate is supplied into a comprehensive range of packaging markets including that of the carbonated soft drinks and beer markets.

The market for cans

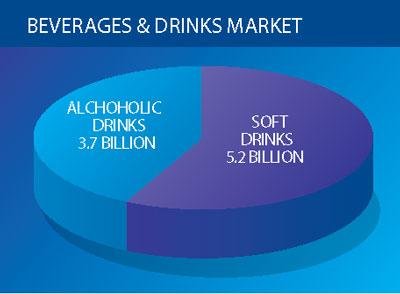

The market for cans is counted not in millions but in billions! The UK canned food, drinks, petfood, aerosol and paint markets generate 16 billion units each year. The UK canned beverages and drinks market in 1995 accounted for 8.9 billion units, comprising 5.2 billion soft drinks and 3.7 billion alcoholic beverages at a rate in excess of 1500 cans per minute.

Although sales are marginally affected by climate, the market for beverage and drinks cans present many market opportunities, with overall annual growth in the UK averaging around two to three per cent. In Europe, the market exceeded 32 billion units in 1995, with growth approaching 11% on 1994. The UK & Eire share of this market is 26%, which makes it the largest consumer in Europe. There are three major beverage can makers in the UK with seven can manufacturing plants between them. Each plant has a number of production lines. In total there are 23 beverage can making lines in the UK, producing huge volumes of cans at the rate in excess of 1500 cans per minute. Beverage can makers are therefore amongst the most important customers of British Steel Tinplate.

In 1995 steel’s market share stood at 20%, with cans made from imported aluminium accounting for the remaining 80%. For British Steel to increase steel’s market share of this growth market, it had to win market share from the aluminium producers. This could best be achieved by adding value to its product, thereby making it more competitive and attractive, not just to can makers but also to fillers, retailers and consumers. Success would be measured when a can maker switched production from aluminium to steel lines and as a result British Steel Tinplate won market share.

In the early 1970s all cans were made from steel. These cans were relatively low technology products, made in three pieces and significantly heavier than the steel cans of today. During 1972, lighter two piece cans were introduced. This switch to two piece cans triggered the arrival of aluminium into the market, enabling it to compete head-on with steel for the first time, signalling a major threat to steel tinplate producers throughout Europe.

The supply chain

To respond to the aluminium threat, British Steel initiated research which was designed to help understand the strategies and expectations of the key players in the supply chain. It was critically important for British Steel Tinplate to understand the key properties that can makers, fillers, retailers and consumers were looking for from steel cans. A clear understanding of these supply chain needs would therefore ensure correct solutions were selected and implemented.

Business theorists emphasise the importance of companies making an assessment between their relative market position and the competition. They refer to value activities as ‘the physically and technologically distinct activities that a firm performs’. When relative market positions have been evaluated, decisions can be made on how value can be added to these activities to achieve competitive advantage.

Examining the issues

A decision of a can maker to change from aluminium to steel has a major impact, as switching radically changes market share. A decision to switch however, will be made for strategic reasons and although there are a number of common operational functions for aluminium and steel lines, changing requires investment and to revert back is expensive and time consuming

The results of British Steel Tinplate’s research identified a number of factors that are critical to the success of steel in the beverage market:

- how well the steel can performs in terms of strength, formability, decoration and recyclability

- the cost of steel versus aluminium

- the development potential for steel cans over aluminium cans

- the effective promotion of the advantages of steel over aluminium to the supply chain.

The research identified the strengths and weaknesses of steel against aluminium as follows: However, as far as the environment was concerned the consumer had no clear understanding of the benefits of steel, giving a poor perception versus aluminium. They are misled by the fact that owing to their high energy usage, used aluminium cans are worth nearly 1p each, whereas energy efficient steel cans are not. Therefore due to this difference in monetary value, consumers have perceived aluminium as more environmentally friendly.

The Blue Peter scheme, which encouraged families and children to recycle aluminium cans, raising 1p per can for charity, succeeded in sustaining this perception. The trade perception was that lightweight cans would be seen as more environmentally friendly, since ‘lightness’ led to less energy and materials being used in manufacture.

Innovation

The clear advantage for steel over aluminium was the strength of the can. The key issue for winning back market share was:

How to position steel where aluminium could not follow?

British Steel began the process of establishing the virtues of steel to create competitive advantage. This was achieved through the development of high technology, added value products. Steel cans offer many advantages over aluminium cans, including a 30% higher crush resistance, 40% greater perforation strength and a 20% higher denting resistance. Therefore strength, steel’s principal asset, allows drink cans to be further reduced in weight and thickness, whereas aluminium is approaching its limits.

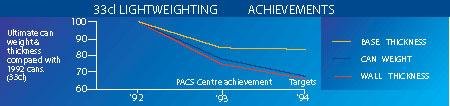

Developed at British Steel’s Packaging Steel Development Centre (PACS) the ultimate can provides a significantly lighter and therefore more competitive steel can. The Centre has its own can making facilities enabling it to provide the vital link between the identification of development potential for steel and the commercial realisation of steel innovation.

