It’s everyone’s favorite day: payday! There’s nothing quite like seeing all of your hard work and effort come to fruition in the form you need: money. According to federal regulations, when companies pay employees they are required to keep records of those payments.

That’s why when you get paid by your company, you get a pay stub. That pay stub serves as an official record of the transaction of work and money between you and the company and will be referenced to if there is ever a pay dispute.

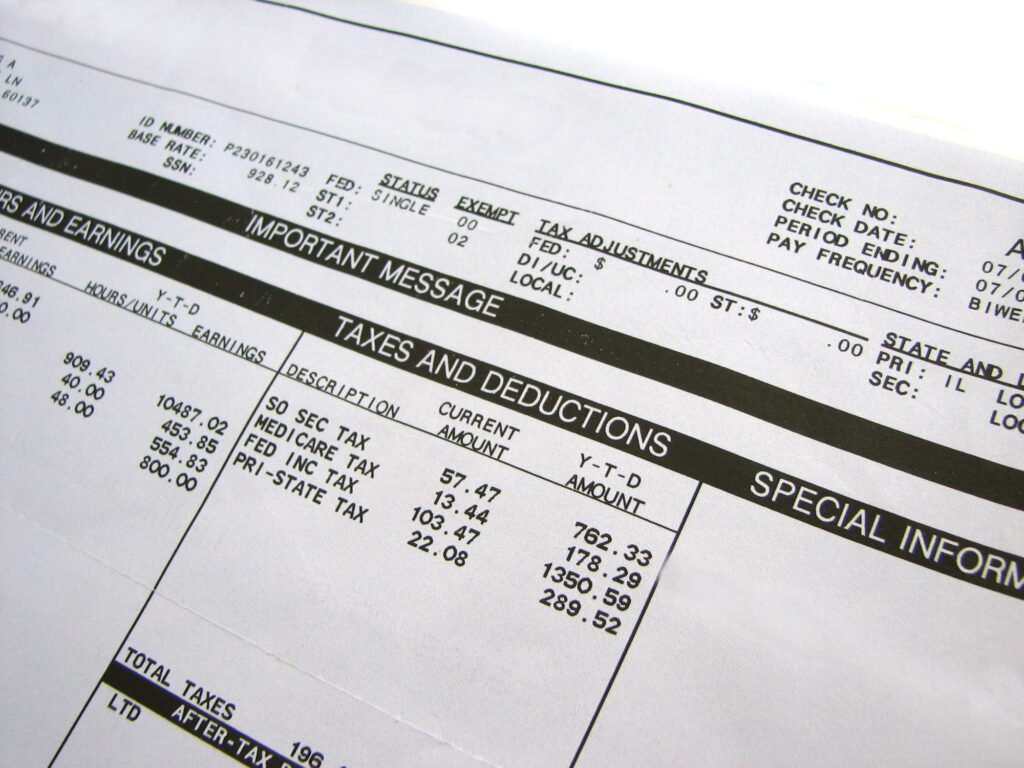

In this article, you’ll learn how to read a pay stub. The complex nature of a stub doesn’t make reading one intuitive at all. However, the truth is that there are just a few parts of the pay stub that you really need to focus on.

Employee Information

First up is employee information. This section of the pay stub will typically serve as the heading. It will contain information regarding you (your employee number, the company you work for, your name, address, etc.). If this information is inaccurate, let your company’s payroll department know immediately, as it could have ramifications for your tax documents.

Gross Earnings

The next section of the pay stub you need to know how to read is the gross earnings section. This section will contain all of the earnings that you have made in the past pay period. The dates of the pay period will typically be defined in the stub as well.

If you’re an hourly employee, then gross earnings will be calculated as your hourly rate times the number of hours worked. If you worked more than 40 hours in a week, then your hourly rate for those overtime hours that were above the 40-hour limit will be time and a half.

If you’re a salaried employee, your gross earnings will be your earnings divided into however many pay periods there are in one year at your company. If you receive commission or any other variable pay on top of that, you’ll see that on your stub as well.

Deductions

Next up is the part we like the least: deductions. These are all of the withholdings for tax purposes and sometimes for the benefits that come with your job (healthcare policy, life insurance, etc.).

Net Pay

Finally, you have net pay. This is gross earnings minus deductions and all other withholdings. This is how much money you will receive in your bank via direct deposit or in your check.

Often, the pay stub will also include year-to-date sums so that you can see how much money you’ve made this year.

If your employer uses the right pay stub creator, all this stuff won’t be too hard to view.

How to Read a Pay Stub, Made Simple

There you have it — everything you need to know about how to read a pay stub, made simple.

For more financial and career advice, be sure to take some time to browse through the rest of the articles on our website!