The UK Government provides a range of public goods and services. The main ones include:

- education

- benefits

- law and order

- defence

- roads

- National Health Service.

Within the UK, public expenditure is largely financed through taxation and Her Majesty’s Revenue and Customs (HMRC) collects most taxes. This case study focuses upon the role of HMRC in collecting taxes and how these help the UK government to control the economy. The case also looks at the types of taxation used within the economy and the way in which HMRC communicates with businesses.

Background to HMRC

HMRC was formed in 2005 following the integration of Inland Revenue and HM Customs & Excise Department. HMRC employs nearly 100,000 staff, which is around 20% of the civil service. The department is not headed by a minister. HMRC is accountable to the Treasury and this is headed by the Chancellor of the Exchequer. HMRC is responsible for implementing the policies of government, without any prejudices towards or against one political group or another. HMRC has many roles. The main ones are to:

- collect taxes

- inform taxpayers of their legal responsibilities to pay tax

- administer benefits including Child Benefit, Child Trust Fund and Tax Credits

- protect the UK’s borders against the trade in illicit goods, including drugs and other illegal items

- enforce the National Minimum Wage

- recover student loans.

Control of the economy

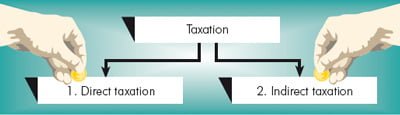

The UK economy changes year after year. The UK government seeks to achieve many policies including economic growth, improving the standard of living of people within the country, controlling inflation and reducing unemployment. Its policies will determine the nature and type of decisions that it makes. The government controls the economy in a number of different ways. One way is through legal statute or legislation using an Act of Parliament that creates new laws. Another way is through the provision of subsidies that make goods or services available for people. A third way is through taxation. Taxes collected by HMRC for the government fall under two headings:

Direct taxation

Direct taxation is levied upon incomes or the resources of individuals and organisations. Income tax is paid upon a person’s income or, for Partnership businesses, upon the partners’ incomes.Corporation tax is levied upon the profits of UK companies. HMRC also collects National Insurance contributions. Although these are not really a tax they are often portrayed as one. National Insurance is the major source of funds used by the government to provide state benefits such as pensions and jobseekers’ allowances.

Indirect taxation

Indirect taxation is not as noticeable as direct taxation. Indirect taxes are added to the price of the goods and services that consumers purchase. Value Added Tax(VAT) at a rate of 17.5% is added to the price of most goods that a consumer purchases. For example, the price of a DVD includes 17.5% VAT. There are, however, certain goods that are zero-rated. For example, VAT does not apply to food, baby clothes or prescription products. Governments have continually reviewed the main issues behind taxation. This especially involves deciding who pays the taxes. This process aims to develop a fair system that applies not just for individuals but also for companies.

Monetary and fiscal policy

The main objectives of the Government are to:

- maintain full employment

- control inflation

- achieve a balance of payments equilibrium

- stabilise exchange rates

- steady economic growth

- improve the standard of living of people within the country.

Successive governments have used two broad types of strategies to achieve these objectives. These are through the use of:

a) monetary policy

b) fiscal policy.

Monetary policy

Monetary policy involves manipulating the price and supply of money and controlling exchange rates. For example, raising interest rates makes borrowing more expensive.

Monetary policy involves manipulating the price and supply of money and controlling exchange rates. Consumers will borrow less and demand for goods in the shops will fall.

The exchange rate is the price at which the pound is bought and sold against other currencies. Rising exchange rates make the pound more expensive and make imports cheaper. This reduces prices in domestic markets.

Fiscal policy

The Latin word ‘fisc’ refers to the public purse (public refers to the government here). Fiscal policy is concerned with how the government collect money in taxes and how it decides to spend that money. All economies need money to support society with hospitals, schools, police, armed forces, social security and state pensions. This is why taxes are needed and why everybody should contribute their fair share.

Collecting income taxes and administering benefits

One of the most important principles of taxation is that of convenience. Taxes must be collected in a convenient form and at a convenient time. Income tax is a tax that is paid on income. It is paid by:

a) employees

b) people who are self employed (partners and sole traders)

c) individuals who may not be working but have an income.

Paying income tax

When people are employed they are liable for income tax and pay this tax under the pay-as-you-earn (PAYE) system. Under this system, income tax is collected from an individual’s pay and is then passed on to HMRC by the employer. The employer deals with the payments as well as all the paperwork.

Somebody who is a sole trader or partner and self-employed is responsible for running and managing their own business. He or she deals with their own tax affairs and is required to contact HMRC to tell them that they are self-employed. The law requires all people who become self-employed to register for tax within three months of starting their business.

Sole traders and partners are responsible for paying their own income tax and National Insurance contributions. If their business has a turnover of more than £61,000 per year, they will also have to register for VAT. If they employ other people they pay their income tax and keep full accounting records. The process of completing tax payments is simple and is detailed below:

a) The trader notifies HMRC they are in business

b) HMRC sends a Self Assessment tax form

c) details of income and expenses are completed

d) any tax allowances are claimed

e) the form is returned to HMRC

f) relevant tax due is paid to HMRC.

Communication systems and taxation

A good communication system involves effectively transferring information between a sender and a receiver. HMRC has developed effective communication systems to ensure the collection of tax revenues is efficient. HMRC has developed effective communication systems to ensure the collection of tax revenues is efficient. They are quick, secure and convenient. They use the latest technology to simplify the systems, provide an electronic form in an online version for self-employed people. On this electronic form, the calculations are done for them. They also provide opportunities for feedback to clarify any queries.

How HMRC communicates

HMRC uses a variety of different media in order to publicise and inform self-employed people about their tax obligations. These include television, radio, newspapers and direct mail. These campaigns emphasise the need for self-employed people to comply with the law and give deadlines for completing the forms. A hotline has been set up for people to report anyone not registering as self-employed and evading paying tax.

Conclusion

HMRC’s role is vital for the government’s control of the economy. Its innovation in using online technology has made tax collection easier and made it harder for income taxes to be evaded. It uses tax revenue to finance its plans for the economy. Society has benefited from all the projects and services that are provided through public expenditure. HMRC’s role is vital for the government’s control of the economy.

This case study helps to illustrate the differences between the two main areas of taxation, direct taxes and indirect taxes. It illustrates how governments use both fiscal policy and monetary policy in order to meet their objectives. Finally, the case looks at the processes for collecting income taxes, both for the employed and the self-employed and how it communicates the tax message.