During the last ten years, the average weight of steel drinks cans has been reduced by 30%. Between 1985 and 1994 the average thickness was reduced from 0.30mm to 0.25mm. Research into ultra-fine and ultra-pure high-technology steels, which are hardened and strengthened during manufacture, offer more opportunities for light weighting. In the near future, steel cans will weigh only 18g, while still meeting the performance characteristics essential for pressure canning.

Product development

Currently, the ends of all drinks cans are made from aluminium ring pull ends. Competitively, British Steel saw an opportunity to penetrate this market. To grasp the new opportunity, British Steel Tinplate joined with other European steelmakers to find a solution. The net result has been the development of a new can end called Ecotop. This steel beverage end is opened via a push button mechanism, offering the customer an attractive alternative to the ring pull end. The small button is pushed open first to release the pressure in the can and then the larger button is pushed open to create the drinking aperture.

During the development of Ecotop many issues were addressed including, ease of opening, pressure resistance, environmental profile and consumer preference. Extensive market research revealed an impressive 83% preference for Ecotop against the aluminium ring pull end.

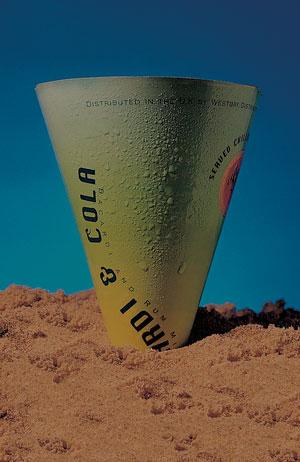

Can design and shelf appeal are crucial for product image. The appearance of aluminium cans have traditionally been perceived to be superior to steel cans in terms of shelf impact. The development of shrink sleeving and wraparound labels have been employed as one innovative method of enhancing the appearance of steel beverage cans. The decoration is applied to the can through the application of a plastic film which contains the appropriate branding. These processes have helped to:

- improve flexibility due to the ease with which design changes can be made to labels

- allow labels to be applied to existing stocks to ‘rejuvenate’ slow moving items

- create striking effects because of the ability to use more colours and through three dimensional effects and colour contrasts

- enable different labels to be applied to the same product – facilitating market testing of new designs;

- create new decoration possibilities, which were not possible with the interaction of metal, basecoats and inks.

Importantly, the quality of conventionally decorated steel cans has also been enhanced, aiding the switch by brands such as Coca-Cola & Carling Black Label back to steel.

Appreciating the environmental benefits

At the beginning of the 1990’s, the environmental benefits of steel were not fully appreciated by consumers. Steel drinks cans have walls 30% thinner than those of other drinks cans. Aluminium manufacturing uses six times more energy than steel on a weight for weight basis and the most effective of any packaging recovery systems is magnetic extraction. It recovers over 80% of steel cans from domestic waste.

More than five million steel cans are recycled every day of the year. Electromagnets installed at local authorities’ waste treatment plants pay for themselves in a short period of time, through the value of the steel collected and the saving on the cost of landfill. British Steel initiated the Steel Can Recycling

Information Bureau to provide information, a helpline and resource packs. Save-a-Can was acquired by British Steel Tinplate in 1990, since when, it has expanded over eight-fold to create over 1,700 banks operated in partnership with more than 200 councils. The tin and aluminium are separated from steel cans and recycled and the steel is returned to the steel industry for use in new steel production.

Decision making

Making a decision to switch production from aluminium to steel does not necessarily fall solely upon the shoulders of the can makers. It was Coca-Cola and Schweppes Beverages that decided, during 1995, to return to steel for a proportion of its drinks cans.

A number of British brands such as Carling Black Label, McEwans Lager and Stones Bitter followed suit. A number of determining factors led these companies to make the transition. First of all there was the cost and better price predictability of steel. There was also the prospect of future savings due to the considerable research and development by British Steel Tinplate and the European steel makers as they conceived the Ultimate Can project.

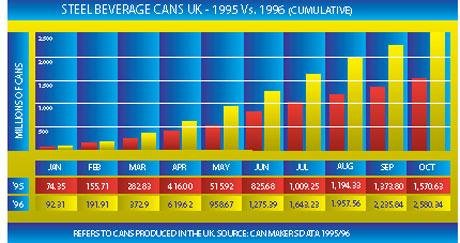

Furthermore, the brewing industry, which has developed ‘draught in can’ beers, which generate greater internal can pressure favour steel cans, due to the over-riding strength of the can, in preference to aluminium, resulting in a market share for steel in ‘draught in can’ beers of over 70%. Since 1992, steel’s market share of the UK’s canned beverages market has doubled and in Europe as a whole steel has increased its market share from 46% in 1993 to 56%. During 1996 four UK production lines converted from aluminium to steel. These conversions resulted in a massive increase in UK steel beverage can sales, which is reflected in the graph.

Conclusion

The key to British Steel both sustaining and further developing its market share is innovation. Innovation not only provides consumers with all steel drinks cans but also helps to develop significant environmental benefits. The result is simply a combination of outstanding product strength combined with low metal cost, which adds value and provides advantages throughout the steel packaging chain.

Steeling market share (PDF)

Steeling market share (PDF)