The break-even point of a business is the level of output or sales at which the revenue received by the business is exactly equal to the cost of making (or selling) that output. In the examples below we show you how to calculate the break-even point of a retailer.

However, the process described is exactly the same for other types of firms such as manufacturers who will be concerned to find the break-even level of output when they produce goods.

The sales revenue of the business is calculated at any level of sales by multiplying the price of the item, by the number of units sold.

Costs are divided into two main types:

Fixed costs are ones that do not vary with sales. For example, one of the fixed costs of a high street shop is the rent paid for the property. The rent is still the same whether the shop sells one item or thousands.

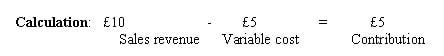

Variable costs are ones that vary with sales. For example, imagine that a bookshop buys books for an average price of £5 each. It then resells the books for a higher price. For the bookshops, the variable cost is £5 per unit.

Total costs are found by adding together fixed and variable costs.

To calculate break-even we now need to find out the point at which sales revenue just covers total cost i.e. fixed and variable costs combined.

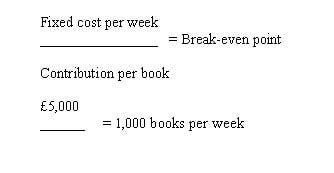

A bookshop has fixed costs of £5,000 per week. It buys books from the publishers at an average cost of £5 each and sells them for an average price of £10 each. How many books does it need to sell to break even?

For every book sold the bookshop takes in £5 more of revenue, than it pays out in variable costs:

We use the term contribution to describe the difference between sales revenue per item and variable cost per item. This is because each £5 is contributing £5 to paying off fixed costs of £5,000. You should now be able to calculate that to break even the bookshop will need to sell exactly 1,000 books a week. Because:

See if you can do these examples yourself:

- A bicycle shop has fixed costs of £20,000 per month. It buys bicycles at an average cost of £100 and sells them for an average price of £200.

How many bicycles will it need to sell to exact break even?

- Here’s an example involving a manufacturing company. A chocolate bar manufacturer has fixed costs of £500,000 per month. It sells chocolate bars and other chocolate products for an average price of 50 pence each. The variable costs of producing each product are 25p each. How many chocolate products would it need to make to exact break even?

Break-even

An important objective of a business is to at least break even, although making a profit is even more desirable. The break-even point is calculated by dividing the fixed costs by the contribution per unit sold.

Unless it does, it cannot afford to modernise itself, install new technologies, or take commercial risks with, say, a new product range.

Nor can it fulfil its social responsibilities and neither can it justify the investment of its owners – private individuals or institutions such as pension funds and insurance companies who need to seek the best possible long-term return on their resources.

Companies like Cadbury Schweppes, Nestle, Kraft and Coca-Cola are able to take wider responsibility for the community and provide excellent opportunities for their employees, while providing good returns to shareholders because they are profitable enterprises.

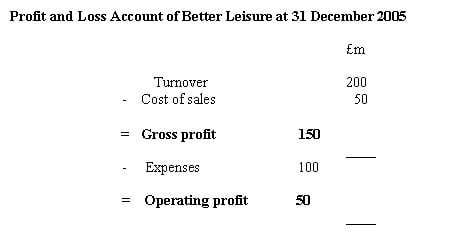

The profit of a business is determined by the relationship between turnover and costs and is set out in the Profit and Loss (P&L;) account.

Turnover – is the value of sales revenue.

Cost of sales – includes all the direct costs of making those sales, e.g. the cost of raw materials, direct labour etc.

Expenses – include the overheads of running the business e.g. rent and rates, heat and lighting.

The profit and loss are set out in the following way:

Profit and Loss Account of Better Leisure on 31 December 2005

The operating profit is not the final profit. We also need to take away corporation tax paid on profits. Some money will also be distributed to shareholders in the form of dividends. So the final retained profit will be less than the operating profit.