This case study focuses on the way in which Britannia Building Society has continued to place its customers at the centre of all its activities in order to produce the benefits that guarantee a successful future. Britannia is one of this country’s leading financial services organisations with a strong competitive advantage from its ‘Mutual’ organisational structure which provides an unbeatable link with its customers – because its owners (members) are its customers.

Today modern organisations must pay close attention to the 3 C’s which are the basic facts of life of business success – namely customers, competition and costs. Customers provide organisations with their basic needs through the sales which the organisation is able to make to contented customers. Competitors provide organisations with a spur to efficiency. No company will be successful unless it can stay ahead of its competitors.

Costs are the driving force that determines profitability. Successful companies must continually seek new ways of keeping costs down whilst at the same time giving better value to customers.

The age of the consumer

When a firm produces goods or services it must make sure that it genuinely meets consumer needs. A business is unlikely to be successful if it tries to deceive customers through advertising and publicity but at the same time failing to meet their needs. The financial services industry has changed out of all recognition in the 1990s. In the past the Industry had been characterised by specialisation:

- Building Societies – focused on managing customers’ savings and lending money to house buyers in the form of mortgages

- Insurance companies – focused on a range of household and business insurances and the provision of life assurance and pensions.

- High Street banks – focused on managing customers’ accounts, money transmission services and a range of loan and overdraft facilities to private and business customers.

All this has changed as the government has encouraged active competition in the financial services market. Increasingly, organisations have begun to offer a range of services. Today a modern financial services organisation acts as a “one-stop shop” providing a range of benefits to customers:

- looking after their savings and rewarding them with interest

- providing mortgages and long term loans as well as short term personal loans and overdrafts

- providing bank accounts with cheque books, ATMs and other money transmission products

- providing customers with a range of insurance and assurance covers and pensions

- servicing customers’ requirements for foreign currency and overseas transactions, etc.

- providing a range of business services

- buying shares and unit trusts for customers

Many organisations, which are household names, now offer all or some of this range of services and compete strongly with each other. These include Britannia Building Society, National Westminster Bank and the Prudential.

As competition has spread within this sector, so too has the sophistication with which customers’ needs are met. This development has been helped particularly by new technologies such as the on-line database. Today, customers receive a 24 hour service from financial service institutions through automated services which are to be found on the wall outside financial services organisations and through telephone links.

Customer service

In such a competitive environment, customers will choose to use those organisations which most closely meet their needs. Customer service, therefore, is at a premium in such a competitive environment.

Customer service is an ideal approach to developing a “one-to-one” relationship with customers and the term can be used at two levels:

- on one level “customer service” is the overall objective of all that a company offers

- the term is also used more precisely to describe the personal relationship which the company develops with its customers, and more particularly between the customer and those who represent the company to the customer – e.g. the counter staff in a building society, representatives who talk to schools and colleges, etc.

Customer service provides many opportunities to develop competitive advantage. For example, it covers the way a customer is treated when applying for a mortgage, on the telephone, with a specialist advisor etc. It would also include the way in which the organisation uses the latest communication technology to personalise letters in a large-scale promotional campaign.

Developing relationships with customers

Britannia has a particular advantage in building a strong relationship with customers because it is a building society. The customers of a building society are also its owners who mutually benefit from the running of the organisation. This is different from the situation in a public limited company where the shareholders (owners of the company) are quite distinct from its customers.

Modern building societies, such as Britannia, operate in a highly competitive environment, but because they are mutuals, they are able to provide better value to their customers than that offered by other financial institutions.

Satisfied customers

The profits of a public limited company, such as a bank, are distributed to its owners (the shareholders) in the form of dividends. Britannia’s owners, its members, are all customers, giving Britannia Building Society a unique advantage over its non-mutual competitors – and their interests and those of the organisation are directly aligned. In addition to the ordinary benefits that the customer of any financial institution will receive such as competitive interest rates, Britannia can produce returns for members in proportion to their contribution to the success of the society.

Satisfied customers are the organisation’s first priority. The better the products and services Britannia offers, the more these will be requested by the members/ customers. This volume in turn generates more profits and it is Britannia’s responsibility to maximise the profits for the benefit of its members. In a public limited company the circle is broken because the profits are used to pay dividends to shareholders, who are usually not also customers.

Although all members of a building society are customers, not all customers are members. Only share account holders and mortgage borrowers are members of the Society. Most become a member by opening a share account or by taking out a mortgage to buy their home, although in order to have a vote they must have at least £100 invested and be over 18 years of age.

Building customer value

Every business needs to attract and keep customers. Any organisation must:

- keep the business ahead of its competitors

- design products to satisfy customers’ needs and requirements

- ensure that customers remain loyal by treating them fairly and openly

- create a reputation for caring about their customers

- reassure customers that their purchase decisions have been good ones

- And, in the case of a financial institution like a building society, it must look after its customers’ money and keep it safe.

