Bank of Scotland has a long and distinguished history. Established by an Act of the Scottish Parliament in 1695, it is the UK’s oldest clearing bank with its headquarters firmly planted in Edinburgh. In the region 22,000 staff are employed by the Bank of Scotland Group, with regional offices and departments supporting the activities of some 325 branch outlets, meeting the banking needs of all areas of the community.

Bank of Scotland also intends to have a long and distinguished future. It is one of Europe’s fastest growing banks. Its Board of Directors recognises that: banking is a global industry new technology is opening up new business opportunities worldwide domestic markets are increasingly exposed to international competition huge economies of scale are available to the industry banks that fail to grow put their future at risk profitable growth is the key to remaining independent.

For any business to grow, it must do one or more of the following:

- sell a higher value of existing products to existing customers

- develop new products and sell them to existing customers

- find new customers for all of its products, both established and new.

In the early 1990s, the Bank of Scotland was looking to grow by strengthening its market position in England. In Scotland, it had an enviable reputation as a first class provider of banking services through the local branch network. In England, its presence was less obvious and its existence less well-known. The challenge for the bank was to find a way of expanding its business in England without incurring the massive overhead costs associated with creating a network of local branches.

Bank of Scotland identified a growth area: lending through a credit card facility. One major attraction was that growth in this market could be achieved without a massive capital outlay. Offering a credit card facility to people in England did not require a network of local branches. It utilised telephone and postal networks and centralised account-handling facilities that were already in place, and within which there was spare capacity. But how to attract customers?

Many people in England already had bank accounts, so there was no great pool of ‘unbanked’ on which to draw. Worse, people were generally slow and reluctant to change their bank, which already offered its own credit card facility.

The solution arrived at was simple, yet also brilliant. Realising that it takes a greater loyalty to overcome a lesser one, the Bank of Scotland asked itself: To what do people show the greatest loyalty? To what in their lives are many people happy to be tied? Out of this line of thinking came a new Bank of Scotland product: the affinity card.

Affinity

Most of us are gregarious and clubable. In forging our social links, we look for people with whom we feel we have something in common e.g. people who share our interests, our enthusiasms, our concerns, our values, our views, our beliefs, and our past experiences. These are people with whom we have an affinity.

In every advanced community, there are individuals whose common link is:

- a recreational activity – golf, football, rugby, bowls, rambling, knitting, dog breeding

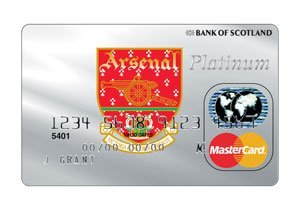

- a particular team – Arsenal FC, Middlesex CCC, London Broncos

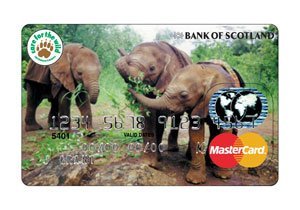

- a shared concern – for animal welfare, poor and disadvantaged people, human rights

- a shared belief or persuasion – in politics, or in religion

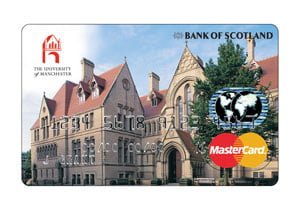

- a shared experience – attendance at the same school or university, or war service

- a shared lifestyle – always using a caravan to go on holiday

- a shared attribute – intellectual ability, physical disability, age.

Many people formalise their affinity by joining a relevant club or society or organisation e.g. the local golf club, Arsenal Supporters Club, RSPB, NSPCC, Amnesty International, the Liberal Party, the Salvation Army, Old Etonians, British Legion, Caravan Club, MENSA, SAGA.

There are also people who band together to protect their own position e.g. trade union members, consumer groups, and members of an institute of directors. Not all affinities are binding enough to lead to groups being formed: in the UK, for example, there is not as yet a group exclusively for people with green eyes.

Groups are a fact of society. In an economy, the size of England, a community of people with a shared interest can run into millions. To sell a product to such groups, a company must do two things: make contact and have a good product. The Bank of Scotland was able to make contact. It also had a very good product: an affinity credit card.

Affinity credit cards

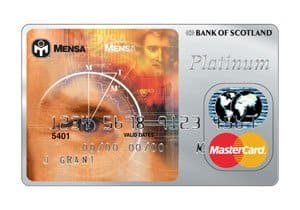

Affinity credit cards offer something over and above what ordinary credit cards provide. Unlike many ordinary credit cards, affinity cards help cardholders to portray an image and to deliver a message about themselves each time they use the card.

