Experian operates the UK’s largest Credit Reference Agency (CRA). There are three in the UK. Banks and credit card companies share information about their customers’ credit accounts with each other through the CRAs. They then use this information to help them quickly make lending decisions. The lender decides whether someone is likely to, and can afford to, repay any borrowings by looking at how much credit they already have and how they are managing this. Lenders pay a fee to the CRA each time they search its records. Consumers give permission for their information to be given to a CRA when they apply for credit.

CRAs also provide services and information directly to consumers. Consumers have a legal right to see the information held about them by a CRA. They can also dispute information that they feel is inaccurate. Experian runs a consumer education program to help consumers understand how credit granting works and how individuals can look after their own credit histories. At some point in life, most people will use credit. It is very much part of modern living. Using credit means borrowing money which usually has to be paid back in instalments with interest. The interest rate charged on different credit products can be compared by checking the APR (annual percentage rate).

Young people may need to apply for credit to help finance their studies, to buy a car or their first home or perhaps to get help with other purchases. Student loans, hire purchase agreements, mortgages, credit cards or store cards are all forms of credit. Adverts and offers for credit deals are almost everywhere we look, from television to high street billboards, at sporting events and on the Internet.

Risk

Lending someone money always involves a certain amount of risk. The risk is that the money won’t be repaid. Lenders often calculate this risk using a system called credit scoring which is usually computerised. This system gives points to each piece of personal information provided by a consumer. This information might include details of your job and wages and whether you own your home or rent. The information held by the CRA on your credit report is also scored. If an application gains enough points the lender will usually offer credit. The lender decides the total number of points an application needs to reach for it to be successful. This will differ from one company to another and, sometimes, from product to product within the same company.

Consumers can check the information on their credit report at any time for a small fee (set by law). Credit reports include details about past and current credit agreements, as well as recent credit applications. CRAs also hold public record information, so your credit report shows whether you have any court judgments or bankruptcy orders and whether you are registered on the electoral roll.

Experian’s CRA has changed dramatically in the last ten years. These changes have largely been prompted by a number of external influences. By carrying out a SLEPT analysis (SLEPT stands for social, legal, economic, political and technological), an organisation can produce a strategic plan to cope with, and in some cases take advantage of, external influences. Opportunities to develop new products and services and to improve existing ones can be identified using this kind of business analysis.

Some major recent external influences on Experian have been:

- changing attitudes to money and credit

- changes in legislation

- the boom in e-commerce

- the emergence of identity fraud.

The Social Environment – Changing attitudes to money and credit

Credit is more widely available than ever before. More and more people use credit as a way of buying things they do not have the money for. An individual should only borrow if s/he knows that the money can be repaid. This ‘buy now, pay later’ culture has led to increasing levels of debt in this country. In January 2006, the level of UK personal debt reached £1.1 trillion, which includes mortgages. This is equal to about £19,000 for every man, woman and child in the country.

These days, people can apply for credit from almost anywhere. You can apply over the Internet, by telephone, in a shop, supermarket, motorway service station or in a shopping centre. Direct marketing campaigns drop ‘not-to-be-missed’ offers through our doors on a daily basis. Consumers are much less loyal and are more likely to shop around and approach several lenders to find the best deal. Stiff competition for demanding customers means that lenders must make quick decisions and offer consumers a good deal so that they can win new customers and make a profit.

Increased demand for credit

Experian has had to develop its systems to cope with the increased demand for credit applications. Lenders receive hundreds of applications for credit every day. Experian must provide accurate information to allow lenders to make fast and profitable lending decisions. More and more people are now asking CRAs for a copy of their own credit report. Last year, over one million consumers contacted Experian for a copy of their report. The CRA has a legal obligation to provide this information and to answer consumers’ queries about it.

Experian’s consumer education program works with many different organisations to publicise the role of the CRA. Experian actively encourages people to check their reports and makes it easy for people to order their own credit reports: online, by phone or in writing. Consumers regularly scrutinise their bank and credit card statements and should also check their credit reports with all three CRAs from time to time.

Experian works closely with many consumer organisations such as Citizens Advice Bureaux. By helping consumer organisations understand how credit referencing works, Experian can make sure the right message is passed to as many consumers as possible. Experian takes its responsibility as a CRA seriously. Dealing with thousands of queries from consumers on a daily basis is also expensive. Better educated consumers are cheaper for Experian to deal with.

Changes in legislation and political focus

Experian is licensed as a CRA by the Office of Fair Trading and is registered with the Information Commissioner’s Office. The Data Protection Act 1998 governs how organisations can collect, use and share personal information. The Consumer Credit Act 1974 gives consumers specific rights in relation to the information CRAs hold about them. Complying with this and other relevant legislation is crucial to Experian’s business.

