These state monopolies reduced consumer choice. For example, only one producer supplied gas, and only one producer supplied electricity. Power lay with government ministers. A nationalised industry could not diversify its business. It could not close down any activity without government permission. For capital investment funds, it had to apply to the Treasury.

A change of political party in power led to a change in policy. In May 1979, the newly-elected Conservative government began a programme of privatisation and de-regulation that took 15 years. Gradually over time, state-owned industries were sold and became private sector companies. Many UK citizens became shareholders for the first time.

This case study explores the advantages and disadvantages of de-regulation in the energy sector.

- maximum market share any one firm might have

- the maximum price a firm can charge

- the performance targets that each firm in the industry must meet.

Currently, the gas and electricity industry is regulated by Ofgem (Office of Gas and Electricity Markets), whose Director General is often referred to as ‘the regulator’. Ofgem’s task is to ensure that competition within the gas and electricity industry increases and that consumers benefit from lower prices and greater choice of supplier. Ofgem has powers of investigation, and keeps a careful watch on how the industry develops. The energy industry is a huge enterprise and opening up markets to competition is a massive undertaking that has been phased in over several years. The new arrangements need time to settle.

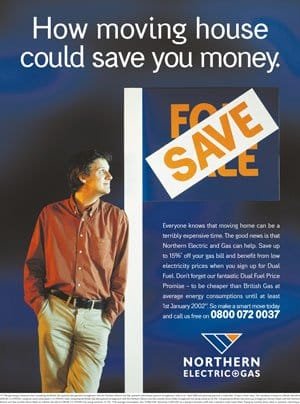

De-regulation encourages competition. It also allows businesses to diversify. Previously, British Gas was debarred from entering the electricity industry. Under the new arrangements, British Gas supplies electricity as well as gas. Similarly, Northern Electric and Gas now supplies gas as well as electricity, as its new trading name makes clear. Nearly all suppliers have become dual fuel suppliers.

De-regulation aims to break up monopolies, to make industries more competitive, to offer consumers greater choice, to make firms more efficient through having to compete and to drive down prices. In such a business climate, there will be losers as well as winners. Northern Electric and Gas is emerging as one of the winners; it is increasing its market share.

The electricity industry is complex. It consists of four main markets.

- Electricity generation. Power stations generate electricity. Seven generating companies sell electricity in bulk (wholesale) to large-scale buyers, which include the supply companies from which many firms and the general public buy electricity (in the retail market). Ofgem monitors generating companies. It checks that they do not force up wholesale electricity prices e.g. by price fixing or by cutting back generating capacity. Ofgem is looking to strengthen the position of buyers in this market.

- Electricity transmission. This is through a national network of high voltage cables – the national grid. The grid is maintained by the National Grid Company (NGC), which charges electricity distributors for using the grid. NGC cannot use its monopoly position to force up prices because Ofgem has control over prices. Ofgem sets performance targets for NGC. If these are met, NGC is allowed to raise its prices by more than if the targets are not met. This gives NGC a financial incentive to be efficient.

- Electricity distribution. This is done by distribution companies (‘distributors’). Each has a monopoly in a particular geographical area. Distributors convert high voltage electricity from the grid into forms suitable for final consumers and deliver the electricity through their own cable networks. Distributors charge electricity suppliers for using the distribution networks. Ofgem can limit these prices, and sets performance targets for each distribution company e.g. time taken to repair faults.

- Electricity supply. This is done by supply companies (‘suppliers’), who sell electricity to final consumers (firms and households). Ofgem sets performance targets for suppliers and also places limits on the prices that each can charge. Firms that fail to meet the targets set for them can be fined. This market has become highly competitive.

The four sectors are not entirely separate. A distributor may also be a final supplier. A company that is both a distributor and a supplier must operate the two businesses as separate entities, under separate trading names. This separation prevents a company from possibly adopting business practices that would be seen as unfair e.g. using profits from the distribution business to subsidise the supply business with a view to setting low supply prices that would drive out competing suppliers.

Growth involves a firm retaining its existing customers and persuading other suppliers’ customers to ‘switch’. The instruments of persuasion are advertising, quality of service and price. Pricing is a tricky area. The temptation is to gain market share by undercutting other suppliers’ prices. Strict rules apply here, however. These include:

- no predatory pricing – no supplier must entice customers away with initial prices that fail to cover the cost of supply

- no price discrimination – between existing,

- established customers and new customers. Any ‘special price offer’ to new customers must also be offered to existing customers.

These rules are vital. The electricity industry has a massive infrastructure. The capital tied up is colossal, and the industry’s fixed costs are huge. By contrast, the cost of supplying one extra unit of electricity from within existing productive capacity is extremely low.

Environmental concerns are making firms become more energy efficient. As a result, the overall rate of growth in the energy market is comparatively slow. So, if an individual energy supply company is to grow, it will do so mainly at the expense of other suppliers.

Not surprisingly, some suppliers are bidding to own their own power stations. Ofgem monitors this and all other takeover activity with a view to preventing any market dominance. The new market arrangements are beginning to settle down. Firms know ‘the rules’ and recognise the determination of Ofgem to enforce them. Not all firms are benefitting equally. In the gas industry, British Gas, which used to have a monopoly, is experiencing a fall in market share, whilst firms such as Northern Electric are experiencing a rise.

The ‘no price discrimination’ rule disadvantages large, established firms that have built up a complex organisational structure. Before they can offer attractive prices to new customers they need to reduce their overheads and slim down their organisation, because any new, low prices have to be offered to all of their customers.

British Gas was particularly affected by the new competitive gas regime. It had an added difficulty. It had entered into long term contracts to purchase gas at prices that now look too high and which prevent it from competing on price alone. To some extent, it is relying on customer inertia to maintain its customer base. By September 1999, however, five million British Gas customers had switched to other gas suppliers. An Ofgem survey in December 1999 found that 96% of customers were aware of their right to change suppliers, and that 27% had already done so.

In the first year of competition in the electricity industry, four million customers switched suppliers. An Ofgem report in June 2000 revealed that customers who moved their accounts from large, established suppliers such as Eastern Electricity and Southern Electric to some of the new entrants in the gas and electricity supply sector could typically save between £50 and £100 a year. Consumers were clear winners.

Overall in 1999, gas users saw their annual gas bill fall by between 15% and 20%. In the same period, typical electricity bills fell by 5-10%. In the battle for market share, Northern Electric has been one of the winners. Since moving from being an electricity supplier to being a dual fuel supplier, its customer base has risen by over 25%. For small and medium users of both gas and electricity, the company is in the top five of ‘best buys’ for customers looking to reduce their bills.

Consumers can now choose from among more than 20 suppliers of gas and electricity. Ofgem is working to ensure that consumers are kept aware of their choices. Suppliers are being required to improve the clarity of their advertising and, under the new Utilities Act, a Gas and Electricity Consumers Council will have a remit to ‘maximise the benefits of competition’ for consumers.

Competition in the gas industry has existed for over four years. A recent Ofgem survey of the supply of gas to industrial and commercial users found that more than 30 shippers and suppliers were now in the market. Competition in electricity is only just over one year old, but more than 25 firms are already involved, so overall the signs there are equally encouraging.