Creating advocates

In business, there is no better publicity for an organisation and its products than ‘word of mouth’. A company grows in proportion to its ability to acquire contented customers. The route to success therefore involves:

- finding out what consumers want – market research

- meeting these requirements – product research, development and quality assurance

- creating and fostering loyal customers – customer service and customer care

- ensuring that new customers know about the organisation and its products – advertising and promotion, including “word of mouth”.

Today, friends and neighbours talk to each other about financial services products. For example, they discuss pension arrangements, savings plans, household insurance, arrangements for buying a house, ways of saving money for a “rainy day”, for children to go to university – and many other topics. The successful organisation depends on its existing customers becoming advocates for its products. Advocates can only be created by ensuring that existing customers receive the best value for money. This is an area in which Britannia has been particularly successful at in recent times. Contented customers have been the best advertisement for the Society.

Rewarding loyalty

Britannia, as an organisation, is based on its members and their loyalty. Loyalty is a characteristic of the utmost importance to building societies. Members have always been encouraged to see themselves as being at the heart of the organisation and the organisation always serves its members to the best of its ability. In order to foster and develop this relationship the organisation shares its success with its members.

The idea of sharing is in the true tradition of a building society. Since building societies were founded, individuals have placed their money into their own society as an investment. This is then lent out to borrowing members to buy their homes. So investors and borrowers act, through their society, in each others’ shared interests.

Britannia is firmly behind this ideal and has carried out detailed market research which has shown that members support this stance. Unlike a bank, a building society does not have to distribute any of its profits to outside shareholders – instead, it is able to focus on the interests of its members.

Loyalty schemes help customers to take a greater ownership and responsibility for their organisation. They prosper in direct proportion to the success of their organisation. The loyalty bonus scheme builds on existing loyalties and seeks new ways of satisfying existing and potential customers. Importantly it sends out a clear message that the members of the Britannia are the key focus of the organisation.

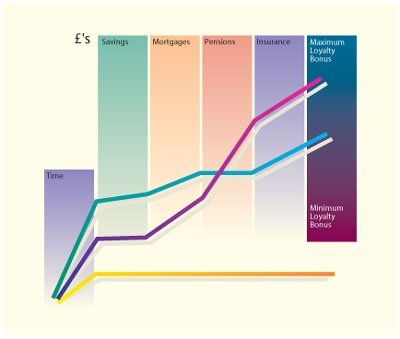

With the Britannia Members’ Loyalty Bonus Scheme, qualifying members are able to share in an annual cash payment from that part of the Society’s profits which is not required for the continued growth or stability of the Society. Therefore, the more business members can give to Britannia, the greater will be profits, and the greater will be the bonus. The Members’ Loyalty Bonus Scheme is an extra benefit. It is in addition to the competitive savings interest, mortgage rates and professional and friendly advice which Britannia already provides.

All Britannia members qualify for this scheme, which means all those who hold:

- Residential (owner occupied) Mortgages.

- All Investment and Savings Accounts, except Deposit Accounts.

Some classes of member, such as those with commercial mortgages or PIBS, do not qualify for the bonus. Bonus points are awarded (up to a maximum) for each members’ holding. In addition, extra points can be earned from extra products that a member buys from Britannia, such as a unit trust or PEP, or an insurance policy.

The size of the bonus depends on the number of Britannia products held by a customer. For example, those with a Britannia mortgage, savings account and insurance policies would be able to earn a larger bonus than someone who had a single savings account with a small balance with Britannia. Points are allocated according to the products that customers hold and the bonus is calculated on the basis of these points. Points also increase with the length of time that a member has been with Britannia.

Conclusion

In recent times a small number of former building societies have moved away from their roots to become public limited companies. However, in doing this, the essential contact point they have with their owners is immediately lost. The new owners become shareholders instead of members, and will be more interested in share prices and dividends than customers. Becoming a public company has obvious short term advantages, but in the longer term it is not necessarily a wholesome proposition.

In contrast, Britannia has chosen to keep to its principles. It has seen the unique relationship that it has with its members/customers as being its key strength. In a competitive environment it has chosen the path of building even stronger customer relationships as being the route to successful growth. The Chief Executive of Britannia has set out this strategic plan in the following way:

‘Being mutual allows us to concentrate on our mission: To improve the financial health of our members and customers by satisfying their evolving borrowing, investment and protection needs.’

The implication is that by taking an alternative route, e.g. becoming a public limited company would act as a distraction whereby the organisation would lose its way and forget its real purpose.

Britannia | Managing and rewarding customer loyalty