Within the Government, there is growing concerned about the level of consumer debt. This is one of the reasons why the Consumer Credit Act is currently being updated. This will give consumers more rights regarding disputes with lenders and more protection from rogue lenders. There are also calls for lenders and other organisations to share more data through CRAs like Experian. The Government helped set up National Debtline in 1987. National Debtline is a free telephone helpline for consumers who are worried about debt. National Debtline now helps over 100,000 consumers every year. It is able to do this with financial support from Government and the credit industry, including Experian.

Data Protection Act

When the Data Protection Act was updated in 1998, it brought major changes for CRAs. This legislation meant that lenders could no longer use information about family members when deciding who they should give credit to. Experian had to change the way it provided credit report information to lenders and consumers. Lenders had to change their credit scoring systems and application forms. A division of Experian called Scorex helped many lenders update and improve their scoring systems. Consumers are now treated as individuals when they apply for credit unless they have a financial link with someone they live with, such as a joint account.

Experian worked very closely with lenders, consumer organisations and the Government over the change in legislation. Experian used the opportunity to make it easier for consumers to get in touch. This included a new automated phone system and the facility for consumers to order and query their credit reports through its website. Experian publicised what the changes were and how consumers would be affected. This prevented many consumers from needing to contact the CRA to ask about the changes. Wherever possible, Experian goes beyond its legal obligations in the way it handles personal information and deals with consumers. The law gives Experian 28 days to respond to credit report queries, but it usually answers them within 10. Experian’s Consumer Help Service liaises with lenders and other information providers on behalf of consumers to try to resolve any disputes as quickly as possible.

The boom in the economy/e-commerce

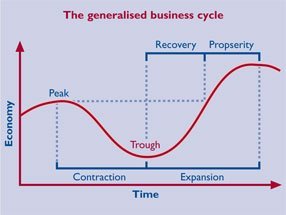

Consumer spending is often used as an indicator of how well the economy is doing. Credit is a key factor in fuelling an economic boom. A consumer’s willingness to take on credit depends on his or her confidence in their ability to repay the money. This confidence comes in part from job stability and faith in the economy. A boom in consumer spending will mean that there is an increase in the number of credit checks lenders make through Experian. The performance of the economy does not directly affect how many people ask Experian for a copy of their credit report.

Communication and information technology is a core part of Experian’s business. There have been major communication advances since Experian’s UK CRA was set up in 1980. The way Experian collects and updates credit report information has changed dramatically, moving from paper-based communications to computer disks and online updates. Faster online systems allow lenders to update information directly, meaning that information is more accurate and saves Experian time and money.

Changes in the technological environment

The credit industry has made huge technological advances. Financial products and services can now be bought online. This is known as e-commerce and is now an important part of the global economy. The boom in e-commerce has meant that Experian has had to introduce new technologies. Ordering a credit report is now simpler and quicker than ever. Consumer education also has to evolve with technology. Experian’s website contains lots of information about credit reports and gives consumers online answers to their questions. The boom in e-commerce has led to an increase in identity fraud. Many consumers are wary of inputting their personal details on the Internet and are worried about becoming a victim of this crime. Identity fraud is the use of stolen identity in criminal activity, to obtain goods or services by deception.

There were around 55,000 reported victims of identity fraud last year and the consumer organisation Which? revealed that 1 in 4 consumers had either been affected by this crime or knew someone who had been. People who are affected by identity fraud often spend many hours sorting out the muddle left by a fraudster and usually find it very difficult to get credit in the meantime. Fraudsters often find the information they need by raiding rubbish bins. Experian has researched and published reports on how easy it is for fraudsters to get information this way. Experian is one of the leading voices in the campaign to warn consumers about the dangers of identity fraud and does a lot to help people protect their identities.

Experian’s consumer education programme tells consumers about the threat of identity fraud from bin raiding and from Internet fraudsters. Advising consumers how to avoid becoming a victim of this crime is important. Experian has a Victims of Fraud team of experts who help people sort out the mess left by a fraudster. In 2003, Experian launched its CreditExpert credit report monitoring service. This product was developed to offer consumers more protection against fraud. CreditExpert gives consumers unlimited online access to their credit reports and notifies them by text or e-mail when major changes take place. This means they know very quickly if a fraudster tries to use their details to get credit.

Conclusion

A SLEPT analysis uses observations of changes in the external environment to help organisations make strategic plans. Experian uses similar tools to develop its business strategies to help it develop and provide market-leading products and services for consumers, businesses and other organisations.

Strategic planning - responding to external influences (PDF)

Strategic planning - responding to external influences (PDF)