Fear of failure and insolvency can be a major inhibitor of entrepreneurship. Insolvency law offers alternatives to companies and individuals in financial difficulties, not all of which necessarily lead to the closure of the business. Insolvency proceedings are a last resort.

The Insolvency Service became an executive agency of the Department of Trade and Industry (DTI) in March 1990. The Official Receiver, a civil servant and an officer of the court, has existed since 1883. The main tasks of the Service are:

- to provide an overall framework for dealing with cases of insolvency

- to provide a system for dealing with the assets and liabilities of insolvent businesses that is fair to the owners and creditors of those businesses

- to ensure that, if possible, insolvency law allows businesses to continue as going concerns and are not closed down needlessly

- to report misconduct by bankrupts and by directors of companies

- to help the financial rehabilitation of bankrupts.

Individuals and Insolvency

The term ‘bankrupt’ usually refers to an individual whom the courts can declare bankrupt because he/she cannot pay his/her debts. They may be business owners but the majority of those who make themselves bankrupt are individuals who are not involved in a business.

The term bankrupt comes from the Italian for broken bench, Banca rotta. The term that we now apply to debtors derives from the practice in Lombardy of breaking the bench of an insolvent merchant. The Lombardy merchants traded from designated benches in the market and if one failed to honour his debts, he suffered the very public humiliation of having his bench broken.

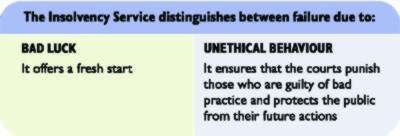

In the past, being declared ‘bankrupt’ carried a degree of shame. Today, insolvency law encourages enterprise by offering a fresh start for individuals/businesses where bankruptcy arose through no fault of their own, for example, as a result of ill health. However, this is not a one-way process. Bankrupts whose conduct has been irresponsible, reckless or illegal are subject to a tough Bankruptcy Restrictions Order regime, which protects the public and the commercial community.

Bankruptcy means that there is an orderly and fair distribution of assets between the creditors and that the individual’s circumstances are investigated to ensure there has been no misconduct.

Individual Voluntary Arrangement (IVA)

Some individuals are in the position that their business or financial affairs can be rescued, if so, they can propose to repay their creditors over a fixed period but they may not be able to pay them in full.

If the creditors are willing to accept say 50p in the pound on what they are owed, then they can approve the proposal and this forms an IVA. If the individual fails to keep up the required payments, they may be made bankrupt.

Companies and insolvency (Ltd’s, PLC’s and some partnerships)

There are several insolvency options for companies. Like individuals, there are two broad types, one for trying to rescue the business and another for the orderly distribution of assets.

Rescuing the business can be achieved through Administration (a formal insolvency procedure) or by the company entering a Company Voluntary Arrangement (CVA), which is similar to an IVA. Where the business cannot be rescued it will enter liquidation and its affairs will be ‘wound up’ (closed down).

Cash flow

Cash flow problems are a major cause of insolvency. Cash flow planning involves making sure that a business generates enough cash at the right time to meet pressing liabilities.

For example, many manufacturing businesses have a cash cycle. They buy raw materials and parts on credit and then manufacture goods, which they store as stock. They then sell these goods on credit (funds, which may be due for payment in anything from 1-3 months time). In the meantime, they have overheads and a workforce to pay.

Unfortunately, the cycle often breaks down because creditors are slow to pay. This leaves the firm with a cash flow problem. Its bank may not be willing to help; this is where an insolvency practitioner or the Insolvency Service steps in.

Consumer debt and insolvency

Individuals can also be declared bankrupt. The majority of people who present their own bankruptcy petitions are not traders; they have not been involved in a business. It is very easy to borrow money, apply for credit cards and run up accounts with mail order catalogues.

For some, an event like the loss of their job or ill health, may mean they cannot meet their debts but others may simply borrow more than they can afford to repay. It may be easy to get credit but it always comes at a price.

The Insolvency Service supervises specialists who deal with bankruptcy and one form of company insolvency i.e. compulsory liquidation. They work from 33 Official Receiver’s (OR) offices across England and Wales. During 2003, the OR dealt with over 30,000 new insolvency cases. Scotland has its own insolvency regime, which operates under Scottish law.

One of the aims of UK law covering insolvency is to help businesses that are in trouble to keep going. This is better than having them close down as it protects jobs. If a business is forced to stop trading it is much harder to restart it.

