Subscribe | Write for Us | Advertise | Contact | Terms of Service | Privacy Policy | Copyright | Guest Post © Copyright 1995 - 2025 GC Digital Marketing

Accounting

Navigate through our accounting articles, presenting detailed discussions on financial reporting standards, auditing processes, and tax regulations to support your financial expertise.

Working Capital Management (Cash, Inventory, Receivables, Payables)

Working capital management is the process of overseeing a company's current assets and liabilities to ensure efficient operations and financial stability. Current assets encompass...

Dividend Policy and Theories

Dividend policy is the strategic approach companies use to determine the allocation of earnings between shareholder distributions and reinvestment in the business. This decision-making...

Investment Appraisal Techniques (NPV, IRR, Payback Period, ARR)

Investment appraisal techniques are crucial tools utilized by businesses to evaluate potential returns and risks associated with investment opportunities. These methods assist companies in...

Financial Markets and Instruments (Stocks, Bonds, Derivatives)

Financial markets are the foundation of modern economies, serving as platforms for trading various financial instruments, including stocks, bonds, and derivatives. These markets are...

Capital Structure and Cost of Capital

Capital structure refers to the composition of a company's financing sources, including equity, debt, and hybrid securities. Equity represents ownership in the company, while...

Introduction to Corporate Finance

Corporate finance is a specialized field within finance that focuses on the financial decisions made by corporations and the analytical tools used to support...

Sources of Finance (Equity, Debt, Hybrid Instruments)

When managing a business, financial management is a crucial component. Securing appropriate funding is essential for both new ventures and expanding enterprises. Businesses have...

The Role of Audit Committees

Audit committees are a vital element of corporate governance, serving a critical function in maintaining the accuracy and transparency of an organization's financial reporting....

Auditor Independence and Objectivity

Auditor independence is a crucial aspect of the auditing process that ensures unbiased and accurate financial statements. Independent auditors provide objective assessments of a...

Statutory Audits (Companies Act Requirements)

Statutory audits are a crucial component of corporate governance, ensuring companies adhere to legal and regulatory requirements established by the government. Independent, qualified auditors...

Fraud Detection and Prevention

Fraud is the intentional act of deception aimed at obtaining unlawful or unfair advantage, often resulting in financial gain for the perpetrator and loss...

Computer-Assisted Audit Techniques (CAATs)

Computer-Assisted Audit Techniques (CAATs) are specialized tools and methodologies employed by auditors to conduct data analysis and testing, streamlining the audit process. These techniques...

Audit Sampling and Testing

Audit sampling and testing are crucial elements of the audit process, enabling auditors to collect evidence to support their conclusions regarding an entity's financial...

Legal and Ethical Responsibilities of Auditors

Auditors play a vital role in verifying the accuracy and reliability of financial information for businesses and organizations. Their legal and ethical responsibilities are...

Audit Reports (Qualified, Unqualified, Adverse, Disclaimer)

Audit reports are crucial documents that offer an impartial evaluation of a company's financial statements. External auditors generate these reports after examining a company's...

Internal Control Systems and Risk Management

Internal control systems are essential components of organizational operations, designed to provide reasonable assurance in achieving objectives related to operational effectiveness and efficiency, financial...

The Auditing Process (Planning, Risk Assessment, Evidence Gathering, Reporting)

The auditing process is a systematic examination of an organization's financial records, transactions, and internal controls to ensure accuracy, compliance, and reliability. It is...

Purpose and Scope of Auditing

Auditing is a systematic examination of financial records, statements, and other documents of an organization to ensure accuracy and compliance with laws and regulations....

Types of Audits (External, Internal, Forensic, Tax)

Audits are systematic examinations and verifications of financial records, statements, and other documents to ensure accuracy and compliance with laws and regulations. They play...

Ethical Issues in Taxation

Taxation is a crucial component of modern societies, providing governments with the necessary funds to finance public services and infrastructure. The ethical implications of...

Legal Services Commission A3 ePoster Edition 15 "The advantages of centralisation"

Legal Services Commission A3 ePoster Edition 15 "The advantages of centralisation"  Kia A3 ePoster Edition 16 "Using sports marketing to engage with consumers"

Kia A3 ePoster Edition 16 "Using sports marketing to engage with consumers"  Enterprise Rent-A-Car A3 ePoster Edition 13 "Using a range of management styles to lead a business"

Enterprise Rent-A-Car A3 ePoster Edition 13 "Using a range of management styles to lead a business"  The role of training and development in career progression (PDF)

The role of training and development in career progression (PDF)  Nestlé A3 ePoster Edition 18 "Achieving sustainability through lean production"

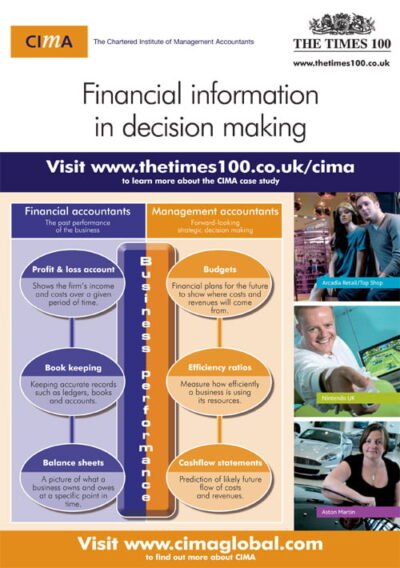

Nestlé A3 ePoster Edition 18 "Achieving sustainability through lean production"  CIMA A3 ePoster Edition 13 "Financial information in decision making"

CIMA A3 ePoster Edition 13 "Financial information in decision making"  NDA A3 ePoster Edition 13 "Meeting responsibilities to stakeholders"

NDA A3 ePoster Edition 13 "Meeting responsibilities to stakeholders"  Investing in people and in brands (PDF)

Investing in people and in brands (PDF)  Lloyds TSB A3 ePoster Edition 13 "Changing work patterns at Lloyds TSB"

Lloyds TSB A3 ePoster Edition 13 "Changing work patterns at Lloyds TSB"  Primark A3 ePoster Edition 16 "Engaging with stakeholders"

Primark A3 ePoster Edition 16 "Engaging with stakeholders"  Developing a career path in retail (MP3)

Developing a career path in retail (MP3)  Launching Real Fruit Winders through new media (PDF)

Launching Real Fruit Winders through new media (PDF)