Source: Pixabay No Attribution Required

Foreword: Many folks looking to diversify their financial portfolios are incredibly eager to learn how to invest in real estate. For newbies, these types of investments include buying properties for the long haul, or investing in fixer-uppers, and flipping them. Believe it or not, both of these real estate investment strategies fall under the same category of active investments.

There are many other viable methods for investing in real estate and realizing returns other than these high-risk, hands-on approaches. Real estate tends to be a long-term appreciating asset, although it is subject to market volatility, corrections, and pricing discrepancies. The statistics tend to indicate a wide range of home values between 1968 – 2004.

While the median price of a home has undoubtedly increased markedly since 1968, the increase in percentage terms is ‘unpredictable’ at best. High growth took place in the 1970s, followed by low growth in the 1980s, and modest growth in the 1990s. After the property bubble burst following the global economic recession in 2008, the property market reversed course as the market flattened. Moreover, we do not know the medium and long-term impact of the Covid-19 pandemic on property prices.

Perhaps the most important point to make regarding real estate profitability – at least in the active sense – is that the property needs to be sold before any profits are realized. Unless the property is sold, the burden of increased property taxation is brought to bear on the homeowner, and it merely has a paper value in terms of the market price. In addition, there is the factor of being in a position to purchase in a buyer’s market. That could mean either having enough money to buy, or being in a strong position to secure the best mortgage conditions. Reading budgeting tips for savings and loans is crucial in that respect.

While many of us believe that real estate is the single best investment you can make, history has shown that this is not always the case. The right property is generally a much more stable investment than stocks, but it is important to ensure a carefully calculated real estate investment to realize gains. Things to consider include active or passive real estate investments, mortgage rates, property taxes, primary or secondary property issues, rental income potential, mortgage repayment/gross income ratio, yield on property investments, et al. Real estate investment professionals typically recommend that people who have a primary residence for a long time may be best served by selling that home and moving into a smaller and more affordable home later in life. What follows are several viable investment options for real estate.

Pick Your Real Estate Investment Strategy

There are active real estate investments, and there are passive real estate investments. The strategy you choose depends on your personal preferences – will you pick a hands-on, or hands-off approach? Passive investment strategies take several different forms, notably real estate investments through crowdfunding platforms, and REITs (real estate investment trusts). Both of these options allow holdings in real estate investments, without having to physically purchase properties or renovate them for resale purposes. It is also possible to pick from a listing of rental properties with positive cash flow, and invest in those types of companies – these investments are ready to go.

The option of active real estate investments is always available to those who want to adopt a hands-on experience with real estate investments. As an active investor, you literally have the option to rehab a property for resale purposes, sell real estate, buy rental properties, or wholesale real estate with distressed sellers and eager buyers. Many of these options are already common knowledge in the investment arena; it’s the specifics that require in-depth reading and understanding.

Before jumping into any real estate investment – whether active or passive – it is vital that a careful reading and understanding of the options is undertaken. This is particularly true where a substantial investment of time, effort, and money is made. The ‘fix and flip’ option is a case in point. To make that type of real estate investment account, the purchase price must allow for additional costs and profits to be added, in order to make it a viable investment when it comes time to sell. There are many other fees incurred by fix and flip options, notably 8% fees for selling, borrowing costs, transfer costs et cetera.

How to Get Good at Making Smart Real Estate Investment Decisions?

Source: Pixabay No Attribution Required

Whatever strategy you choose, be sure to invest all the necessary time in meticulous research. There is no substitute for knowledge in this arena. Fortunately, the process of learning isn’t dull at all; there are webinars, seminars, YouTube videos, articles, guides, courses, blueprints, government resources and other industry-specific tools to use. Indeed, the philosophy of real estate investing is such that you can adopt a multi-pronged strategy and be successful. During the learning process, there are a variety of meetings, forums, and online platforms to consult to make it easier to fast-track the learning experience.

Many real estate investors who focus on physical property with their own money stress the following, ‘Location! Location, Location!’ However, there is so much more at stake than just the location of a property. The proximity to schools, healthcare options, amenities, and so forth naturally comes into play too. But what about the market value? This is an important barometer of the property market, and it certainly provides indications regarding the price ceiling you can expect when it comes time to sell the property. None of these factors must be avoided or ignored in real estate investments.

As a rule, there are two things you need – a knowledge of property law and a cushion of investment capital to provide you with the necessary time to make the real estate investment pay off. Sometimes, your investment capital will be eaten up while you’re waiting to sell, or while renovations are underway. Without those funds, the investment may go into foreclosure. The law provides knowledge regarding issues like security deposits, insurance protection, background checks, eviction processes, and landlord/tenant obligations, duties, and responsibilities.

Generally, the passive investment option with REITs, crowdfunding, and pre-vetted rental properties are a lot less worrisome for new investors. They may yield less return than active investments, but the flip side is that you will have to roll your sleeves up and get your hands dirty while you’re making money. The option that is best for you is a matter of personal preference – once you know your preferences, you can start to build your portfolio.

Feeding and fuelling the world through technology (PDF)

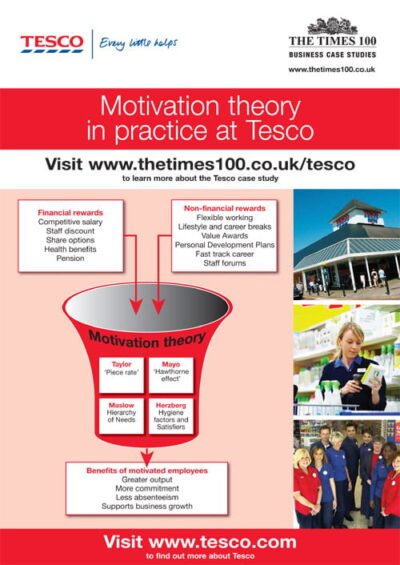

Feeding and fuelling the world through technology (PDF)  Tesco A3 ePoster Edition 15 "Motivation theory in practice at Tesco"

Tesco A3 ePoster Edition 15 "Motivation theory in practice at Tesco"  Partners in international trade (PDF)

Partners in international trade (PDF)  The importance of building a strong brand image (PDF)

The importance of building a strong brand image (PDF)  Using teamwork to build a better workplace (MP3)

Using teamwork to build a better workplace (MP3)  Decentralisation within a book retailer (PDF)

Decentralisation within a book retailer (PDF)