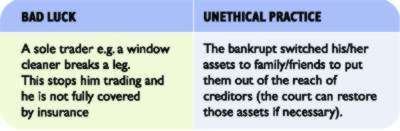

The Insolvency Service must distinguish between businesses and individuals that fail through bad luck and those that fail because of fraud or unethical practice.

Several different officials may be asked to take responsibility for a particular case of insolvency. Directors or creditors of a company finding itself in financial difficulty may appoint an insolvency practitioner as an Administrator. He/she then tries to rescue a company, or to protect certain types of creditors once a company is in serious financial difficulties. If the rescue attempt fails, however, the company may have to be ‘wound up’. Another similar rescue procedure is a CVA.

The Insolvency Act gives an administrator powers to manage the business. The Administrator’s major responsibility is to set out proposals for the rescue of a business. These are put to a meeting of creditors. If things go well, a new management team can be installed.

Where directors have acted unlawfully, however (e.g. by stealing company funds), the Administrator reports the matter to the Insolvency Service, which has a different role. Where appropriate it will report the facts to lawyers for consideration. Where allegations are serious enough, bodies such as the Serious Fraud Office can investigate and prosecutions may follow.

There are several possible penalties for unethical behaviour. These include disqualification or banning directors from promoting, forming or managing a company for 2-15 years. In 2002-2003, for example, specialist staff working for the Insolvency Service identified a number of so-called ‘Carousel’ fraud cases. These involved attempts to defraud HM Customs and Excise by making false claims for VAT repayment. Eighteen company directors were disqualified for an average of 7 years. HM Customs and Excise also brought criminal prosecutions.

Individual sole traders and members of a partnership may become bankrupt as they cannot pay pressing debts. However, there are also alternatives, such as debt management plans and individual voluntary arrangements. Bankruptcy is a last resort. A court makes a bankruptcy order, only after a bankruptcy petition has been presented. It is usually presented by either:

- the debtor (debtor’s petition)

- one or more creditors who are owed at least £750 and that amount is unsecured (creditor’s petition).

The majority of bankrupts present their own petition.

Once a bankruptcy order has been made, a local OR will deal with it. Bankrupts are freed from the burden of debt; they can make a fresh start. Their assets are shared out fairly among the creditors and there are restrictions on what bankrupts can do – for example, they cannot obtain credit unless they disclose the fact that they are bankrupt.

Some bankrupts also find it difficult to open a bank account. The OR or an insolvency practitioner will act as a trustee in bankruptcy. From the date of the bankruptcy order, he/she will protect the assets of the bankrupt individual. The OR will also examine the financial affairs of the individual for the period before and during the bankruptcy. He/she will report any matters that suggest there has been a criminal offence and/or he/she will apply for a bankruptcy restriction order, which places a number of restrictions on the individual for between 2 and 15 years.

When a creditor presents a bankruptcy petition (against an individual) or a winding up petition (against a company) and the court makes an insolvency order the court will appoint the OR either as:

- receiver and manager (for an individual who has become bankrupt)

- liquidator (for a company).

This is to protect the insolvent’s property.

The OR will take immediate steps to collect or secure any assets or property of the bankrupt or the company. To help this process, insolvency orders are advertised in an appropriate newspaper and in The London Gazette, which is published every working day.

The OR obtains information about the individuals or company’s affairs, dealings and transactions, including its assets and liabilities. The OR reports this information to creditors (and shareholders, in cases where the company is wound-up). The OR will then act, either as a trustee (individuals) or liquidator (companies). Following this, assets can be sold off and the proceeds distributed to creditors. Sometimes, an insolvency practitioner will be appointed to act as trustee or liquidator and realise the insolvent’s assets.

In addition, the OR will investigate the affairs of the bankrupt or company and look for evidence of possible malpractice. The OR has wide-ranging legal powers to acquire information and collect documents. These may uncover:

- a criminal offence

- a case for disqualifying some directors of liquidated companies

- a case for applying for a bankruptcy restrictions order (individuals).

The OR may then take the case to court. A court can then can take action against the guilty party.

In a business world, which is always changing, business failure is an everyday event. However, it is vital to minimise the negative effects.

The Insolvency Service plays a crucial role. It creates the frameworks and processes for helping honest enterprises and individuals to get a fresh start from the problems of insolvency.

At the same time it seeks to punish and eliminate dishonest practice and to protect the public and commercial community. By doing this the Insolvency Service helps to ensure the commercial framework in England and Wales is fair and competitive.