People like to be identified with the interests they pursue, the causes they support, and the allegiances they hold. Carrying and using the card is a source of pride that may also carry the potential for personal progress. It invites a response – e.g. ‘RSPCA, eh! You must meet my daughter’ or ‘Arsenal, eh? I’m football daft too’ or ‘I went to Warwick too, you know’ or ‘MENSA! So what’s your IQ?’

Such responses open up the possibility of new friends, new opportunities, and new horizons and enable card owners to support a cause in which they believe at no cost to themselves. This is because the affinity group (club, society, charitable organisation etc) receives a royalty each time that its member uses its affinity card.

The major benefit to the affinity group, in addition to the royalties, is that a good quality credit card represents a benefit that can be made exclusive to members. This makes it easier for the affinity group to persuade people to join. The major benefit to the card issuer is that the company gains access to a group that matches well with the consumer profile it has created for its product.

Benefits of early market entry

Many charitable organisations, clubs and societies have a high proportion of their members who are securely employed and comparatively well paid, or comfortably placed in retirement. A major benefit to Bank of Scotland from entering the affinity credit card market early was that it was able to have ‘first pick’ and select good quality businesses.

Not all membership lists are equally desirable. Latecomers to the industry either have to prise good accounts away from established suppliers, find good untapped sources or settle for new business of inferior quality. From a bank’s point of view, a good credit card customer is one who:

- has a substantial and reliable source of income

- uses the credit card regularly

- makes substantial purchases using the card

- never defaults on the minimum monthly repayment

- regularly carries over a debit balance on which interest is chargeable

- never loses the card

- intends to honour the conditions attached to using the card

- is likely to stay with the product for at least four years.

Some affinity groups have a high proportion of members who meet all these criteria. Other groups produce less satisfactory customers, e.g. people who use their card too seldom to generate a profit for the bank, people who are habitual switchers and people who will either default or defraud. A bank that is looking to grow may be tempted to take on new credit card customers without paying sufficient attention to the probable profitability of the new business. Some business carries too high a risk.

Bank of Scotland operates rigid quality controls on new business. It is looking only for profitable growth. Identifying potential customers is one thing. Reaching them is quite another. In this respect, the Bank of Scotland is particularly successful.

Making contact

Bank of Scotland has several ways of making contact. One involves gaining access to membership lists. The usual route is through club officials, who may or may not decide to cooperate, depending partly on the wishes of the club’s members. Sometimes the bank is able to obtain a list free of charge. Other times it may have to pay to obtain the list.

Once a list has been obtained, the bank makes contact through direct mailing to individuals. Often, the club or society endorses the contact, which increases the likelihood of the credit card offer being taken up. A 10% take up would be considered a good response. Marketing through a direct mailing from lists is attractive because it allows marketing material to be closely targeted. Other ways of advertising the product include:

- face to face selling at special events e.g. the annual general meeting or conference

- judiciously placed leaflet drops

- inserts in newspapers and magazines, including specialist publications

- television advertising that includes a phone number to call

- inserts on judiciously selected web pages on the Internet.

Not all of these methods produce equally good results. Some, such as television advertising, may produce a high level of response but also run the risk of attracting poor quality business from people whose creditworthiness is not easy to confirm. It is too early to be sure how Internet advertising will perform, but it is opening up exciting new possibilities.

Increasing market share

In a growing market, increasing one’s market share involves growing faster than the overall growth trend. That is a tough task. Simply retaining market share is a significant achievement. Every year, all issuers of credit cards lose some customers through death or desertion. There is a constant need to attract and retain new customers. Ways of doing this include:

- adding value to the product by enhancing the total package e.g. by offering the cardholder cheap travel insurance or privileged access to holiday and hotel bookings

- providing a good service e.g. eliminating errors in billing and responding positively and promptly to complaints

- increasing the range of countries and premises in which the card is welcomed.

One way to attract new customers is to offer a favourable initial deal e.g. a reduced rate of interest for 6 months (a ‘teaser’) that produces an overall saving over a rival credit card in Year 1. One danger of this approach is that some customers become sophisticated ‘cherry-pickers’ who move on after one year. Bank of Scotland intends to remain a major player in the affinity card market, and, with justification, remains confident in its ability to continue to lead the field.

Conclusion

The UK affinity card market generates a lot of business. Cumulative royalty payments to participant organisations exceed £20 million from the Bank of Scotland alone and one particular charity receives £2 million annually from this source.

The UK market is probably a long way from saturation, however. Of 42 million credit cards in the UK, only 2.2 million (about 1 in 20) are affinity cards. In the USA, the figure is 1 in 5. There remains room for growth.

Bank of Scotland sets out to be the dominant provider and is the market leader with a 56% market share. The bank currently handles more than 500 affinity groups, many of them with large, prestigious organisations. It is keen to strengthen its position in the face of increasing competition.